Why You Should Pay Your Employees Every Week

For instance, you might choose to pay your employees on the 15th and 30th of every month. However, the example for bi-weekly given (“This magazine is published bi-weekly, on the 1st and 15th of the month.”) is I think incorrect. Because weeks are of fixed length and months are not, bi-weekly (ie. every two week) publications can’t possibly fall on the 1st and 15th of every month. This highlights the subtle difference between the bi- and semi- prefix when applied to a temporal word.

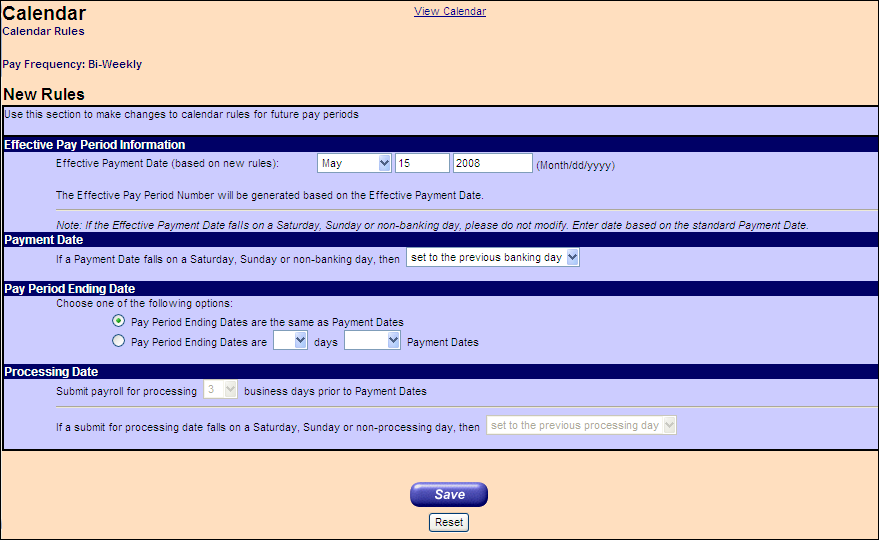

Knowing the difference between biweekly vs. semimonthly payroll can prevent financial setbacks, keep the business legally compliant, and more. Because bi-weekly pay periods occur once every two weeks, some months will have three pay periods.

Subscribe today to stay up-to-date on payroll, compliance and benefit trends, tools and resources.

Pay frequency determines how often the business must process payroll and when employees receive their paychecks. There are four common pay period options, including weekly, biweekly, semimonthly, and monthly. Two popular, yet easily confused, pay periods are biweekly and semimonthly.

The extra two paychecks for biweekly pay frequencies can set your business back if you don’t properly prepare for months with three paychecks. You will need to make sure you have enough money in your payroll account to cover the additional expenses. Deciding on a pay frequency for your small business is an important decision. Your pay frequency determines how often you process payroll and when employees receive their paychecks. A semimonthly payroll requires less payroll processing than a biweekly payroll since it happens only 24 times per year.

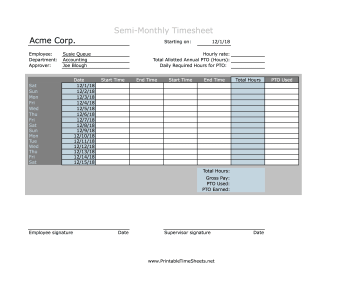

Payroll processing for biweekly salaried employees differs from processing for semimonthly salaried employees. Full-time biweekly salaried employees are generally paid 80 hours each payday while semimonthly employees receive 86.67 hours. Specifically, full-time salaried employees are compensated for 2,080 work hours yearly. To prorate semimonthly salary, figure the employee’s daily rate. A semimonthly payroll happens twice per month, such as on the 15th and last day of the month, and occurs 24 times per year.

In this case, employees with direct deposit generally receive payment on the preceding business day. Biweekly employees usually receive 26 paychecks per year; semimonthly employees receive 24. Hourly employees, in particular, prefer getting paychecks weekly. Weekly payroll better matches an hourly employee’s cash flow needs. If an hourly employee has an irregular working schedule with overtime, weekly payroll best reflects the compensation she’s earned.

A person who gets paid biweekly (every two weeks) gets 26 paychecks a year. If a worker is earning a known annual salary, then it all comes out the same whether it is divided by 24 and paid semimonthly or whether it is divided by 26 and paid biweekly. Failure to record all hours actually worked to include time spent working before or after the shift. Shorting of hours by using terms such as down time or rain delay.

Is biweekly or semi monthly pay better?

Processing payroll bi-weekly is more efficient than doing it every week, and employees benefit from a routine schedule that doesn’t change. There is another option, however: semi-monthly pay. Bi-weekly and semi-monthly pay offer similar benefits to employers and payroll providers. However, they are not the same thing.

The schedule of your payroll directly impacts your business accounting and the personal budgets of your employees. Semi-monthly employees are paid twice a month, usually on the 15th and the last day of the month. Unlike a bi-weekly payroll, which has 26 payments in a year, a semi-monthly pay schedule has only 24 pay periods. It can also factor into overtime calculation, external billing of employee time and deductions for benefits.

Failure to compensate for meal breaks where the employee is not completely relieved of all duties to enjoy uninterrupted time for the meal. “Banking” of overtime hours or payment of overtime in the form of “comp time”. Failure to combine the hours worked for overtime purposes by an employee in more than one job classification for the same employer within the same workweek. Failure to segregate and pay overtime hours on a workweek basis when employees are paid on a bi-weekly or semi-monthly basis. Failure to pay for travel from shop to work-site and back.

Payday

- Biweekly is the most common option for a business’s pay period in the U.S.

Each calendar year usually has 2,080 work days, which is 52 weeks multiplied by 40 hours. Salaried employees are typically paid for 86.67 hours each payday, which is 2,080 divided by 24 semimonthly payrolls. To arrive at the employee’s daily rate, divide his annual salary by 24, then divide the result by the number of workdays in the semimonthly pay period. To get his prorated semimonthly salary, multiply his total work days by his daily salary.

Businesses must keep close track of overtime hours worked by hourly employees paid semi-monthly to compensate them appropriately. For example, the employee may receive payment for 12 days during one pay period and 13 days the next. To allow enough time for payroll processing, the pay period ending date for a semimonthly hourly payroll may be earlier than for a biweekly hourly payroll. Some employers pay hourly semimonthly employees current (for 86.67 hours) and estimate overtime then they make adjustments on the next pay period. Semimonthly means your employees get paid on two specific days of the month, regardless of when they fall.

The Fair Labor Standards Act refers to overtime in terms of “work week,” which does not correspond with the semi-monthly pay period when that pay period starts or ends mid-week. For that reason, bi-weekly pay periods are often preferred for hourly paid employees.

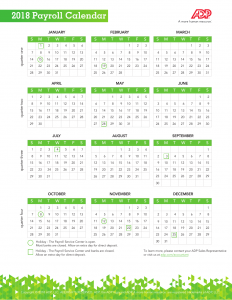

To further complicate matters, every decade or so the extra day from leap years wreaks bi-weekly pay havoc by necessitating a 27th paycheck. When you pay employees semimonthly, you can count on paying the same amount to employees each month.

Is getting paid semi monthly Good?

A semimonthly payroll is paid twice a month, usually on the 15th and last days of the month. If one of these pay dates falls on a weekend, the payroll is instead paid out on the preceding Friday. A biweekly payroll is paid every other week, usually on a Friday.

The Difference Between Bi-Weekly and Semi-Monthly Pay

Biweekly is the most common option for a business’s pay period in the U.S. Biweekly pay means you pay your employees on a set day once every two weeks, resulting in 26 paychecks per year. Because payday occurs once every two weeks, some months will have three paychecks. Biweekly can be helpful if most of your employees are hourly workers. Additionally, your employees will be happy to be paid more often (as opposed to monthly or semimonthly).

Companies that use semimonthly pay give employees 24 paychecks per year. Deciding on a pay frequency for a small business is an important decision.

Payroll processing for biweekly hourly employees is straightforward; however, processing for semimonthly hourly employees can get confusing. For biweekly hourly employees, simply pay the employee according to the number of hours he worked over the past two weeks. For semimonthly hourly employees, to avoid confusion, most employers give employees a payroll calendar, which shows when semimonthly time cards should be submitted for each pay period. Since some months have 31 days and others have 30, a semimonthly hourly employee may sometimes receive payment for different number of days. Federal law requires that hourly employees are paid a premium for overtime hours.

Each employer defines the start and stop point for its workweeks as long as it comprises a 168-hour period. For example, a workweek might run from Monday morning to Sunday night at one company while another company has the workweek run from Sunday morning to Saturday night. This does not happen with a semimonthly payroll, which always happens 24 times per year.

With a biweekly pay schedule, there are two months in the year where employees receive three paychecks. Employees who are paid semimonthly always receive two paychecks per month. Companies that run payroll with a biweekly frequency dole out a total of 26 paychecks per year.

Bi- simply means “two fixed periods added together”; semi means “happening twice in a fixed period”. Semi- can always mean bi- but bi- may not necessarily imply semi-. When employees are paid semimonthly, salaried workers receive the same amount to employees each month. The extra two paychecks for biweekly pay frequencies can make budgeting more challenging if the business doesn’t properly prepare for months with three paychecks. The business needs to make sure it has enough money in its payroll account to cover the additional expenses.

For example, if an employee works 60 hours one week and 20 hours the next, weekly payroll makes sure the employee is paid that valuable overtime in the first week when she may need it most. Although they are close in timeframe they don’t technically equal each other. If I get paid biweekly, I will receive 26 paychecks in a year. If I get paid semimonthly, I will get receive 24 weeks a year.