What is the debt to total assets ratio?

Companies with high debt/asset ratios are said to be “highly leveraged,” not highly liquid as stated above. A company with a high debt ratio (highly leveraged) could be in danger if creditors start to demand repayment of debt. Debt to asset indicates what proportion of a company’s assets are being financed with debt, rather than equity. The ratio basically helps in the assessment of the percentage of assets that are being funded by debt is-à-vis the percentage of assets that are being funded by the investors.

This indicates 40% of the corporation’s assets are being financed by the creditors, and the owners are providing 60% of the assets’ cost. Generally, the higher the debt to total assets ratio, the greater the financial leverage and the greater the risk.

The debt/asset ratio shows the proportion of a company’s assets which are financed through debt. If the ratio is less than 0.5, most of the company’s assets are financed through equity. If the ratio is greater than 0.5, most of the company’s assets are financed through debt.

Generally, a ratio of 0.4 – 40 percent – or lower is considered a good debt ratio. A ratio above 0.6 is generally considered to be a poor ratio, since there’s a risk that the business will not generate enough cash flow to service its debt. You may struggle to borrow money if your ratio percentage starts creeping towards 60 percent. Let’s assume that a corporation has $100 million in total assets, $40 million in total liabilities, and $60 million in stockholders’ equity. This corporation’s debt to total assets ratio is 0.4 ($40 million of liabilities divided by $100 million of assets), 0.4 to 1, or 40%.

Accounting Topics

The debt to asset ratio, or total debt to total assets, measures a company’s assets that are financed by liabilities, or debts, rather than its equity. This ratio can be used to measure a company’s growth through its acquired assets over time. Total liabilities divided by total assets or the debt/asset ratio shows the proportion of a company’s assets which are financed through debt. If the ratio is less than 0.5, most of the company’s assets are financed through equity.

A company’s debt-to-asset ratio shows the percentage of total assets that were paid for with borrowed money, represented by debt on the balance sheet. Some see it as an indicator of financial leverage or a measure of solvency, while others see it as critical insight into a firm’s financial health or distress. The debt to assets ratio indicates the proportion of a company’s assets that are being financed with debt, rather than equity. A ratio greater than 1 shows that a considerable proportion of assets are being funded with debt, while a low ratio indicates that the bulk of asset funding is coming from equity. A company may also be at risk of nonpayment if its debt is subject to sudden increases in interest rates, as is the case with variable-rate debt.

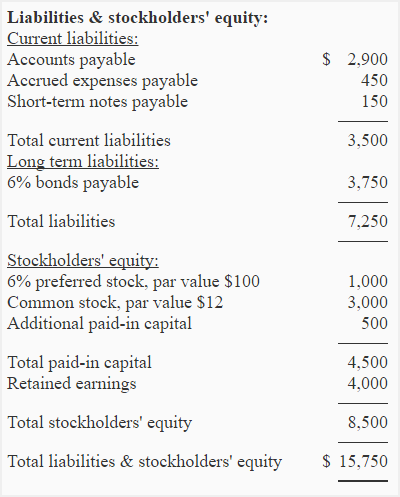

It is a financial ratio that indicates the percentage of a company’s assets that are provided via debt. It is the ratio of total debt (the sum of current liabilities and long-term liabilities) and total assets (the sum of current assets, fixed assets, and other assets such as ‘goodwill’). A single financial ratio can tell you only so much about a company’s financial health. A company might have a low debt-to-total assets ratio, but might be weak in other areas of its business. You should use a debt-to-total assets ratio with other ratios and information when assessing a company’s finances.

How Do I Calculate the Debt-to-Equity Ratio in Excel?

- This ratio can be used to measure a company’s growth through its acquired assets over time.

- Total liabilities divided by total assets or the debt/asset ratio shows the proportion of a company’s assets which are financed through debt.

- The debt to asset ratio, or total debt to total assets, measures a company’s assets that are financed by liabilities, or debts, rather than its equity.

Like all financial ratios, a company’s debt ratio should be compared with their industry average or other competing firms. Another ratio, referred to as the debt to equity ratio, can be computed using this information. This ratio also provides a risk assessment for creditors of the company, and may be used in place of the asset to debt ratio. Calculate the debt to equity ratio by dividing total liabilities (from before) by total stockholder equity.

Also, a company reports some asset values at their original cost on its balance sheet. The market values of its assets might change, which can distort the true risk of its debt level. Debt to asset ratio is a financial ratio that indicates the percentage of a company’s assets that are provided via debt.

What is the Debt to Asset Ratio?

For example, the average debt ratio for natural gas utility companies is above 50 percent, while heavy construction companies average 30 percent or less in assets financed through debt. Thus, to determine an optimal debt ratio for a particular company, it is important to set the benchmark by keeping the comparisons among competitors. The debt to total assets ratio is an indicator of a company’s financial leverage. It tells you the percentage of a company’s total assets that were financed by creditors. In other words, it is the total amount of a company’s liabilities divided by the total amount of the company’s assets.

Limitations of the Total-Debt-to-Total-Assets Ratio

If the ratio is greater than 0.5, most of the company’s assets are financed through debt. Companies with high debt/asset ratios are said to be highly leveraged. The higher the ratio, the greater risk will be associated with the firm’s operation. In addition, high debt to assets ratio may indicate low borrowing capacity of a firm, which in turn will lower the firm’s financial flexibility.

The debt to asset ratio is aleverage ratiothat measures the amount of total assets that are financed by creditors instead of investors. In other words, it shows what percentage of assets is funded by borrowing compared with the percentage of resources that are funded by the investors.

It is calculated as the total liabilities divided by total assets, often expressed as a percentage. Using the ratio obtained from this calculation, you can identify how leveraged a company is overall and compare that to other companies or industry averages. Acceptable asset to debt ratios vary by industry and growth stage, but an acceptable ratio is generally close to 0.5. This would mean that the company has only financed half of its assets with debt. The debt-to-asset ratio, also known simply as the debt ratio, describes how much of a company’s assets are financed by borrowed money.

This ratio examines the percent of the company that is financed by debt. If a company’s debt to assets ratio was 60 percent, this would mean that the company is backed 60 percent by long term and current portion debt. In this example, let’s say the CEO of a mid-sized corporation wants to calculate the debt to asset ratio of the company. A financial advisor might assist in this process, and they would first analyze the company’s balance sheet to determine the total amount in liabilities as well as the total amount of assets. A lower debt-to-asset ratio suggests a stronger financial structure, just as a higher debt-to-asset ratio suggests higher risk.

What Is Total-Debt-to-Total-Assets?

The formula is derived by dividing the aggregate of all short term and long term debts (total debts) by the aggregate of all current assets and non-current assets (total assets). The debt to assets ratio (D/A) is a leverage ratio used to determine how much debt (a sum of long term and current portion of debt) a company has on its balance sheet relative to total assets.

A debt-to-asset ratio is a financial ratio used to assess a company’s leverage – specifically, how much debt the business is carrying to finance its assets. Sometimes referred to simply as a debt ratio, it is calculated by dividing a company’s total debt by its total assets. Average ratios vary by business type and whether a ratio is “good” or not depends on the context in which it is analyzed. Therefore, analysts, investors and creditors need to see subsequent figures to assess a company’s progress toward reducing debt. In addition, the type of industry in which the company does business affects how debt is used, as debt ratios vary from industry to industry and by specific sectors.