What is Adjusting Entries

An adjustment entry is an entry that is used to bring income and expenses into line at the reporting date. It reflects the economic activity that has already been carried out but has not been properly accounted for.

Classification of Adjusting Entries

The mechanism for making corrections, or adjusting entries, is not regulated by accounting legislation.

Currently, there are two main ways to make corrections.

Errors in accounts can be corrected using the additional or corrective transaction method and the “red reverse” method.

The additional recording method is used if the correct account correspondence was used for accounting, but the amount of the business transaction was mistakenly understated.

If the amount is overstated or incorrect invoice correspondence is used for correction, the “red storno” method is applied.

The organization must approve the selected method independently.

When choosing a particular method, keep in mind that regardless of how corrections are made, the balance on the corresponding accounting account will be the same, and the turnover on the account will be different.

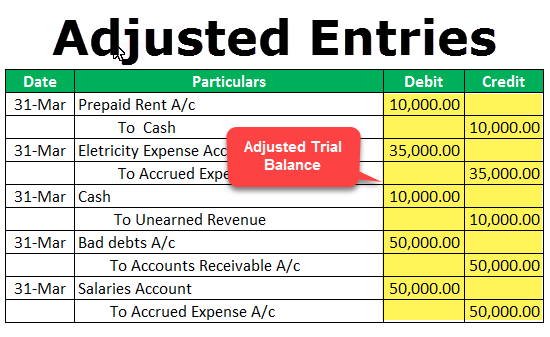

Examples of Adjusting Journal Entries

The additional recording method is used if:

- the cost indicators of the operation or the revenue should be increased due to the detected distortion;

- in the record, they are less than they should be in fact;

- in this case, the amount of the original record was specified incorrectly.

In this case, the additional records method is used.

The adjustment is made by making an additional entry with the same account correspondence for the amount of the difference between the correct transaction amount and the amount reflected in the previous transaction.

In other words, to correct the error in assets or liabilities, perform the same transaction, but only for the missing amount.

For example, the organization found that the cost of current car repair services is reflected in accounting for 5000 dollars instead of 6000 dollars (excluding VAT). In other words, the amount of the business transaction was mistakenly underestimated by $ 1000. An adjusting entry was made to correct an error in accounting: The debit of the account “General Expenses” credit of the account “Settlements with suppliers and contractors” — 1000 dollars-the the cost of services for current car repairs, mistakenly not accounted for earlier, is included in general expenses.

Let’s take another example. From enterprise cash paid wages to employees for $ 20 000. In reality, another sum was earned. In the inventory journal entry incorrectly states the sum of $ 2,000, i.e. entry is made:

Debit “Calculations with the personnel on payment” the Credit account “cash” – $ 2,000.

To correct the error in accrual, an additional entry is made for the amount of the difference between the correct and incorrect entries – $ 18,000 (20,000-2000): The debit of the account “Payments to staff on remuneration”, Credit of the account “cash” – $ 18,000. The “red storno” method is universal. It is most often used when correcting incorrect account correspondence or when overstating the amount of a business transaction. It’s quite simple to adjust the entry by this method.

In this case, the “red storno” method is used in accounting not only to correct errors but also to correct accounting data for individual accounts. If the correspondence of accounts is made incorrectly or if the correct correspondence is recorded for a large amount during the period, the “red storno” method is used, in which two transactions are made:

- an incorrect entry is repeated in both registers in red ink, which means subtracting (reversing, or destroying the entry);

- then the correct entry is made – an additional transaction with the correct account correspondence.

Thus, adjusting entries play a very important role in accounting.