Why is it required to prepare subledger–general ledger reconciliations?

Sometimes general ledger accounts will not have a subsidiary ledger to reconcile to. In this case, the cash balance in the general ledger will be reconciled to the monthly bank statement. This process is becoming increasingly automated, so bank reconciliations will not be discussed here. Occasionally general ledger account balances must be reconciled to an outside statement.

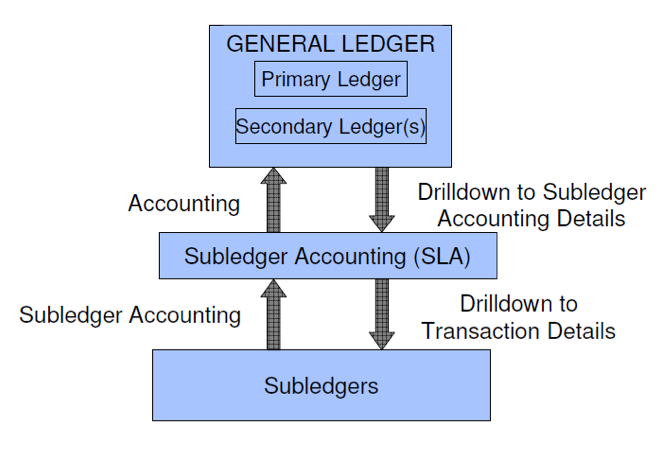

If discrepancies exist, the process of matching each transaction to its respective accounting entry is automatically performed. The process finds all transactions and accounting entries that contributed to the out of balance situation. As a prerequisite to the reconciliation process, subledger transactions from Oracle Fusion Payables and Oracle Fusion Receivables are imported and accounted in Oracle Fusion General Ledger. The General Ledger journal entries are then posted, which updates the General Ledger balances.

Subsidiary ledgers can include purchases, payables, receivables, production cost, payroll and any other account type. Recording financial information is a lengthy and time-consuming process, and its end result is the preparation of year-end financial statements. A business conducts many transactions within an accounting year, and these should be recorded in different accounts according to corresponding accounting standards.

Your accounting system will have a number of subsidiary ledgers (called subledgers) for items such as cash, accounts receivable, and accounts payable. All the entries that are posted to these subledgers will transact through the general ledger account. The general ledger reconciliation process is a critical internal control. Each general ledger balance sheet account must be reconciled to the supporting detail at the end of each month.

What does subledger mean?

A subledger is a ledger containing all of a detailed sub-set of transactions. The total of the transactions in the subledger roll up into the general ledger. For example, a subledger may contain all accounts receivable, or accounts payable, or fixed asset transactions.

Other subsidiary account ledgers include the accounts receivable subsidiary ledger, the inventory subsidiary ledger, and the equipment subsidiary ledger. The general ledger is a master ledger containing a summary of all the accounts that a company uses in operating its business. The subsidiary ledgers roll up to the general ledger, which records the aggregate totals of the subsidiary ledgers.

Reconciliation reports can then be run to start the account reconciliation process. In double-entry accounting—which is commonly used by companies—every financial transaction is posted in two accounts, the income statement and the balance sheet. One account will receive a debit, and the other account will receive a credit. For example, when a business makes a sale, it debits either cash or accounts receivable (on the balance sheet) and credits sales revenue (on the income statement).

What is a General Ledger?

Subsidiary ledgers are used when there is a large amount of transaction information that would clutter up the general ledger. This situation typically arises in companies with significant sales volume. Thus, there is no need for a subsidiary ledger in a small company. E.g. ABC is a company which does around 75% of their sales on credit; as a result, it has many accounts receivables. Also referred to as ‘subsidiary ledger’, this is a detailed subset of accounts that contains transaction information.

The GL is a set of master accounts and transactions are recorded and SL is an intermediary set of accounts linked to the general ledger. GL contains all debit and credit entries of transactions and entry for the same is done. Sub-ledger is a detailed subset of accounts that contains transaction information. Sub-ledger is an intermediary set of accounts linked to the general ledger. It is a detailed subset of accounts that contains transaction information.

For large scale businesses where many transactions are conducted, it may not be convenient to enter all transactions in the general ledger due to the high volume. In such cases, individual transactions are recorded in ‘subsidiary ledgers’, and the totals are transferred to an account in the general ledger. This account is referred to as the ‘Control account’, and account types that generally have a high activity level is recorded here.

It is the main accounting record of the company, containing and recording every accounting transaction. The general ledger is also commonly referred to as the ledger, or the more informally, the ‘books’ of the company. The accounts payable subsidiary ledger is similar to other subsidiary ledgers in that it merely provides details of the control account in the general ledger.

This supporting detail may be a subsidiary ledger or other documentation such as a bank statement. The accounts payable subsidiary ledger is helpful in providing internal accounting controls. The accounts payable subsidiary ledger amounts can be crosschecked with the aggregate amount reported on the general ledger to prevent errors in reporting.

For instance, a general ledger rent deposit account must be reconciled to the bank statement to account for any interest the deposit has been accruing. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. There may be a subsidiary set of ledgers that summarize into the general ledger.

What is difference between Ledger and subledger?

General ledger and sub ledger are such accounts that record business transactions. The key difference between general ledger and sub ledger is that while general ledger is the set of master accounts where transactions are recorded, sub ledger is an intermediary set of accounts that are linked to the general ledger.

- In other words, the subsidiary ledger contains the individual payables owed to each of the suppliers and vendors, as well as the amounts owed.

- The accounts payable subsidiary ledger is a breakdown of the total amount of payables listed on the general ledger.

- When the financial statements are prepared, the accounts payable total is listed with other short-term financial obligations under the current liabilities section of the balance sheet.

The general ledger accrues the balances that make up the line items on these reports, and the changes are reflected in the profit and loss statement as well. In accounting, an account records every transactional increase and decrease to the balance of that account. For example, the accounts payable account contains all transactions increasing or decreasing accounts payable. The general ledger is the record of all accounts used by the company.

An accounts payable subsidiary ledger is an accounting ledger that shows the transaction history and amounts owed to each supplier and vendor. An accounts payable (AP) is essentially an extension of credit from a supplier that gives a business (the buyer in the transaction) time to pay for the supplies. The subsidiary ledger records all of the accounts payables that a company owes. When a business receives an invoice, it credits the amount of the invoice to accounts payable (on the balance sheet) and debits an expense (on the income statement) for the same amount. When the company pays the bill, it debits accounts payable and credits the cash account.

The general ledger, in turn, allocates these totals into assets, liabilities, and equity accounts. Within most accounting systems, the process is performed via accounting software. The balance in the customer accounts is periodically reconciled with the accounts payable balance in the general ledger to ensure accuracy. The accounts payable subsidiary ledger is also commonly referred to as the AP sub-ledger or subaccount.

Management can also check to ensure that each invoice from the vendors and suppliers are being recorded. Recording of financial information is books of account as per standard accounting principle. A subsidiary ledger stores the details for a general ledger control account. Most accounts in the general ledger are not control accounts; instead, individual transactions are recorded directly into them.

Examples of Subledger

The accounts receivable ledger stores accounting data for each individual customer. The subsidiary ledger is essentially a worksheet for all of the payables owed to suppliers. Payables and Receivables enable you to quickly reconcile these subledgers to your General Ledger. Compare the open payables and receivables balances in the subledger modules to their corresponding account balance in your general ledger for a given accounting period.

The total of sub-ledger should always match with the line item amount on the general ledger. So, it contains detail information regarding the business transaction and financial accounts. It can include purchase, payable, receivable, production cost and payroll.

In the latter case, a person researching an issue in the financial statements must refer back to the subsidiary ledger to find information about the original transaction. The general ledger is usually printed and stored in an organization’s year-end book, which serves as the annual archive of its business transactions. A general ledger account is an account or record used to sort, store and summarize a company’s transactions. These accounts are arranged in the general ledger (and in the chart of accounts) with the balance sheet accounts appearing first followed by the income statement accounts. Companies must reconcile their accounts to prevent balance sheet errors, check for fraud, and avoid auditors’ negative opinions.

When the financial statements are prepared, the accounts payable total is listed with other short-term financial obligations under the current liabilities section of the balance sheet. The accounts payable subsidiary ledger is a breakdown of the total amount of payables listed on the general ledger. In other words, the subsidiary ledger contains the individual payables owed to each of the suppliers and vendors, as well as the amounts owed.

General Ledger vs Sub Ledger

With every transaction in the general ledger, the left (debit) and right (credit) side of the journal entry should agree, reconciling to zero. A common form of general ledger reconciliation occurs when a subsidiary ledger is reconciled to the general ledger balance. A subsidiary ledger contains detailed information on a specific account. Two of the most common subsidiary ledgers are the accounts receivable and the accounts payable ledgers.

Subledger

General ledger and sub ledger are such accounts that record business transactions. The relationship between these two is that multiple sub ledgers are attached to the general ledger. The two primary financial documents of any company are their balance sheet and the profit and loss statement, and both of these are drawn directly from the companys general ledger. The chart of accounts determines the order of how the numerical balances appear, but all entries that are entered will appear.

The general ledger is comprised of all the individual accounts needed to record the assets, liabilities, equity, revenue, expense, gain, and loss transactions of a business. In most cases, detailed transactions are recorded directly in these general ledger accounts.