What Percentage of Expenses Should Payroll Be?

As shown in Figure 3.3 “Using Department Rates to Allocate SailRite Company’s Overhead”, products going through the Hull Fabrication department are charged $50 in overhead costs for each machine hour used. Products going through the Assembly department are charged $23 in overhead costs for each direct labor hour used. This ratio is derived from the proper allocation of overhead (indirect expenses) and the cost of goods (direct expenses). Every single property unless government owned is subject to some form of property tax. Therefore, the taxes on production factories are categorized as manufacturing overheads as they are costs which cannot be avoided nor cancelled.

Failing to recover the full cost of overhead in estimating or pricing likely will make a business, product or job unprofitable when the final numbers are applied. Balance sheet is a financial statement which outlines a company’s financial assets, liabilities, and shareholder’s equity at a specific time. Both assets and liabilities are separated into two categories depending on their time frame; current and long-term. Business overheads in particular fall under current liabilities as they are costs for which the company must pay on a relatively short-term/immediate basis. This includes the cost of hiring external law and audit firms on behalf of the company.

Labor costs, such as employee time, that are not chargeable to a direct manufacturing or production activity also fall under fixed expenses. This will include company-paid business travels and arrangements. As well as refreshments, meals, and entertainment fees during company gatherings.

Organizations that use this approach tend to have simple operations within each department but different activities across departments. One department may use machinery, while another department may use labor, as is the case with SailRite’s two departments. This assumption of a causal relationship is increasingly less realistic as production processes become more complex. The overhead is attributed to a product or service on the basis of direct labor hours, machine hours, direct labor cost etc.

However, equipment can vary between administrative overheads and manufacturing overheads based on the purpose of which they are using the equipment. For example, for a printing company a printer would be considered a manufacturing overhead. This includes mainly monthly and annual salaries that are agreed upon.

For example, overhead costs such as the rent for a factory allows workers to manufacture products which can then be sold for a profit. Overheads are also very important cost element along with direct materials and direct labor. The department allocation approach allows cost pools to be formed for each department and provides for flexibility in the selection of an allocation base. Although Figure 3.3 “Using Department Rates to Allocate SailRite Company’s Overhead” shows just two rates, many companies have more than two departments and therefore more than two rates.

How Do I Calculate My Overhead Rate?

In other words, it is the cost incurred on labor, material or services that cannot be economically identified with a specific saleable cost of goods or service per unit of the business. They are Indirect in nature and need to be shared out among the cost units as precisely as possible.

They are considered overheads as these costs must be paid regardless of sales and profits of the company. In addition, salary differs from wage as salary is not affected by working hours and time, therefore will remain constant. In particular, this would more commonly apply to more senior staff members as they are typically signed to longer tenure contracts, meaning that their salaries are more commonly predetermined. It comprises of all indirect costs whether in the form of Indirect material, indirect Labor or Indirect Expenses which are incurred in the manufacturing of the goods and services.

Allocation Rates for Automated Investment

What is the allocation rate?

Compute the overhead allocation rate by dividing total overhead by the number of direct labor hours. For every hour needed to make a product, you need to apply $2.50 worth of overhead to that product.

These costs are treated as overheads due to the fact that they aren’t directly related to any particular function of the organization nor does it directly result in generating any profits. Instead, these costs simply take on the role of supporting all of the business’ other functions. Overhead expenses are all costs on the income statement except for direct labor, direct materials, and direct expenses. Overhead expenses include accounting fees, advertising, insurance, interest, legal fees, labor burden, rent, repairs, supplies, taxes, telephone bills, travel expenditures, and utilities.

In addition, property taxes do not change in relation to the business’s profits or sales and will likely remain the same unless a change by the government administration. Manufacturing overheads are all costs endured by a business that is within the physical platform in which the product or service is created. Difference between manufacturing overheads and administrative overheads is that manufacturing overheads are categorized within a factory or office in which the sale takes place. Whilst administrative overheads is typically categorized within some sort of back-office or supporting office. Although there are cases when the two physical buildings may overlap, it is the usage of the overheads that separates them.

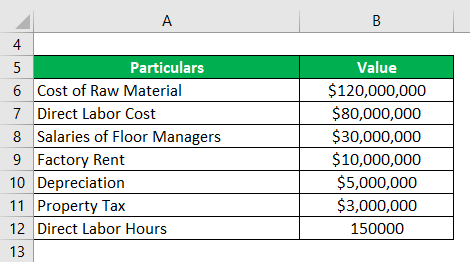

Common bases of allocation are direct labor hours charged against a product, or the amount of machine hours used during the production of a product. The amount of allocation charged per unit is known as the overhead rate. An overhead allocation rate (or burden rate) is sometimes viewed as a mysterious percentage that is applied to a construction company’s job costs, often based on a “same as last year” mindset. Kline Company expects to incur $800,000 in overhead costs this coming year—$200,000 in the Cut and Polish department and $600,000 in the Quality Control department. The Cut and Polish department expects to use 25,000 machine hours, and the Quality Control department plans to utilize 50,000 hours of direct labor time for the year.

Allocation Rate

Although in most cases necessary, these costs can sometimes be avoided and reduced. Administrative overheads include items such as utilities, strategic planning, and various supporting functions.

- Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit, unlike operating expenses such as raw material and labor.

- In business, overhead or overhead expense refers to an ongoing expense of operating a business.

- Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits.

Overhead absorption is based on a combination of the overhead rate and the usage of the allocation base by the cost object. Thus, the allocation of overhead to a product may be based on an overhead rate of $5.00 per direct labor hour used, which can be altered by changing the number of hours used or the amount of overhead cost in the cost pool.

This would not apply if company has own internal lawyers and audit plans. Due to regulations and necessary annual audits to ensure a satisfactory work place environment, these costs often cannot be avoided. Also, since these costs do not necessarily contribute directly to sales, they are considered as indirect overheads.

A problem often arises when this rate is not monitored or revisited annually to assess whether it is an accurate representation of the company’s current overhead costs. When this occurs, an over- or under-allocation of costs can occur, thereby skewing financial results and impairing the ability of owners and financial executives to manage the business properly. These can include rent or mortgage payments, depreciation of assets, salaries and payroll, membership and subscription dues, legal fees and accounting costs. Fixed expense amounts stay the same regardless if a business earns more — or loses more — in revenue that month. Associated payroll costs, including outsourcing payroll services, are included in the fixed expense category.

approach is similar to the plantwide approach except that cost pools are formed for each department rather than for the entire plant, and a separate predetermined overhead rate is established for each department. Instead, they will be broken out into various department cost pools. This approach allows for the use of different allocation bases for different departments depending on what drives overhead costs for each department. For example, the Hull Fabrication department at SailRite Company may find that overhead costs are driven more by the use of machinery than by labor, and therefore decides to use machine hours as the allocation base. The Assembly department may find that overhead costs are driven more by labor activity than by machine use and therefore decides to use labor hours or labor costs as the allocation base.

This includes office equipment such as printer, fax machine, computers, refrigerator, etc. They are equipment that do not directly result in sales and profits as they are only used for supporting functions that they can provide to business operations.

The overhead absorption rate is calculated to include the overhead in the cost of production of goods and services. It’s used to define the amount to be debited for indirect labor, material and other indirect expenses for production to the work in progress.

In business, overhead or overhead expense refers to an ongoing expense of operating a business. Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit, unlike operating expenses such as raw material and labor. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities.

For example, if a company’s business is labor-intensive, such as concrete forming, direct labor costs would be a better choice as an allocation method. In addition, any medical insurance, payroll taxes or fringe benefits related to direct labor that are not charged to a specific job should be included as indirect costs and allocated to jobs. If an administrative employee was involved in a construction activity for a portion of his or her time, costs associated with that employee for that portion of time should be included in indirect costs. Assume Kline Company allocates overhead costs with the plantwide approach, and direct labor cost is the allocation base. Calculate the rate used by the company to allocate overhead costs.

The direct material cost is one of the primary components for product cost. Under this method, the absorption rate is based on the direct material cost. To calculate this, divide the overheads by the estimated or actual direct material costs. There are two basic ways to evaluate the method of allocating overhead, which are sometimes blended, using either direct labor costs or direct materials costs. Assessing which method is most appropriate for a contractor should be based on the most critical component of the construction activity, labor or materials.

What Is an Allocation Rate?

These are total costs incurred in formulating policies, planning and controlling the operations of an undertaking and motivating its personnel towards attainment of its objectives. These costs are not related directly to production, selling, distribution, research or development activity or function. In the scenario with the soda bottler above, the facility lease payments are still owed even if no current production takes place within the facility. Likewise, the company still incurs other business expenses, such as insurance payments and administrative and management salaries.

Despite these costs occurring periodically and sometimes without prior preparation, they are usually one-off payments and are expected to be within the company’s budget for travel and entertainment. Make a comprehensive list of indirect business expenses including items like rent, taxes, utilities, office equipment, factory maintenance etc. Direct expenses related to the production of goods and services, such as labor and raw materials, are not included in overhead costs.

AccountingTools

What is overhead cost allocation?

An allocation rate is a percentage of an investor’s cash or capital outlay that goes toward a final investment. The allocation rate most often refers to the amount of capital invested in a product net of any fees that may be incurred through the investment transaction.

There are two types of overhead, which are administrative overhead and manufacturing overhead. Manufacturing overhead is all of the costs that a factory incurs, other than direct costs. To calculate the overhead costs of a business, add all the ongoing business expenses that keep your business running but do not contribute to the revenue generation process. These are indirect costs such as administrative expenses, selling and marketing costs and production expenses. You can allocate overhead costs by any reasonable measure, as long as it is consistently applied across reporting periods.

Overhead expenses are other costs not related to labor, direct materials, or production. They represent more static costs and pertain to general business functions, such as paying accounting personnel and facility costs.