What is Cash Flow Statement (CFS)?

A Cash Flow Statement (CFS), or sometimes called a statement of cash flows, is a financial statement issued by a company that totals its amount of cash as well as cash equivalents going in and out of the company. This Cash Flow Statements (CFS) is often seen as a transparent account of company income and activity, which is why the statement is used by investors to gauge a company’s net cash flow and how the company’s activity brings about income. Though, it is crucial to remember that the definition of cash flow is different than that of net income. This is because net income includes company transactions that may not include cash transfers.

How does a Cash Flow Statement work?

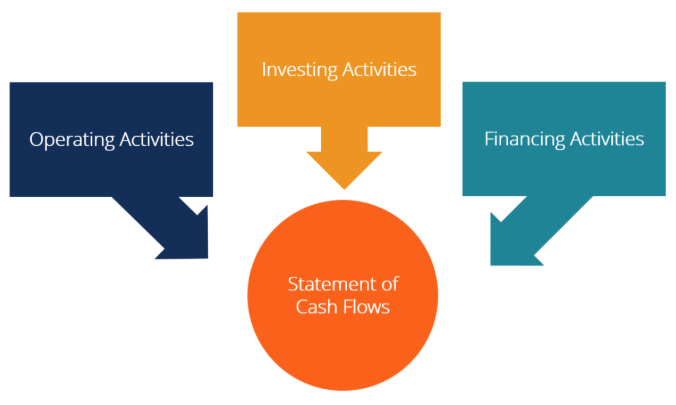

A Cash Flow Statement oftentimes anatomizes cash income generated from a company as well as spending activity. The total of the following calculates a Cash Flow Statement

- Net income

- Non-cash expenses and

- Changes occurring with the company’s working capital

The formula goes as follows:-

Cash Flows from Operations = Net income + Non-cash Expenses + Changes in Working Capital

Do keep in mind however that since Working Capital is an element of activity for companies to generate income, investors who do use Cash Flow Statements must bear in mind that there is a way that a company can dictate cash flow by extending the period it takes to pay the bills in order to conserve cash. Furthermore, receipt of cash can also be sped up in order to reduce the amount of time needed to collect a debt owed to the company and hold off on purchasing inventory.

Cash Flow brought about by investor activity can be seen substantially reflecting upon the company’s purchases of capital assets. Among other things, investors should take into consideration when looking at a Cash Flow Statement is that depending on the company, they have different classifications of what items are or are not capital expenditures.

Cash flow from financing activities oftentimes indicates the company’s purchase or sale of stock and any proceeds from or payments on debt financing. The measure varies with the different capital structures, dividend policies, or debt terms companies may have.

Cash Flow Statements — Why do it matter

Cash Flow Statements can be an invaluable analysis to a company as it helps direct an activity such as business expansions, product development, buying and selling of stocks, dividend payouts, and reducing the amount of debt to pay. Because of this, many hold Cash Flow Statements in much higher regard than any form of finance-measuring statements such as Earnings per Share statements.

- Cash flow relies primarily on a company’s cash gained from operations.

- In turn, cash gained from operations is determined through a company’s net income.

- This means that high revenues, low overhead, and efficiency are the main drivers of cash flow.

If a company’s Cash Flow Statement dips in the negative, a company may have to incur loans in order to operate and, in a worst-case scenario, close down. However, while negative cash flow may be a problem, it definitely isn’t a surefire way to say that a company has hit rock bottom.

An example of this is that if a company where to spend net cash for a period of time in order to build an additional manufacturing plant, its Cash Flow Statement may be negative. However, it could pay off in the long term after the manufacturing plant generates extra cash. However, should a company’s Cash Flow Statement becomes negative due to an acquisition or investment, any long term benefit available in the first example may not be there.