What is the allowance method?

Accounts Receivable Aging Method

To predict your company’s bad debts, you must create an allowance for doubtful accounts entry. You must also use another entry, bad debts expense, to balance your books.

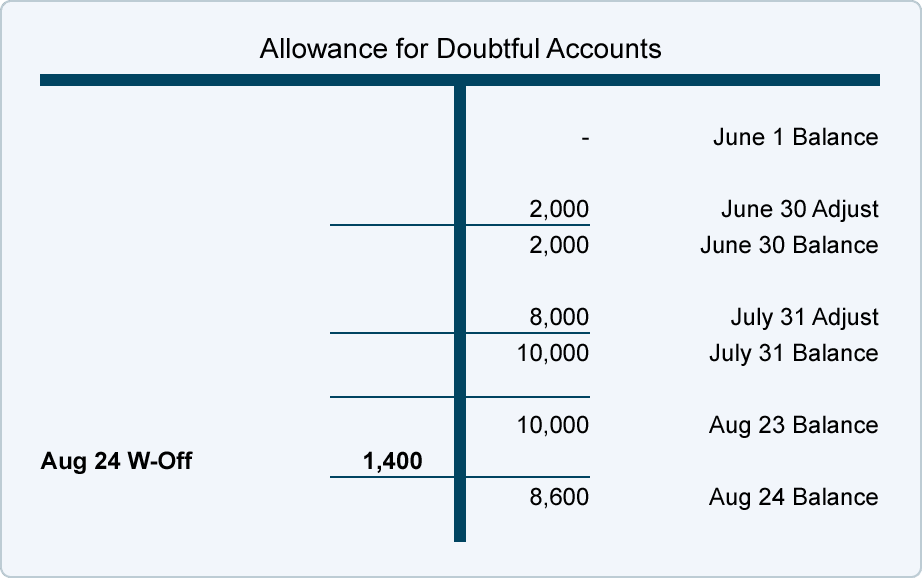

A company will debit bad debts expense and credit this allowance account. The allowance for doubtful accounts is a contra-asset account that nets against accounts receivable, which means that it reduces the total value of receivables when both balances are listed on the balance sheet. This allowance can accumulate across accounting periods and may be adjusted based on the balance in the account.

If the following accounting period results in net sales of $80,000, an additional $2,400 is reported in the allowance for doubtful accounts, and $2,400 is recorded in the second period in bad debt expense. The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400. The allowance method follows GAAP matching principle since we estimate uncollectible accounts at the end of the year. We can calculate this estimates based on Sales (income statement approach) for the year or based on Accounts Receivable balance at the time of the estimate (balance sheet approach). Under the direct write off method, when a small business determines an invoice is uncollectible they can debit the Bad Debts Expense account and credit Accounts Receivable immediately.

This eliminates the revenue recorded as well as the outstanding balance owed to the business in the books. The direct write-off method is used only when we decide a customer will not pay. We do not record any estimates or use the Allowance for Doubtful Accounts under the direct write-off method.

Under the allowance method, a company records an adjusting entry at the end of each accounting period for the amount of the losses it anticipates as the result of extending credit to its customers. The entry will involve the operating expense account Bad Debts Expense and the contra-asset account Allowance for Doubtful Accounts. Later, when a specific account receivable is actually written off as uncollectible, the company debits Allowance for Doubtful Accounts and credits Accounts Receivable. The sales method applies a flat percentage to the total dollar amount of sales for the period.

The matching principle requires a business to record revenues and their related expenses in the same accounting period. Because of this violation, GAAP allows a business to use the direct write-off method only for insignificant amounts. This means creating a debit to the accounts receivable asset account in the amount of the recovery, with the offsetting credit to the allowance for doubtful accounts contra asset account. If the original entry was instead a credit to accounts receivable and a debit to bad debt expense (the direct write-off method), then reverse this original entry.

Next, let’s assume that the corporation focuses on the bad debts expense. As a result, its November income statement will be matching $2,400 of bad debts expense with the credit sales of $800,000. If the balance in Accounts Receivable is $800,000 as of November 30, the corporation will report Accounts Receivable (net) of $797,600. When a business writes off an uncollectible account, it charges the amount as a bad debt expense on the income statement. With the direct write-off method, this expense might occur in a period after the initial sale was recorded, which violates the matching principle of generally accepted accounting principles, or GAAP.

Why Does GAAP Require Accrual Basis Rather Than Cash Accounting?

Increase your bad debts expense by debiting the account, and decrease your ADA account by crediting it. Estimated uncollectibles are recorded as an increase to Bad Debts Expense and an increase to Allowance for Doubtful Accounts (a contra asset account) through an adjusting entry at the end of each period. The only impact that the allowance for doubtful accounts has on the income statement is the initial charge to bad debt expense when the allowance is initially funded.

Therefore, generally accepted accounting principles (GAAP) dictate that the allowance must still be established in the same accounting period as the sale but can be based on an anticipated and estimated figure. The allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. Two primary methods exist for estimating the dollar amount of accounts receivables not expected to be collected. The allowance is established by recognizing bad debt expense on the income statement in the same period as the associated sale is reported. Only entities that extend credit to their customers use an allowance for doubtful accounts.

Allowance for uncollectible accounts is a contra asset account on the balance sheet representing accounts receivable the company does not expect to collect. When customers buy products on credit and then don’t pay their bills, the selling company must write-off the unpaid bill as uncollectible. Allowance for uncollectible accounts is also referred to as allowance for doubtful accounts, and may be expensed as bad debt expense or uncollectible accounts expense.

Thus, the company cannot enter credits in either the Accounts Receivable control account or the customers’ accounts receivable subsidiary ledger accounts. If only one or the other were credited, the Accounts Receivable control account balance would not agree with the total of the balances in the accounts receivable subsidiary ledger.

- This allowance can accumulate across accounting periods and may be adjusted based on the balance in the account.

- A company will debit bad debts expense and credit this allowance account.

- The allowance for doubtful accounts is a contra-asset account that nets against accounts receivable, which means that it reduces the total value of receivables when both balances are listed on the balance sheet.

Regardless of company policies and procedures for credit collections, the risk of the failure to receive payment is always present in a transaction utilizing credit. Thus, a company is required to realize this risk through the establishment of the allowance account and offsetting bad debt expense. In accordance with the matching principle of accounting, this ensures that expenses related to the sale are recorded in the same accounting period as the revenue is earned. The percentage of credit sales approach focuses on the income statement and the matching principle.

For example, based on previous experience, a company may expect that 3% of net sales are not collectible. If the total net sales for the period is $100,000, the company establishes an allowance for doubtful accounts for $3,000 while simultaneously reporting $3,000 in bad debt expense.

We record Bad Debt Expense for the amount we determine will not be paid. This method violates the GAAP matching principle of revenues and expenses recorded in the same period. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Thus, the net impact of the provision for doubtful debts is to accelerate the recognition of bad debts into earlier reporting periods.

Spotting Creative Accounting on the Balance Sheet

The allowance is a contra account, which means that it is paired with and offsets the accounts receivable account. When a specific bad debt is identified, the allowance for doubtful accounts is debited (which reduces the reserve) and the accounts receivable account is credited (which reduces the receivable asset). When a company’s Allowance for Doubtful Accounts is understated, the credit balance in this account is too small. This indicates that the company has reported too little of Bad Debts Expense and therefore too much net income.

The allowance method

Any subsequent write-offs of accounts receivable against the allowance for doubtful accounts only impact the balance sheet. In the direct write off method, a small business owner can debit the Bad Debts Expense account and credit Accounts Receivable. The direct write off method is a way businesses account for debt can’t be collected from clients, where the Bad Debts Expense account is debited and Accounts Receivable is credited. For this reason, bad debt expense is calculated using the allowance method, which provides an estimated dollar amount of uncollectible accounts in the same period in which the revenue is earned. When the firm makes the bad debts adjusting entry, it does not know which specific accounts will become uncollectible.

When the allowance account is used, the company is anticipating that some accounts will be uncollectible in advance of knowing the specific account. When a specific account is identified as uncollectible, the Allowance for Doubtful Accounts should be debited and Accounts Receivable should be credited. A bad debt expense is recognized when a receivable is no longer collectible because a customer is unable to fulfill their obligation to pay an outstanding debt due to bankruptcy or other financial problems. Companies that extend credit to their customers report bad debts as an allowance for doubtful accounts on the balance sheet, which is also known as a provision for credit losses. The mechanics of the allowance method are that the initial entry is a debit to bad debt expense and a credit to the allowance for doubtful accounts (which increases the reserve).

Use the percentage of bad debts you had in the previous accounting period and apply it to your estimate. For example, if 2% of your sales were uncollectible, you could set aside 2% of your sales in your ADA account. Let’s say you have a total of $50,000 in accounts receivable ($50,000 X 2%). Because the allowance for doubtful accounts is established in the same accounting period as the original sale, an entity does not know for certain which exact receivables will be paid and which will default.

If the seller is a new company, it might calculate its bad debts expense by using an industry average until it develops its own experience rate. Let’s say your business brought in $100,000 worth of sales in an accounting period. Based on past trends, you predict that 3% of your sales will be bad debts. You must record $3,000 as a debit in your bad debts expense account and a matching $3,000 as a credit in your allowance for doubtful accounts.

When an account receivable is written off using the allowance method the?

105. When an account is written off using the allowance method, accounts receivable a.is unchanged and the allowance account increases.

What Is a Bad Debt Expense?

Sales revenues of $500,000 are immediately matched with $1,500 of bad debts expense. The balance in the account Allowance for Doubtful Accounts is ignored at the time of the weekly entries. However, at some later date, the balance in the allowance account must be reviewed and perhaps further adjusted, so that the balance sheet will report the correct net realizable value.