Which Budgets Are Prepared Before the Sales Budget?

Companies, governments, families and other organizations use it to express strategic plans of activities or events in measurable terms. Both these budgets are considered important milestones in the budgetary control process. They are equipped with a number of uses such as cost control and performance measurement. A master budget is the overall budget for all departments and functions showing the target the company intends to meet during the accounting period, typically one year.

A master budget is an aggregate of a company’s individual budgets designed to present a complete picture of its financial activity and health. Master budgets are often used in larger companies to keep all individual managers aligned.

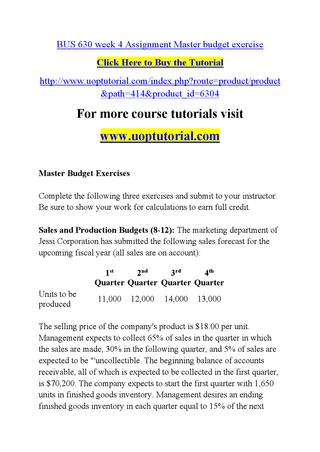

Companies create a sales budget to determine how much revenue they expect to generate from their products and services. Because sales provides the top-line number in all operating budgets, after the master budget, the sales budget is the next budget companies usually prepare. Many small-business owners create sub-components of the master budget expenses to help calculate spending areas that can be cut during slow times or to help calculate production and overhead costs. After you’ve listed all of your expected expenses for the year, label each as a fixed or variable cost. A fixed cost is one you can’t easily change from month to month, such as your rent, insurance premium, loan payment or copier lease.

The major components of a master budget include income and expenses, overhead and production costs, and the monthly, annual, average and projection totals. The master budget is the aggregation of all lower-level budgets produced by a company’s various functional areas, and also includes budgeted financial statements, a cash forecast, and a financing plan. The master budget is typically presented in either a monthly or quarterly format, and usually covers a company’s entire fiscal year.

On the other hand, flexible budgets are time-consuming and require more planning due to the alterations in activity levels. Master budgets are usually presented in monthly or quarterly formats, for the entire financial year. Various other documents can also be presented along with the master budget in order to assist informed decision making. A document that consists of key financial ratios calculated based on information is included in the budget.

A master budget is a set of interrelated budgets that constitutes a plan of action for a specified time period. The master budget is developed within the framework of a sales forecast. A financial budget presents a company’s strategy for managing its assets, cash flow, income, and expenses.

AccountingTools

A financial budget is used to establish a picture of a company’s financial health and present a comprehensive overview of its spending relative to revenues from core operations. Flexible budgets are not rigid as static budgets; thus, are an appropriate tool for performance measurement to evaluate the performance of the managers. If the volume is fixed, then the managers can later claim that the demand and cost forecasts significantly changed from the budgeted levels and they were unable to achieve the budget. Flexible budgets are most appropriate for organizations that operate with an increased variable cost structure where the costs are mainly associated with the level of activity.

Typically, the machine hours are between 4,000 and 7,000 hours per month. Based on this information, the flexible budget for each month would be $40,000 + $10 per MH. For a small-business owner, having a budget — also called a forecast — in place helps him keep spending under control and monitor his company’s progress toward his revenue and profit goals. The traditional budget was a month-by-month revenue and expense forecast for the upcoming 12 months, prepared at approximately the same time each year. In recent times, more companies have gravitated to implementing a rolling budget — adjusting the budget during the year based on actual results and then projecting forward.

Companies typically carve out the sales numbers, cost of goods sold and selling expenses given in the master budget to use as the base for the sales budget. A budget is a forecast that businesses prepare to act as a road map in aiding the company in achieving its sales, expansion and profitability objectives. Companies typically craft a master budget using the previous year’s income statement as the base. However, businesses that intend to issue or access debt, pursue investment capital or purchase assets often develop a balance sheet forecast as an addition to the income sheet forecast. Most budgets break down the year into quarters or months for ease of monitoring and adjusting.

- A master budget is an aggregate of a company’s individual budgets designed to present a complete picture of its financial activity and health.

Major Components of a Master Budget

In addition, if a company uses participative budgeting to create its budgets on a rolling basis, the total employee time used over the course of a year is substantial. Consequently, it is best to adopt a leaner approach to a rolling budget, with fewer people involved in the process. The figures obtained from the sales, inventory and expense budgets are combined with the company’s beginning-of-the-period cash balance to make the cash budget. This budget can be quite useful to a company, because it helps predict the company’s cash balance at the end of each month.

Module 9: Operating Budgets

These ratios will help to understand whether the master budget has been prepared realistically based on the actual past results. Master budget is a financial forecast of all elements in the business for the financial year prepared by combining many functional budgets such as sales budget, purchases budget, etc. These different budgets are interconnected and collectively provide accounting estimates for the upcoming financial period. Individual budgets will be prepared by each department, and the net outcome will be reflected in the master budget. A rolling budget calls for considerably more management attention than is the case when a company produces a one-year static budget, since some budget updating activities must now be repeated every month.

This budget helps management determine expected expenses related to sales and administrative personnel and other sales and administrative costs. A master budget is the combination of a series of separate but connected sub-budgets that describe a company’s production and financial goals. In order to complete a master budget, company management completes the sub-budgets that make up the master budget. The order that sub-budgets are completed matters, because the outputs of the earlier budgets make up the inputs to the later budgets.

What is a master budget and what is its purpose?

The master budget is the aggregation of all lower-level budgets produced by a company’s various functional areas, and also includes budgeted financial statements, a cash forecast, and a financing plan.

A budget is a financial plan for a defined period, often one year. It may also include planned sales volumes and revenues, resource quantities, costs and expenses, assets, liabilities and cash flows.

A small business could, for example, review actual results at the end of each quarter and then forecast ahead an additional four quarters. Cash flow/cash budget – a prediction of future cash receipts and expenditures for a particular time period. The cash flow budget helps the business to determine when income will be sufficient to cover expenses and when the company will need to seek outside financing.

Accounting Topics

A master budget is used to project the income and expenses of a company. From the master budget, a small-business owner can develop a variety of reports to help set specific goals for the business.

By understanding the budgets that make up the master budget, you can bring the budgeting process to your company. Let’s assume a company determines that its cost of electricity and supplies will vary by approximately $10 for each machine hour (MH) used. It also knows that other costs are fixed costs of approximately $40,000 per month.

This is of paramount importance to seasonal firms, because the company may be solvent on an annual basis, but may not realize that certain months of the year cash shortages are expected. For some companies, the cash budget represents the end of the budgeting process; however, other companies go on to complete budgeted financial statements. As such, the inventory budget cannot be prepared until the production budget is completed. The sales and administrative expense budget is prepared from the sales budget.

There may also be a discussion of the headcount changes that are required to achieve the budget. To create an accurate picture, operating budgets must account for factors such as sales, production, labor costs, materials costs, overhead, manufacturing costs, and administrative expenses. Operating budgets are generally created on a weekly, monthly, or yearly basis. A manager might compare these reports month after month to see if a company is overspending on supplies. Businesses develop budgets to identify, plan, track and allocate personnel and financial resources across their operations.