What is straight-line depreciation?

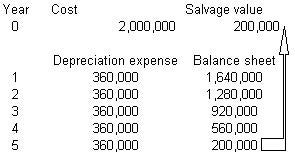

Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. To illustrate straight line depreciation let’s assume that a company purchases equipment at a cost of $430,000 and it is expected to be used in the business for 10 years.

The straight line depreciation method gives you a realistic picture of your business’s profit margin using long-term assets. Straight line depreciation can be calculated on assets such as manufacturing equipment, vehicles, office furniture, computers, and office buildings. These types of assets are known as long-term assets as they are essential to operating your business on a day-to-day basis and lasts for more than one year. When you divide the costs of these assets, you are able to have a full view of your profit margins. The straight line depreciation method is useful because, instead of taking a hit in your accounting early on and then seeing exaggerated profits, your profits and expenses are evened out at an equal pace.

Accumulated depreciation is known as a contra account, because it separately shows a negative amount that is directly associated with an accumulated depreciation account on the balance sheet. Depreciation expense is usually charged against the relevant asset directly. The values of the fixed assets stated on the balance sheet will decline, even if the business has not invested in or disposed of any assets. Otherwise, depreciation expense is charged against accumulated depreciation. Showing accumulated depreciation separately on the balance sheet has the effect of preserving the historical cost of assets on the balance sheet.

What Is an Example of Straight Line Depreciation?

However, assets like real estate or furniture steadily lose their value over time, therefore the straight line depreciation method is more suitable in these cases. If depreciation is assumed to be incurred in equal amounts in each business period over the life of the asset, the depreciation method used is straight line (SL). If the expense is assumed to be incurred in decreasing amounts in each business period over the life of the asset, the method used is said to be accelerated. Two commonly used methods of the accelerating the depreciation of an asset are the sum-of-years digits (SYD) and the declining balance (DB) methods. Frequently, accelerated depreciation is chosen for a business’ tax expense but straight line is chosen for its financial reporting purposes.

For a more accelerated depreciation method see, for example, our Double Declining Balance Method Depreciation Calculator. Accumulated depreciation is applicable to assets that are capitalized.

It does not result in any cash outflow; it just means that the asset is not worth as much as it used to be. Most income tax systems allow a tax deduction for recovery of the cost of assets used in a business or for the production of income. Where the assets are consumed currently, the cost may be deducted currently as an expense or treated as part of cost of goods sold.

What Is Accumulated Depreciation?

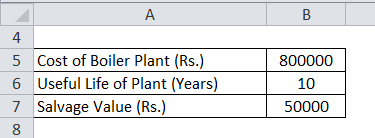

At the end of the 10 years, the company expects to receive a salvage value of $30,000. If the asset is purchased in the middle of the accounting year there will be $20,000 of depreciation in the first and the eleventh accounting year and $40,000 in each of the years 2 through 10. The Excel equivalent function for Straight-Line Method is SLN(cost,salvage,life) will calculate the depreciation expense for any period.

The calculation divides the asset cost by the number of years in the estimated useful life to arrive at the amount of depreciation to be deducted each year. For accounting in particular, depreciation concerns allocating the cost of an asset over a period of time, usually its useful life.

Depreciation is thus the decrease in the value of assets and the method used to reallocate, or “write down” the cost of a tangible asset (such as equipment) over its useful life span. Businesses depreciate long-term assets for both accounting and tax purposes. Generally, the cost is allocated as depreciation expense among the periods in which the asset is expected to be used.

- Businesses depreciate long-term assets for both accounting and tax purposes.

- Depreciation is thus the decrease in the value of assets and the method used to reallocate, or “write down” the cost of a tangible asset (such as equipment) over its useful life span.

Declining Balance Method

When a company purchases an asset, such as a piece of equipment, such large purchases can skewer the income statement confusingly. Instead of appearing as a sharp jump in the accounting books, this can be smoothed by expensing the asset over its useful life. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits.

Straight-line depreciation is the simplest and most often used method. In this method, the company estimates the residual value (also known as salvage value or scrap value) of the asset at the end of the period during which it will be used to generate revenues (useful life). In determining the net income (profits) from an activity, the receipts from the activity must be reduced by appropriate costs. One such cost is the cost of assets used but not immediately consumed in the activity.

Straight line depreciation allows you to use an asset and spread the cost across the time you use it. Instead of one, potentially large expense in a single accounting period, the impact on net income for each period will be smaller. After calculating the depreciation expense, you’ll know how much of the asset’s total cost should be expensed each period. Why would a business willingly choose costlier early expenses on the asset?

There are several standard methods of computing depreciation expense, including fixed percentage, straight line, and declining balance methods. Depreciation expense generally begins when the asset is placed in service. For example, a depreciation expense of 100 per year for five years may be recognized for an asset costing 500. Depreciation has been defined as the diminution in the utility or value of an asset and is a non-cash expense.

Straight-line depreciation is the most commonly used depreciation method for our customers. In For-Profit organizations, the traditional form of this method only applies to assets placed in service before 1981. Calculating depreciation using the straight-line method uses the asset’s original cost and the estimated useful life of the asset to determine the amount of depreciation for each year of the asset’s life.

There are advantages to using both the straight line and the declining balance methods. The straight line depreciation method is easier to use, which will result in less complicated accounting. However, the declining balance method can be more accurate when assessing the value of an asset, for example, if you buy a new computer for your business, it will lose more value early on.

AccountingTools

Capitalized assets are assets that provide value for more than one year. Accounting rules dictate that expenses and sales are matched in the period in which they are incurred. Depreciation is a solution for this matching problem for capitalized assets.

The cost of assets not currently consumed generally must be deferred and recovered over time, such as through depreciation. Some systems permit the full deduction of the cost, at least in part, in the year the assets are acquired.

Other systems allow depreciation expense over some life using some depreciation method or percentage. Rules vary highly by country, and may vary within a country based on the type of asset or type of taxpayer. Many systems that specify depreciation lives and methods for financial reporting require the same lives and methods be used for tax purposes. Most tax systems provide different rules for real property (buildings, etc.) and personal property (equipment, etc.). There are a lot of reasons businesses choose to use the straight line depreciation method.

If there have been no investments or dispositions in fixed assets for the year, then the values of the assets will be the same on the balance sheet for the current and prior year (P/Y). Methods of computing depreciation, and the periods over which assets are depreciated, may vary between asset types within the same business and may vary for tax purposes. These may be specified by law or accounting standards, which may vary by country.