What is the difference between accounts payable and accounts receivable?

Revenue is only increased when receivables are converted into cash inflows through the collection. Revenue represents the total income of a company before deducting expenses.

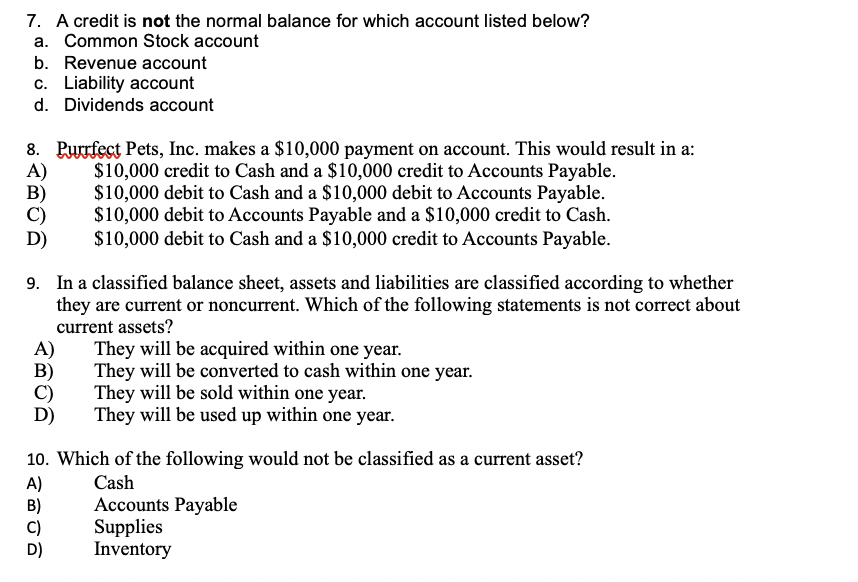

When the amount of the credit sale is remitted, Company B will debit its liability Accounts Payable and will credit Cash. Company A will debit Cash and will credit its current asset Accounts Receivable. Liabilities are any items on the balance sheet that the company owes to financial institutions or vendors.

On the other hand, expenses and withdrawals decrease capital, hence they normally have debit balances. Note that each account is assigned a three-digit number followed by the account name. The first digit of the number signifies if it is an asset, liability, etc. For example, if the first digit is a “1” it is an asset, if the first digit is a “3” it is a revenue account, etc.

State Correct Term for Following Accounting Terms Flashcards

Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days.

Accountants record increases in asset, expense, and owner’s drawing accounts on the debit side, and they record increases in liability, revenue, and owner’s capital accounts on the credit side. An account’s assigned normal balance is on the side where increases go because the increases in any account are usually greater than the decreases.

A bill or invoice from a supplier of goods or services on credit is often referred to as a vendor invoice. The vendor invoices are entered as credits in the Accounts Payable account, thereby increasing the credit balance in Accounts Payable. When a company pays a vendor, it will reduce Accounts Payable with a debit amount. As a result, the normal credit balance in Accounts Payable is the amount of vendor invoices that have been recorded but have not yet been paid.

Their role is to define how your company’s money is spent or received. Each category can be further broken down into several categories. The general ledger is comprised of all the individual accounts needed to record the assets, liabilities, equity, revenue, expense, gain, and loss transactions of a business. In most cases, detailed transactions are recorded directly in these general ledger accounts.

Since assets are on the left side of the accounting equation, both the Cash account and the Accounts Receivable account are expected to have debit balances. Therefore, the Cash account is increased with a debit entry of $2,000; and the Accounts Receivable account is decreased with a credit entry of $2,000. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses.

Accounts receivablesare money owed to the company from its customers. As a result, accounts receivable are assets since eventually, they will be converted to cash when the customer pays the company in exchange for the goods or services provided.

In the latter case, a person researching an issue in the financial statements must refer back to the subsidiary ledger to find information about the original transaction. The general ledger is usually printed and stored in an organization’s year-end book, which serves as the annual archive of its business transactions.

Accounts Payable Outline

- In relation to other accounts, the Freight Expense account is similar to the “Cost of Sales-Freight” account, but are two totally different entities.

- In accounting, the concept of a freight expense or freight spend account can be generalized as a payment for sending out a product to a customer.

The company decided to include a column to indicate whether a debit or credit will increase the amount in the account. This sample chart of accounts also includes a column containing a description of each account in order to assist in the selection of the most appropriate account.

Companies looking to increase profits want to increase their receivables by selling their goods or services. Typically, companies practice accrual-based accounting, wherein they add the balance of accounts receivable to total revenue when building the balance sheet, even if the cash hasn’t been collected yet.

They can be current liabilities such as accounts payable and accruals or long-term liabilities like bonds payable or mortgages payable. In finance and accounting, accounts payable can serve as either a credit or a debit. Because accounts payable is a liability account, it should have a credit balance.

What is the normal balance side of any account?

Both accounts belong to Assets, so they have a normal debit balance and will increase with a debit entry and decrease with a credit entry. Let’s look at another example. Let’s assume that you deposited $10,000 into your business account.

Debit and Credit

In accounting, the concept of a freight expense or freight spend account can be generalized as a payment for sending out a product to a customer. Increases are recorded as debits while decreases are recorded as credits. In relation to other accounts, the Freight Expense account is similar to the “Cost of Sales-Freight” account, but are two totally different entities. While the Freight Expense account is increased for payments towards outgoing goods, the Cost of Sales-Freight account is increased for payments towards incoming goods.

Accounting Chapter 2 Flashcards

Since Cash is an asset account, its normal or expected balance will be a debit balance. In the first transaction, the company increased its Cash balance when the owner invested $5,000 of her personal money in the business. (See #1 in the T-account above.) In our second transaction, the business spent $3,000 of its cash to purchase equipment. Hence, item #2 in the T-account was a credit of $3,000 in order to reduce the account balance from $5,000 down to $2,000. Accounts payable are not to be confused with accounts receivable.

Therefore, asset, expense, and owner’s drawing accounts normally have debit balances. Liability, revenue, and owner’s capital accounts normally have credit balances. To determine the correct entry, identify the accounts affected by a transaction, which category each account falls into, and whether the transaction increases or decreases the account’s balance. Asset accounts normally have debit balances, while liabilities and capital normally have credit balances.

Which accounts have a normal debit balance?

Normal balance is the side where the balance of the account is normally found. Asset accounts normally have debit balances, while liabilities and capital normally have credit balances. Income has a normal credit balance since it increases capital .

just simple question .wat are the three golden rules of accounts?

The credit balance indicates the amount that a company owes to its vendors. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. Thus, accounts payable is credited when goods/services are purchased on credit because the liability increases. On the other hand, when a company makes a payment for items purchased on credit, this results in a debit to accounts payable (decrease).