Which Transactions Affect Retained Earnings?

Additional paid-in capitaldoes not directly boost retained earnings but can lead to higher RE in the long-term. Additional paid-in capital reflects the amount of equity capital that is generated by the sale of shares of stock on the primary market that exceeds its par value. The par value of a stock is the minimum value of each share as determined by the company at issuance. If a share is issued with a par value of $1 but sells for $30, the additional paid-in capital for that share is $29. In this scenario, you still own 1,000 shares having a par value of $10.00 each.

Preferred shares sometimes have par values that are more than marginal, but most common shares today have par values of just a few pennies. Because of this, “additional paid-in capital” tends to be essentially representative of the total paid-in capital figure and is sometimes shown by itself on the balance sheet. The additional paid-in capital is usually booked as shareholders’ equity on the balance sheet. Let us assume that during its IPO phase, the XYZ Widget Company issues one million shares of stock, with a par value of $1 per share, and that investors bid on shares for $2, $4, and $10 above the par value. Let us further assume that those shares ultimately sell for $11, consequently making the company $11 million.

Additional Resources

The key difference between the two is that the contributed capital is referred to as the total value of cash and assets that shareholders provided to a company in exchange for the company’s shares. The additional paid-in capital indicates the value of cash or assets that the shareholders provided in excess of the par value of the company’s shares. This does not mean, however, that the distribution is tax-free; rather, it simply means that the distribution will not represent a taxable dividend.

In order to determine the taxability of the distribution, the shareholder must adjust his basis in the corporation’s stock. The distribution will first be treated as a tax-free reduction of the shareholder’s stock basis, with any distribution in excess of basis generating capital gain.

This amount is generally not available for dividends and can be useful when comparing it to a company’s retained earnings, also listed on the Balance Sheet. Additional paid-in capital (APIC), is an accounting term referring to money an investor pays above and beyond the par value price of a stock. The financial accounting term additional paid-in capital refers to the amount paid in excess of par value by investors when capital stock is first issued. There are a number of subsequent transactions that can also affect the balance of this account.

After the IPO, none of the daily stock movements will have an impact on the additional paid-in capital number in this example. This is because those trades do not generate any capital for the company, and therefore they have no impact on the company’s balance sheet.

How do you calculate additional paid in capital?

Additional Paid In Capital (APIC) is the value of share capital above its stated par value and is an accounting item under Shareholders’ Equity on the balance sheet. APIC can be created whenever a company issues new shares and can be reduced when a company repurchases its shares.

In this instance, the additional paid-in capital is $10 million ($11 million minus the par value of $1 million). Therefore, the company’s balance sheet itemizes $1 million as “paid-in-capital,” and $10 million as “additional paid-in capital”. Additional paid-in capital represents the amount of money the company has sold its shares for in excess of the par value. Additional paid-in capital on the Balance Sheet has nothing to do with the market price per share. If an investor purchases shares from the company and sells off to another investor at a higher price, it would not affect the capital of the company.

Additional paid-in capital appears in the owner’s equity section of the company’s balance sheet. With regard to common stock, the paid-in capital is based on par value of the stock including additional paid-in capital. It is to note that this given amount is in excess of the premium that investors pay in return of the shares. – For example, if 1,000 shares of $10 par value common stock are issued by at a price of $12 per share, the additional paid-in capital is $2,000 (1,000 shares x $2). Additional paid-in capital is shown in the Shareholders’s Equity section of the balance sheet.

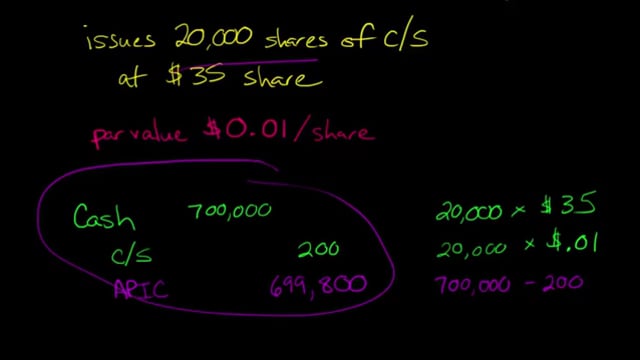

Only the shares sold by the company to raise capital should be included in the calculation. In accounting terms, additional paid-in capital is the value of a company’s shares above the value at which they were issued. For example, the board of directors of a business authorizes 10,000,000 shares of common stock at a par value of $0.01.

- For accounting purposes, the additional paid-in capital — sometimes termed “capital surplus” — equals the amount of money investors paid over a nominal “par value” to acquire shares of stock.

We need to pass the accounting entry for additional paid-in capital on the balance sheet. Short of the retirement of any shares, the account balance of paid-in capital, specifically the total par value and the amount of additional paid-in capital, should remain unchanged as a company carries on its business. For common stock, paid-in capital, also referred to as contributed capital, consists of a stock’s par value plus any amount paid in excess of par value. In contrast, additional paid-in capital refers only to the amount of capital in excess of par value or the premium paid by investors in return for the shares issued to them.

For accounting purposes, the additional paid-in capital — sometimes termed “capital surplus” — equals the amount of money investors paid over a nominal “par value” to acquire shares of stock. Added together, the par value and additional paid-in capital equal the total amount of money a corporation has received through its sale of stock.

How Additional Paid In Capital is created

To record the receipt of cash, the company records a debit of $5,000,000 to the cash account, $10,000 to the common stock account, and $4,990,000 to the additional paid-in capital account. There is no change in the additional paid-in capital account when a company’s shares are traded on a secondary market between investors, since the amounts exchanged during these transactions do not involve the company that issued the shares. Additional paid-in capital is the value of share capital above its par value. It is also commonly known as the “contributed capital in excess of par” or “share premium.” Essentially, the additional paid-in capital reveals how much money investors paid for the shares above their nominal value.

In other words, it indicates the difference between the actual price the investors paid for the company’s shares and the nominal value of the shares. Additional paid-in capital is included inshareholder equityand can arise from issuing either preferred stock orcommon stock. The amount of additional paid-in capital is determined solely by the number of shares a company sells.

The new $10,000 is recorded in the owner’s equity section of your balance sheet as “additional paid-in capital.” While the par value of your 1,000 shares remains at $10.00, the “market value” of your shares increases to $20.00 each. Additional Paid In Capital is an accounting term found on the Balance Sheet under Shareholder’s Equity.

Additional Paid-In Capital

Additional paid-in capital is an accounting term, whose amount is generally booked in the shareholders’ equity (SE) section of the balance sheet. At the end of the day, a small business can be summarized by its balance sheets, and any investor or owner wants to see a growing shareholders’ equity, because that means the company is doing well. Additional paid-in capital is one part of figuring the total shareholders’ equity, but it’s not the only element. Stockholders’ equity is related to additional paid-in capital vs. contributed capital.