What’s More Important, Cash Flow or Profits?

When a current asset increases, it reduces your operating cash flow in relation to net income. For example, if you have an item in inventory, that means you’ve laid out cash for it. But because of accrual accounting rules, if you haven’t sold it yet, you can’t report its cost as an expense, and therefore, its cost hasn’t yet reduced net income. Companies that use accrual basis accounting can assemble their statement of cash flows in one of two ways, using either the direct method or the indirect method. The more commonly used indirect method shows the company’s net income, and adjusts it with reconciling entries, to arrive at the company’s operating cash flow.

Most companies use the accrual method of accounting, so the income statement and balance sheet will have figures consistent with this method. Under the indirect method, expenses that do not affect cash are added to net income in the operating activities section of the statement of cash flows. If land costing $145,000 was sold for $205,000, the $60,000 gain on the sale would be added to net income in of the operating activities section of the statement of cash flows (prepared by the indirect method). Rarely would the cash flows from operating activities, as reported on the statement of cash flows, be the same as the net income reported on the income statement. The statement of cash flows shows the effects on cash of a company’s operating, investing, and financing activities.

It reports cash receipts, cash payments, and net change in cash from operating, investing, and financing activities. The statement of cash flows reports the cash receipts, cash payments, and net change in cash resulting from the operating, investing, and financing activities of a company during a period.

In contrast, under the indirect method, cash flow from operating activities is calculated by first taking the net income from a company’s income statement. Because a company’s income statement is prepared on an accrual basis, revenue is only recognized when it is earned and not when it is received.

All other changes in balance sheet accounts are analyzed to determine their effect on cash. You’ll need to make three types of adjustments to reach operating cash flow.

What is the cash flow statement with example?

Cash Flows From Other Activities Additions to property, plant, equipment, capitalized software expense, cash paid in mergers and acquisitions, purchase of marketable securities, and proceeds from the sale of assets are all examples of entries that should be included in the cash flow from investing activities section.

In the most commonly used formulas, accounts receivable are used only for credit sales and all sales are done on credit. If cash sales have also occurred, receipts from cash sales must also be included to develop an accurate figure of cash flow from operating activities. Since the direct method does not include net income, it must also provide a reconciliation of net income to the net cash provided by operations. The purpose of drawing up a cash flow statement is to see a company’s sources of cash and uses of cash over a specified time period. The statement of cash flows is part of the main group of financial statements that a business issues, though it is commonly considered to be third in importance after the income statement and balance sheet.

The first, noncash items, includes items that don’t reduce cash, but they still get recorded as an income statement expense that reduces net income. The second category, timing differences, involves changes in assets and liabilities on the balance sheet. These adjusting entries compensate for the way companies recognize revenue and expenses under accrual accounting rules. The third category covers non-operating gains or losses, which means income or losses generated by activities other than the core functions of the company.

Comparative balance sheets, a current income statement, and certain transaction data all provide information necessary for preparation of the statement of cash flows. Comparative balance sheets indicate how assets, liabilities, and equities have changed during the period. A current income statement provides information about the amount of cash provided from operating activities. Certain transactions provide additional detailed information needed to determine whether cash was provided or used during the period.

What Is a Cash Flow Statement?

The indirect method also makes adjustments to add back non-operating activities that do not affect a company’s operating cash flow. With theindirect method, cash flow from operating activities is calculated by first taking the net income off of a company’s income statement. Because a company’s income statement is prepared on anaccrual basis, revenue is only recognized when it is earned and not when it is received. Under the direct method, the cash flow from operating activities is presented as actual cash inflows and outflows on a cash basis, without starting from net income on an accrued basis. The investing and financing sections of the statement of cash flows are prepared in the same way for both the indirect and direct methods.

The cash flows from operations section begins with net income, then reconciles all noncash items to cash items involving operational activities. So, in other words, it is the company’s net income, but in a cash version. Many line items in the cash flow statement do not belong in the operating activities section.

Cash flows from operating activities can be calculated and disclosed on the cash flow statement using the direct or indirect method. The direct method shows the cash inflows and outflows affecting all current asset and liability accounts, which largely make up most of the current operations of the entity.

In preparing the cash flows from operating activities section of the statement of cash flows by the indirect method, the amortization of bond discount for the period is deducted from the net income for the period. In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the period is added to the net income for the period.

Direct Cash Flow Method

- The statement captures both the current operating results and the accompanying changes in the balance sheet and income statement.

- Essentially, the cash flow statement is concerned with the flow of cash in and out of the business.

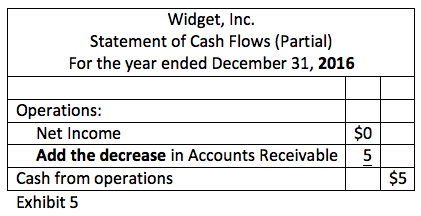

If accounts receivable go up during a period, it means sales are up, but no cash was received at the time of sale. The cash flow statement deducts receivables from net income because it is not cash. The cash flows from the operations section can also include accounts payable, depreciation, amortization, and numerous prepaid items booked as revenue or expenses, but with no associated cash flow. This is the first section of the cash flow statement and includes transactions from all operational business activities.

What is included in a statement of cash flows?

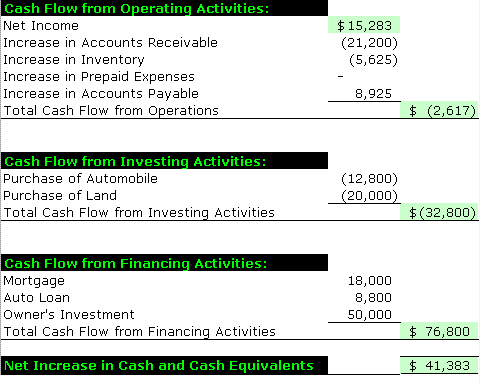

Statement of cash flows: Statement of cash flows includes cash flows from operating, financing and investing activities. Financing activities include the inflow of cash from investors, such as banks and shareholders and the outflow of cash to shareholders as dividends as the company generates income.

This results in cash net income, which is equal to “net cash flow from operating activities.” The indirect method involves adjusting accrual-based net income. This is done by starting with accrual net income and adding or subtracting noncash items included in net income. The main purpose of the statement of cash flows is to provide information about a company’s cash receipts and cash payments in a period. The statement of cash flows provides information about a company’s operating, financing, and investing activities.

Accounts Receivable and Cash Flow

The statement can be of considerable use in detecting movements of cash that are not readily apparent by perusing the income statement. Thus, cash flow analysis is useful for determining the underlying health of a business. However, theFinancial Accounting Standards Board (FASB) prefers companies use the direct method as it offers a clearer picture of cash flows in and out of a business. However, if the direct method is used, it is still recommended to do a reconciliation of the cash flow statement to the balance sheet. Many accountants prefer the indirect method because it is simple to prepare the cash flow statement using information from the other two common financial statements, the income statement and balance sheet.

Figure 12.2 “Examples of Cash Flow Activity by Category” presents a more comprehensive list of examples of items typically included in operating, investing, and financing sections of the statement of cash flows. The cash flow statement is divided into three categories—cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities. Although total cash generated from operating activities is the same under the direct and indirect methods, the information is presented in a different format. Opposite of the noncash items, certain current assets affect your company’s actual cash flow but don’t affect your income statement profit.

The first part of a cash flow statement analyzes a company’s cash flow from net income or losses. For most companies, this section of the cash flow statement reconciles the net income (as shown on the income statement) to the actual cash the company received from or used in its operating activities. To do this, it adjusts net income for any non-cash items (such as adding back depreciation expenses) and adjusts for any cash that was used or provided by other operating assets and liabilities. The exact formula used to calculate the inflows and outflows of the various accounts differs based on the type of account.

Cash flows from operating activities is a section of a company’s cash flow statement that explains the sources and uses of cash from ongoing regular business activities in a given period. This typically includes net income from the income statement, adjustments to net income, and changes in working capital. Figure 12.1 “Examples of Cash Flows from Operating, Investing, and Financing Activities” shows examples of cash flow activities that generate cash or require cash outflows within a period.

Those preparers that use the direct method must also provide operating cash flows under the indirect method. The indirect method must be disclosed in the cash flow statement to comply with U.S. accounting standards, or GAAP.

Net cash flow from operating activities under the direct method is the difference between cash revenues and cash expenses. The direct method adjusts the revenues and expenses directly to reflect the cash basis.

The cash flows from the operating activities section also reflect changes in working capital. A positive change in assets from one period to the next is recorded as a cash outflow, while a positive change in liabilities is recorded as a cash inflow. Inventories, accounts receivable, tax assets, accrued revenue, and deferred revenue are common examples of assets for which a change in value will be reflected in cash flow from operating activities. Net income is typically the first line item in the operating activities section of the cash flow statement. This value, which measures a business’s profitability, is derived directly from the net income shown in the company’s income statement for the corresponding period.

The operating cash flows component of the cash flow statement refers to all cash flows that have to do with the actual operations of the business. Essentially, it is the difference between the cash generated from customers and the cash paid to suppliers.

Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. The statement captures both the current operating results and the accompanying changes in the balance sheet and income statement.

The cash flow statement, as the name suggests, provides a picture of how much cash is flowing in and out of the business during the fiscal year. Non-cash investing and financing activities are disclosed in footnotes to the financial statements. General Accepted Accounting Principles (GAAP), non-cash activities may be disclosed in a footnote or within the cash flow statement itself.

This is simply the difference between the beginning and ending cash balances. This involves analyzing the current year’s income statement, comparative balance sheets and selected transaction data.