What is year-end closing? definition and meaning

Expense accounts do not appear on the post-closing trial balance. The post-closing trial balance ensures there are no temporary accounts remaining open and all debit balance is equal to all credit balances. Also, it determines if there are any balances in the permanent accounts after passing the closing entries.

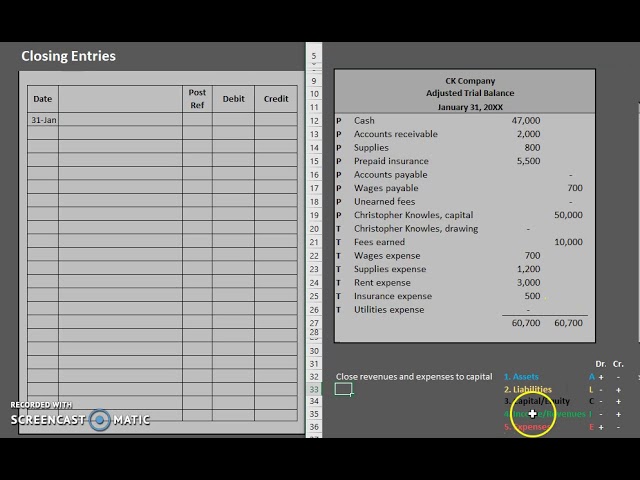

Adjusted Trial Balance

If a company’s revenues were greater than its expenses, the closing entry entails debiting income summary and crediting retained earnings. In the event of a loss for the period, the income summary account needs to be credited and retained earnings are reduced through a debit. If the income summary account has a credit balance after completing the entries, or the credit entry amounts exceeded the debits, the company has a net income.

Temporary – revenues, expenses, dividends (or withdrawals) account. These account balances do not roll over into the next period after closing. The closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period. Since income statement accounts record current year activity, they must be zeroed out or closed at the end of each accounting period.

It contains all the company’s revenues and expenses for the current accounting time period. In other words, it contains net incomeor the earnings figure that remains after subtracting all business expenses, depreciation, debt service expense, and taxes. The income summary account doesn’t factor in when preparing financial statements because its only purpose is to be used during the closing process. This accounts list is identical to the accounts presented on the balance sheet. This makes sense because all of the income statement accounts have been closed and no longer have a current balance.

What is the Post Closing Trial Balance?

A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. Temporary accounts include revenue, expenses, and dividends and must be closed at the end of the accounting year. A post-closing trial balance is a listing of all balance sheet accounts containing non-zero balances at the end of a reporting period. The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances, which should net to zero. A post-closing trial balance lists every account that contains a balance after the close of the accounting period for a business.

This way they will have a zero balance for the start of the next accounting period and only current balances will exist in these accounts. In order to achieve this, closing entries must be made to transfer the ending income statement balances to balance sheet accounts.

- A closing entry is a journal entry made at the end of accounting periodsthat involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet.

As closing entries close all the temporary ledger accounts, the trial balance (post-closing) includes permanent ledger accounts, or we can say balance sheet accounts. The post-closing trial balance is created after the closing process is complete.

If the debit balance exceeds the credits the company has a net loss. Now, the income summary must be closed to the retained earnings account. Perform a journal entry to debit the income summary account and credit the retained earnings account. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We need to do the closing entries to make them match and zero out the temporary accounts.

After the closing entries have been made and all of the temporary accounts have been closed, a post closing trial balance is prepared. This is a listing of all the accounts with balances that will carry forward to the next accounting period. Since theincome statementaccounts don’t have balances anymore, you can think of this as the openingbalance sheetfor the next accounting period.

These accounts only include balance sheet accounts and not accounts that carry a zero balance. Temporary accounts and nominal accounts do not carry a balance at the end of the period and thus do not appear on the post-closing trial balance. The income summary account serves as a temporary account used only during the closing process.

Post-closing trial balance

Does Post Closing Trial Balance have to balance?

A post-closing trial balance is a listing of all balance sheet accounts containing non-zero balances at the end of a reporting period. The post-closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances, which should net to zero.

The income summary account only appears during the closing process and never carries a balance. The accountant closes out both the revenue account balances and the expense account balances to the income summary. He then closes the income summary out to the owner’s capital account. The purpose of the income summary account is to just facilitate the closing process, so it does not appear on the post-closing trial balance. In the first and second closing entries, the balances of Service Revenue and the various expense accounts were actually transferred to Income Summary, which is a temporary account.

The accounting period closes when the accountant records all financial entries in the general ledger and the financial statements are prepared. The balances contained in the post-closing trial balance represent the beginning balances for the following period.

A simple difference between adjusted and unadjusted trial balance is the amounts in the adjusting entries. -Use the Trial Balance section to prove the equality of debits and credits in the general ledger. -Use the Adjustments section to enter changes in account balances that are needed to present an accurate and complete picture of the financial affairs of the business.

The post-closing balance includes only balance sheet accounts. You should not include income statement accounts such as the revenue and operating expense accounts. Other accounts such as tax accounts, interest and donations do not belong on a post-closing trial balance report.

Financial Accounting

The Income Summary account would have a credit balance of 1,060 (9,850 credit in the first entry and 8,790 debit in the second). Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. A Post-closing Trial Balance lists all the balance sheet accounts that have a non-zero balance at the end of a reporting period. Hence, Companies use this tool to ensure that all debit balances are equal to the total of all credit balances after an accountant passes closing entries.

Expense accounts also represent temporary income statement accounts. These accounts accumulate the expenses incurred during the period and start fresh each period. This allows the company to consider only the expenses used during the current period. As the accountant prepares the income statement, she uses the expense balances from the accounting records. Since the expenses start fresh each period, the accountant only needs to find the balance.