What’s the Difference Between Amortization and Depreciation in Accounting?

Second, amortization reduces the duration of the bond, lowering the debt’s sensitivity to interest rate risk, as compared with other non-amortized debt with the same maturity and coupon rate. This is because as time passes, there are smaller interest payments, so the weighted-average maturity (WAM) of the cash flows associated with the bond is lower. If the borrower were making fully amortizing payments, he would pay $1,266.71, as indicated in the first example, and that amount would increase or decrease when the loan’s interest rate adjusts.

By making regular, scheduled payments on time, the loan or mortgage will be paid off by a maturity date. At the end of year one, you have made 12 payments, most of the payments have been towards interest, and only $3,406 of the principal is paid off, leaving a loan balance of $396,593. The next year, the monthly payment amount remains the same, but the principal paid grows to $6,075. Now fast forward to year 29 when $24,566 (almost all of the $25,767.48 annual payments) will go towards principal. Free mortgage calculators or amortization calculators are easily found online to help with these calculations quickly.

The term is most often used for mortgage loans; corporate loans with negative amortization are called PIK loans. By making regular payments toward a mortgage, you reduce the balance of both principal and interest. In the case of a 15-year fixed-rate mortgage, the loan is paid in full at the end of 15 years. A 30-year fixed-rate mortgage is paid in full at the end of 30 years, if payments are made on schedule.

What is a straight line mortgage?

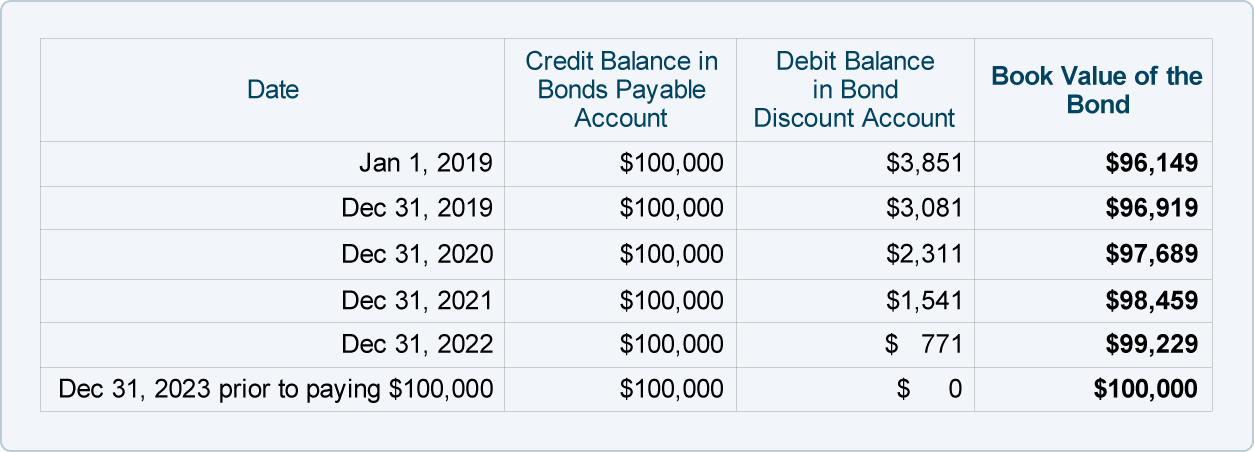

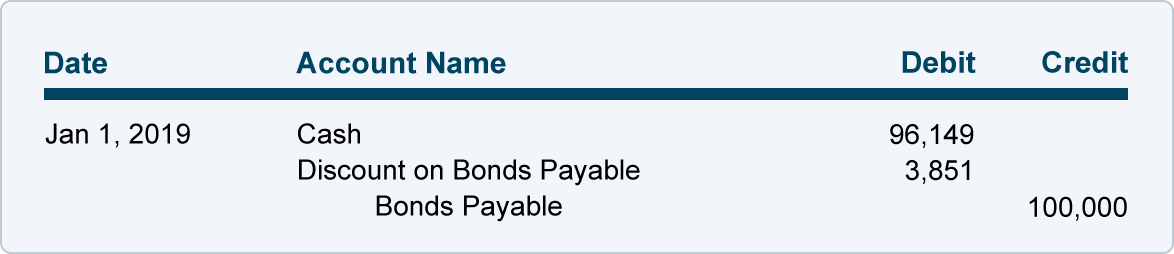

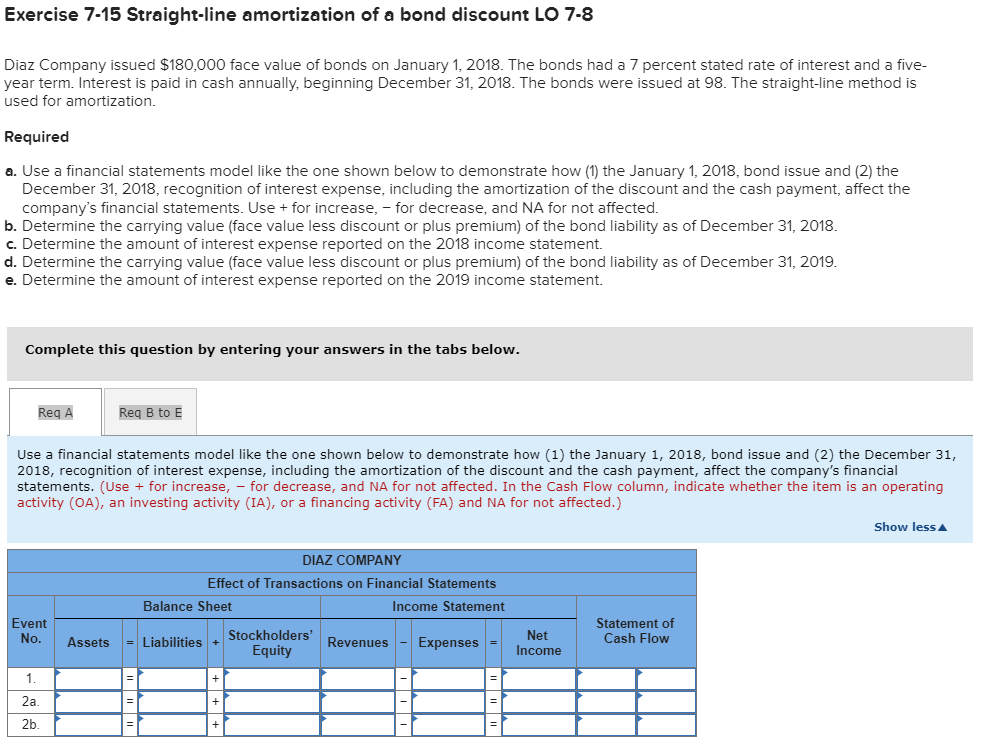

Straight line amortization is always the easiest way to account for discounts or premiums on bonds. Under the straight line method, the premium or discount on the bond is amortized in equal amounts over the life of the bond. Premiums are amortized similarly.

Then for a loan with monthly repayments, divide the result by 12 to get your monthly interest. Subtract the interest from the total monthly payment, and the remaining amount is what goes toward principal.

The amount of principal due in a given month is the total monthly payment (a flat amount) minus the interest payment for that month. The next month, the outstanding loan balance is calculated as the previous month’s outstanding balance minus the most recent principal payment. As an amortization method the shorted amount (difference between interest and repayment) is then added to the total amount owed to the lender. Such a practice would have to be agreed upon before shorting the payment so as to avoid default on payment. This method is generally used in an introductory period before loan payments exceed interest and the loan becomes self-amortizing.

It’s relatively easy to produce a loan amortization schedule if you know what the monthly payment on the loan is. Starting in month one, take the total amount of the loan and multiply it by the interest rate on the loan.

Personal loansthat you get from a bank, credit union,or online lenderare generally amortized loans as well. They often have three-year terms, fixed interest rates, and fixed monthly payments. These loans are often used for small projectsor debt consolidation. Amortization of debt affects two fundamental risks of bond investing.

With mortgage and auto loan payments, a higher percentage of the flat monthly payment goes toward interest early in the loan. With each subsequent payment, a greater percentage of the payment goes toward the loan’s principal. Amortization can be calculated using most modern financial calculators, spreadsheet software packages such as Microsoft Excel, or online amortization charts. This schedule is quite useful for properly recording the interest and principal components of a loan payment.

Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly. With amortization, the payment amount consists of both principal repayment and interest on the debt.

Here’s how to account for a bond under annual straight line and effective interest amortization methods, and the accounting impacts of choosing one method over the other.

- Amortization refers to the reduction of a debt over time by paying the same amount each period, usually monthly.

A fully amortizing payment refers to a type of periodic repayment on a debt. If the borrower makes payments according to the loan’s amortization schedule, the debt is fully paid off by the end of its set term. If the loan is a fixed-rate loan, each fully amortizingpayment is an equal dollar amount.

However, if the loan is structured so the borrower only pays interest payments for the first five years, his monthly payments are only $937.50 during that time. As a result, after the introductory interest rate expires, his payments may increase up to $1,949.04. By taking non-fully amortizing payments early in the life of the loan, the borrower essentially commits to making larger fully amortizing payments later in the loan’s term. Amortization can refer to the process of paying off debt over time in regular installments of interest and principal sufficient to repay the loan in full by its maturity date.

The principal paid off over the life of an amortized loan or bond is divvied up according to an amortization schedule, typically through calculating equal payments all along the way. This means that in the early years of a loan, the interest portion of the debt service will be larger than the principal portion. As the loan matures, however, the portion of each payment that goes towards interest will become lesser and the payment to principal will be larger.

However, each payment represents a slightly different percentage mix of interest versus principal. An amortized bond is different from a balloon or bullet loan, where there is a large portion of the principal that must be repaid only at its maturity. To illustrate a fully amortizing payment, imagine a man takes out a 30-year fixed-rate mortgage with a 4.5% interest rate, and his monthly payments are $1,266.71. Because these payments are fully amortizing, if the borrower makes them each month, he pays off the loan by the end of its term.

Calculate Straight Line Mortgage Loan

An amortization schedule is used to reduce the current balance on a loan, for example a mortgage or car loan, through installment payments. A loan amortization schedule gives you the most basic information about your loan and how you’ll repay it. It typically includes a full list of all the payments that you’ll be required to make over the lifetime of the loan. Each payment on the schedule gets broken down according to the portion of the payment that goes toward interest and principal.

Is amortization always straight line?

The straight-line amortization method is the simplest way to amortize a bond or loan because it allocates an equal amount of interest over each accounting period in the debt’s life. The straight line amortization formula is computed by dividing the total interest amount by the number of periods in the debt’s life.

What Does Straight Line Amortization Mean?

As more principal is repaid, less interest is due on the principal balance. Over time, the interest portion of each monthly payment declines and the principal repayment portion increases. Amortization is an accounting technique used to periodically lower the book value of a loan or intangible asset over a set period of time. First, amortization is used in the process of paying off debt through regular principal and interest payments over time.

The calculations for an amortizing loan are similar to that of an annuity using the time value of money, and can be carried out quickly using an amortization calculator. An amortized bond is one in which the principal (face value) on the debt is paid down regularly, along with its interest expense over the life of the bond. A fixed-rate residential mortgage is one common example because the monthly payment remains constant over its life of, say, 30 years.

Gather the information you need to calculate the loan’s amortization. To calculate amortization, you also need the term of the loan and the payment amount each period. Most NegAm loans today are tied to the Monthly Treasury Average, in keeping with the monthly adjustments of this loan. There are also Hybrid ARM loans in which there is a period of fixed payments for months or years, followed by an increased change cycle, such as six months fixed, then monthly adjustable. Amortizing a debt means to reduce the balance by paying principal and interest on an established schedule.

For month two, do the same thing, except start with the remaining principal balance from month one rather than the original amount of the loan. By the end of the set loan term, your principal should be at zero.

When you take out a loan with a fixed rate and set repayment term, you’ll typically receive a loan amortization schedule. By understanding how to calculate a loan amortization schedule, you’ll be in a better position to consider valuable moves like making extra payments to pay down your loan faster. For monthly payments, the interest payment is calculated by multiplying the interest rate by the outstanding loan balance and dividing by twelve.

Loans with shorter terms have less interest because they amortize over a shorter period of time. Amortization is the process of spreading out a loan (such as a home loan or auto loans) into a series of fixed payments. While each monthly payment remains the same, the payment is made up of parts that change over time. A portion of each payment goes towards interest costs (what your lendergets paid for the loan) and reducing your loan balance (also known as paying off the loan principal).