Why would a company use LIFO instead of FIFO?

How Tax Lots Help You Pay Less to the IRS

FIFO versus LIFO comparison chart FIFOLIFOStands for First in, first out Last in, first out Unsold inventory Unsold inventory comprises goods acquired most recently. Restrictions There are no GAAP or IFRS restrictions for using FIFO; both allow this accounting method to be used. Effect of Inflation If costs are increasing, the items acquired first were cheaper. This decreases the cost of goods sold (COGS) under FIFO and increases profit. If costs are increasing, then recently acquired items are more expensive.

FIFO vs. Other Valuation Methods

To date, 105 of the company’s product have been purchased. Using the FIFO method, they would look at how much each item cost them to produce. Since only 100 items cost them $50.00, the remaining 5 will have to use the higher $55.00 cost number in order to achieve an accurate total. During periods of inflation, FIFO maximizes profits as older, cheaper inventory is used as cost of goods sold; in contrast, LIFO maximizes profits during periods of deflation.

Since newest items are sold first, the oldest items may remain in the inventory for many years. Fluctuations Only the newest items remain in the inventory and the cost is more recent. Hence, there is no unusual increase or decrease in cost of goods sold. Goods from number of years ago may remain in the inventory. Selling them may result in reporting unusual increase or decrease in cost of goods.

LIFO accounting is not permitted by the IFRS standards so it is less popular. It does, however, allow the inventory valuation to be lower in inflationary times. LIFO is the opposite of the FIFO method and it assumes that the most recent items added to a company’s inventory are sold first. The company will go by those inventory costs in the COGS (Cost of Goods Sold) calculation. Those who favor LIFO argue that its use leads to a better matching of costs and revenues than the other methods.

As well, the taxes a company will pay will be cheaper because they will be making less profit. Over an extended period, these savings can be significant for a business. A change from LIFO to any other method will impact the balance sheet as well as the income statement in the year of the change.

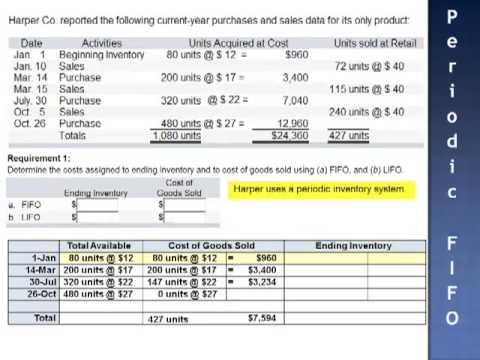

In the video, we saw how the cost of goods sold, inventory cost, and gross margin for each of the four basic costing methods using perpetual and periodic inventory procedures was different. The differences for the four methods occur because the company paid different prices for goods purchased. No differences would occur if purchase prices were constant.

Outside the United States, many countries, such as Canada, India and Russia are required to follow the rules set down by the IFRS (International Financial Reporting Standards) Foundation. The IFRS provides a framework for globally accepted accounting standards, among them is the requirements that all companies calculate cost of goods sold using the FIFO method. As such, many businesses, including those in the United States, make it a policy to go with FIFO. FIFO stands for First In, First Out, which means the goods that are unsold are the ones that were most recently added to the inventory. Conversely, LIFO is Last In, First Out, which means goods most recently added to the inventory are sold first so the unsold goods are ones that were added to the inventory the earliest.

The LIFO reserve is a contra-asset or asset reduction account that companies use to adjust downward the cost of inventory carried at FIFO to LIFO. Many companies use dollarvalue LIFO, since this method applies inflation factors to “inventory pools” rather than adjusting individual inventory items.

This increases the cost of goods sold (COGS) under LIFO and decreases the net profit. Effect of Deflation Converse to the inflation scenario, accounting profit (and therefore tax) is lower using FIFO in a deflationary period. Using LIFO for a deflationary period results in both accounting profit and value of unsold inventory being higher. Record keeping Since oldest items are sold first, the number of records to be maintained decreases.

LIFO users will report higher cost of goods sold, and hence, less taxable income than if they used FIFO in inflationary times. There are two popular accounting solutions for this problem. You’ve probably heard of them, as their abbreviations sound vaguely like names of dogs. First-in, first-out (FIFO) and last-in, first-out (LIFO) are the methods most public companies use to allocate costs between inventory and cost of goods sold.

What is FIFO and LIFO example?

FIFO stands for “First-In, First-Out”. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The FIFO method assumes that the oldest products in a company’s inventory have been sold first. The costs paid for those oldest products are the ones used in the calculation.

- FIFO versus LIFO comparison chart FIFOLIFOStands for First in, first out Last in, first out Unsold inventory Unsold inventory comprises goods acquired most recently.

- Restrictions There are no GAAP or IFRS restrictions for using FIFO; both allow this accounting method to be used.

The LIFO method assumes that the most recent products added to a company’s inventory have been sold first. The costs paid for those recent products are the ones used in the calculation. The “Last In, First Out” inventory method has been hotly debated at the federal level. Congress has threatened to outlaw the method as the Internal Revenue Service introduces laws and requirements that make using the LIFO method inconvenient at best.

Some companies focus on minimizing taxes by picking the method with the smallest profit. It is a method used for cost flow assumption purposes in the cost of goods sold calculation.

Companies that are on LIFO for taxation and financial reporting typically use FIFO internally for pricing, purchasing and other inventory management functions. Advantages and disadvantages of LIFO The advantages of the LIFO method are based on the fact that prices have risen almost constantly for decades. LIFO supporters claim this upward trend in prices leads to inventory, or paper, profits if the FIFO method is used. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs. The larger the cost of goods sold, the smaller the net income.

What Is First In, First Out (FIFO)?

The LIFO method for financial accounting may be used over FIFO when the cost of inventory is increasing, perhaps due to inflation. Using FIFO means the cost of a sale will be higher because the more expensive items in inventory are being sold off first.

When a company uses LIFO, the income statement reports both sales revenue and cost of goods sold in current dollars. The resulting gross margin is a better indicator of management’s ability to generate income than gross margin computed using FIFO, which may include substantial inventory (paper) profits. Now company management wants to see the cost of goods sold.

Specific Inventory Tracing

Since a company’s purchase prices are seldom constant, inventory costing method affects cost of goods sold, inventory cost, gross margin, and net income. Therefore, companies must disclose on their financial statements which inventory costing methods were used. LIFO, on the other hand, leads us to believe that companies want to sell their newest inventory, even if they still have old stock sitting around. LIFO’s a very American answer to the problem of inventory valuation, because in times of rising prices, it can lower a firm’s taxes.

What is the FIFO method?

First In, First Out (FIFO) is an accounting method in which assets purchased or acquired first are disposed of first. FIFO assumes that the remaining inventory consists of items purchased last. An alternative to FIFO, LIFO is an accounting method in which assets purchased or acquired last are disposed of first.

Using the LIFO method of inventory means that when you count the cost of goods sold, you use the current price rather than whatever price you paid for the specific inventory in stock. If the prices of those goods go up from your initial purchase, your cost of goods sold will read higher, thereby reducing your profits and, as a result, your tax burden and access to credit. If the costs go down, your profits may be artificially inflated.

Imagine a firm replenishing its inventory stock with new items that cost more than the old inventory. When it comes time to calculate cost of goods sold, should the company average its costs across all inventory? Should it count the ones it bought earlier and for cheaper? Or maybe it should use the latest inventory for its calculations. This decision is critical and will affect a company’s gross margin, net income, and taxes, as well as future inventory valuations.