What is Net Cash Flow?

Part 1 of 3: Calculating Monthly Business Cash Flow

This is the net cash generated from sales and purchase of equipment and assets (tangible or intangible) and any other capital expenditure for core operations. It also includes the movement of cash due to investments made outside the company like investing in other businesses, stock market, bonds etc. Add the balance in your operating activities, financing activities, and investing activities columns together.

Apparently, both companies chose to return cash to owners by repurchasing stock. A section of the statement of cash flows that includes cash activities related to net income, such as cash receipts from sales revenue and cash payments for merchandise. For example, a business may see a profit every month, but its money is tied up in hard assets or accounts receivable, and there is no cash to pay employees. Once a debt is paid, or the business sees an influx in revenue, it starts to see positive cash flow again.

START YOUR BUSINESS

Just as the name suggests, working capital is the money that the business needs to “work.” Therefore, any cash used in or provided by working capital is included in the “cash flows from operating activities” section. Assessing the amounts, timing, and uncertainty of cash flows is one of the most basic objectives of financial reporting. You can approximate a company’s net cash flow by looking at the period-over-period change in cash on the balance sheet. However, the statement of cash flows is a more insightful place to look.

They also fare better in downturns, by avoiding the costs of financial distress. The three categories of cash flows are operating activities, investing activities, and financing activities. Operating activities include cash activities related to net income. Investing activities include cash activities related to noncurrent assets. Financing activities include cash activities related to noncurrent liabilities and owners’ equity.

This is a negative event for cash flow and may contribute to the “Net changes in current assets and current liabilities” on the firm’s cash flow statement to be negative. On the flip side, if accounts payable were also to increase, it means a firm is able to pay its suppliers more slowly, which is a positive for cash flow. Cash flow from investing activities is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various investment-related activities in a specific period. Investing activities include purchases of physical assets, investments in securities, or the sale of securities or assets. Companies with strong financial flexibility can take advantage of profitable investments.

Create columns for operating activities, financing activities, and investing activities. Open all your bank statements for the month you are calculating cash flow for. Your objective is to determine whether you had a positive or negative cash flow for this month. The three sections of Apple’s statement of cash flows are listed with operating activities at the top and financing activities at the bottom of the statement (highlighted in orange). In the center, are the investing activities (highlighted in blue).

If the number is negative, your business spent more than it earned that month. Add up all inflow you generated from debt or equity financing. This includes money spent or received from stocks, bonds and other securities. Include proceeds from sale of stock, money received from borrowing, and money received from contributions and investment income.

However, negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development. The cash inflows and cash outflows in the cash flow statement are segmented into cash flow from operations, investing, and financing.

BUSINESS OPERATIONS

Overall, the cash flow statement provides an account of the cash used in operations, including working capital, financing, and investing. There are three sections–labeled activities–on the cash flow statement. Negative cash flow is often indicative of a company’s poor performance.

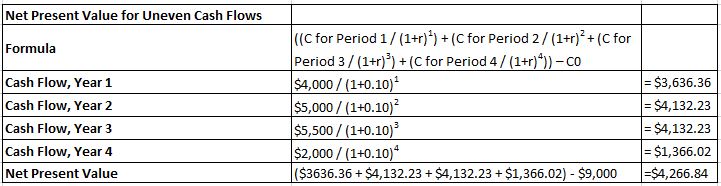

The NPV is a metric that is able to determine whether or not an investment opportunity is a smart financial decision. NPV is the present value (PV) of all the cash flows (with inflows being positive cash flows and outflows being negative), which means that the NPV can be considered a formula for revenues minus costs. If NPV is positive, that means that the value of the revenues (cash inflows) is greater than the costs (cash outflows).

- The balance sheet provides an overview of a company’s assets, liabilities, and owner’s equity as of a specific date.

- The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period.

What is Net Cash Flow?

The balance sheet provides an overview of a company’s assets, liabilities, and owner’s equity as of a specific date. The income statement provides an overview of company revenues and expenses during a period. The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period. Positive cash flow is where you have more money coming in than going out, and negative cash flow is where you have more money going out than coming in.

These details provide insight in the liquidity and solvency, as well the entities ability to meet future needs for capital and growth. This information shows both companies generated significant amounts of cash from daily operating activities; $4,600,000,000 for The Home Depot and $3,900,000,000 for Lowe’s. It is interesting to note both companies spent significant amounts of cash to acquire property and equipment and long-term investments as reflected in the negative investing activities amounts. For both companies, a significant amount of cash outflows from financing activities were for the repurchase of common stock.

How do I calculate net cash flow?

The company’s total net cash flow formula is the sum of the operating cash flow, the investing cash flow and the financing cash flow for each year. Therefore: Year 2015 = 1,720,000 – 1,700,000 – 570,000 = -$550,000.

Thus, the increase in receivables needed to be reversed out to show the net cash impact of sales during the year. The same elimination occurs for current liabilities in order to arrive at the cash flow from operating activities figure. For a measure of the gross free cash flow generated by a firm, use unlevered free cash flow. This is a company’s cash flow excluding interest payments, and it shows how much cash is available to the firm before taking financial obligations into account. The difference between levered and unlevered free cash flow shows if the business is overextended or operating with a healthy amount of debt.

They have gathered below information from cash account and now they want to segregate the cash flow in operating, financing and investing activities. Net income is carried over from the income statement and is the first item of the cash flow statement.

Positive cash flow indicates that a company’sliquid assetsare increasing. This enables it to settle debts, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges.

Negative cash flow indicates that a company’s liquid assets are decreasing. Investments in property, plant, and equipment and acquisitions of other businesses are accounted for in the cash flow from investing activities section. Proceeds from issuing long-term debt, debt repayments, and dividends paid out are accounted for in the cash flow from financing activities section. Dynamic Label Inc. has been preparing the cash flow statement to know which activity gave them positive cash flow and which activity gave them negative cash flow.

When revenues are greater than costs, the investor makes a profit. Company WYZ has been operating in the manufacturing business for ages.

Cash flow comes in your company either through revenue generated from operations, investment income, or from loans. There are several formulas you can use to calculate cash flow for different purposes, including free cash flow, operating cash flow, and net cash flow, among others. Any change in the balances of each line item of working capital from one period to another will affect a firm’s cash flows. For example, if a company’s accounts receivable increase at the end of the year, this means that the firm collected less money from its customers than it recorded in sales during the same year on its income statement.

In this example, cash flow is more important because it keeps the business running while still maintaining a profit. Alternately, a business may see increased revenue and cash flow, but there is a substantial amount of debt, so the business does not make a profit. After all adjustments to net income are accounted for, what’s left over is the net cash provided by operating activities, also known as operating cash flow. This number is not a replacement for net income, but it does provide a great summary of how much cash a company’s core business has generated. This increase would have shown up in operating income as additional revenue, but the cash had not yet been received by year end.

Net cash flow is the sum of cash flow from operations (CFO), cash flow from investing (CFI), and cash flow from financing (CFF). Cash flow from operating activities also reflects changes to certain current assets and liabilities from the balance sheet. Increases in current assets, such as inventories, accounts receivable, and deferred revenue, are considered uses of cash, while reductions in these assets are sources of cash.

Net cash flow from operating activities is calculated as the sum of net income, adjustments for non-cash expenses and changes in working capital. However, both are important in determining the financial health of a company. Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Most cash flow investing activities are cash out flows because most entities make long term investments for operations and future growth. Working capital is calculated as current assets minus current liabilities on the balance sheet (see Lesson 302).