Where Does Accumulated Depreciation Go on an Income Statement?

Depreciation expenses, on the other hand, are the allocated portion of the cost of a company’s fixed assets that are appropriate for the period. Depreciation expense is recognized on the income statement as a non-cash expense that reduces the company’s net income.

Accumulated depreciation is the total amount of depreciation expenses that have been charged to expense the cost of an asset over its lifetime. As your equipment ages and deteriorates, your accounting has to reflect that loss of value. Every month that your assets depreciate, you report the depreciation expense on your income statement. You also report depreciation on your balance sheet but not as a liability.

Where is accumulated depreciation on the balance sheet?

The accumulated depreciation account is an asset account with a credit balance (also known as a contra asset account); this means that it appears on the balance sheet as a reduction from the gross amount of fixed assets reported.

Firms do not have to deduct the entire cost of the asset from net income in the year it is purchased if it will give value for more than one year. Accumulated depreciation is the total amount of depreciation expense that has been recorded so far for the asset.

a.The portion of the cost of a fixed asset deducted from revenue of the period is debited to Depreciation Expense. The reduction in the fixed asset account is recorded by a credit to Accumulated Depreciation rather than to the fixed asset account. The use of the contra asset account facilitates the presentation of original cost and accumulated depreciation on the balance sheet. Depreciation Expense—debit balance; Accumulated Depreciation—credit balance.

Current assets on the balance sheet contain all of the assets that are likely to be converted into cash within one year. Companies rely on their current assets to fund ongoing operations and pay current expenses. Accumulated depreciation is an asset account with a credit balance known as a long-term contra asset account that is reported on the balance sheet under the heading Property, Plant and Equipment. The amount of a long-term asset’s cost that has been allocated, since the time that the asset was acquired.

Understanding Accumulated Depreciation

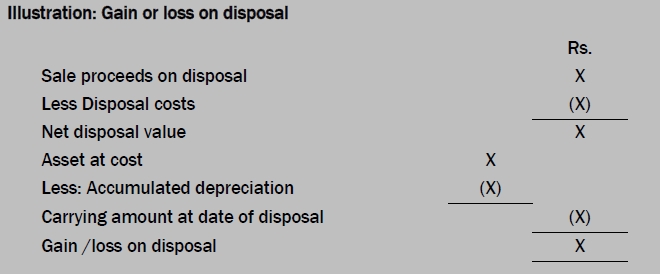

Each period, the depreciation expense recorded in that period is added to the beginning accumulated depreciation balance. An asset’s carrying value on the balance sheet is the difference between its historical cost and accumulated depreciation. At the end of an asset’s useful life, its carrying value on the balance sheet will match its salvage value. The amount of accumulated depreciation for an asset or group of assets will increase over time as depreciation expenses continue to be credited against the assets. The two main distinctions between assets on the balance sheet are current and non-current assets.

Essentially, accumulated depreciation is the total amount of a company’s cost that has been allocated to depreciation expense since the asset was put into use. Accumulated depreciation is the total depreciation expense a business has applied to a fixed asset since its purchase. At the end of an asset’s operating life, its accumulated depreciation equals the price the corporate owner originally paid — assuming the resource’s salvage value is zero.

If not, accumulated depreciation equals the asset’s book value minus its residual worth. “Fixed asset” is what finance people call a tangible asset, capital resource, physical asset or depreciable resource. Depreciation is an accounting convention that allows companies to expense an estimate for the portion of long-term operating assets used in the current year. It is a non-cash expense that inflates net income but helps to match revenues with expenses in the period in which they are incurred.

Depreciation expense flows through to the income statement in the period it is recorded. Accumulated depreciation is presented on the balance sheet below the line for related capitalized assets. The accumulated depreciation balance increases over time, adding the amount of depreciation expense recorded in the current period.

Companies looking to increase profits want to increase their receivables by selling their goods or services. Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet.

- Depreciation expenses, on the other hand, are the allocated portion of the cost of a company’s fixed assets that are appropriate for the period.

When to Use Depreciation Expense Instead of Accumulated Depreciation

The carrying amount of fixed assets in the balance sheet is the difference between the cost of the asset and the total accumulated depreciation. To spread the cost of a capital asset, a corporate bookkeeper debits the depreciation expense account and credits the accumulated depreciation account. The last item is a contra-asset account that reduces the worth of the corresponding fixed resource. The accumulated depreciation lies right underneath the “property, plant and equipment” account in a statement of financial position, also known as a balance sheet or report on financial condition.

Long-term assets are listed on the balance sheet, which provides a snapshot in time of the company’s assets, liabilities, and shareholder equity. The balance sheet equation is “assets equals liabilities plus shareholder’s equity” because a company can only fund the purchase of assets with capital from debt and shareholder’s equity. Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses.

Depreciation expense flows through an income statement, and this is where accumulated depreciation connects to a statement of profit and loss — the other name for an income statement or P&L. Capitalized property, plant, and equipment (PP&E) are also included in long-term assets, except for the portion designated to be expensed or depreciated in the current year. Capitalized assets are long-term operating assets that are useful for more than one period.

In trial balance, the accumulated depreciation expenses are the contra account of the fixed assets accounts. Depreciation is a way to account for changes in the value of an asset. Depreciation also affects your business taxes and is included on tax statements.

Accumulated Depreciation

You record depreciation expense on the income statement and record accumulated depreciation as a contra asset account on the balance sheet. Accumulated depreciation is the total depreciation for a fixed asset that has been charged to expense since that asset was acquired and made available for use. The accumulated depreciation account is a contra asset account on a company’s balance sheet, meaning it has a credit balance. It appears on the balance sheet as a reduction from the gross amount of fixed assets reported. Accumulated depreciation is the total amount a company depreciates its assets, while depreciation expense is the amount a company’s assets are depreciated for a single period.

No, it is not customary for the balances of the two accounts to be equal in amount. Depreciation Expense appears on the income statement; Accumulated Depreciation appears on the balance sheet.

For accounting purposes, the depreciation expense is debited, and the accumulated depreciation is credited. When recording depreciation in the general ledger, a company debits depreciation expense and credits accumulated depreciation.

Is Accumulated Depreciation a plant asset?

Accumulated depreciation is presented on the balance sheet just below the related capital asset line. The carrying value of an asset is its historical cost minus accumulated depreciation.

Accumulated depreciation has a credit balance, because it aggregates the amount of depreciation expense charged against a fixed asset. This account is paired with the fixed assets line item on the balance sheet, so that the combined total of the two accounts reveals the remaining book value of the fixed assets. Over time, the amount of accumulated depreciation will increase as more depreciation is charged against the fixed assets, resulting in an even lower remaining book value. Accumulated depreciation is the sum of depreciation expense over the years.

How does proration affect asset depreciation?

Each time a company charges depreciation as an expense on its income statement, it increases accumulated depreciation by the same amount for that period. As a result, a company’s accumulated depreciation increases over time, as depreciation continues to be charged against the company’s assets. Accumulated depreciation is the total amount an asset has been depreciated up until a single point.