What is a trial balance: The Trial Balance

We note below several ways in which errors could occur and yet not be spotted by reviewing the trial balance. The trial balance is strictly a report that is compiled from the accounting records. Business owners may also choose to prepare a trial balance in the middle of a standard reporting period to assess financial position and ensure that accounting systems are on track. A trial balance is a financial report showing the closing balances of all accounts in the general ledger at a point in time.

- For example, an accounts payable clerk records a $100 supplier invoice with a debit to supplies expense and a $100 credit to the accounts payable liability account.

- BILL assumes no responsibility for any inaccuracies or inconsistencies in the content.

- Then, when the accounting team corrects any errors found and makes adjustments to bring the financial statements into compliance with an accounting framework (such as GAAP or IFRS), the report is called the adjusted trial balance.

Sign up today and start your risk-free 30-day trial to see for yourself all of the features that make BILL a must-have for any business. In this example, the debits equal credits ($120,000 and $120,000), which suggests that the debit and credit entries are accurate. You should try to create a trial balance at least once every reporting period. This ensures that your books are correct and that you can withstand a financial audit.

What Is a Trial Balance?

Accounting and bookkeeping professionals might use a trial balance to perform an internal audit of the company’s finances. While modern accounting software can minimize data entry errors and similar mistakes, trial balances still have their uses among internal company leadership. A trial balance is a list of credit entries and debit entries that businesses use to internally audit their double-entry accounting systems. The goal is to confirm that the sum of all debits equals the sum of all credits and identify whether any entries have been recorded in the wrong account.

However, there still could be mistakes or errors in the accounting systems. A trial balance can be used to assess the financial position of a company between full annual audits. Once a book is balanced, an adjusted trial balance can be completed.

How to prepare and use a trial balance

Make sure that the accounts listed on your trial balance are the same as on your general ledger. Depending on your accounting system, you may need to combine multiple expenses and sources of income. For example, your accounts payable account may contain multiple smaller entries, which you’ll need to total before transferring this data to your trial balance.

- A trial balance is a tool accountants use to check that the general accounting ledger is accurate and to minimize errors occurring in a company’s financial statements.

- The trial balance can also be used to manually compile financial statements, though with the predominant use of computerized accounting systems that create the statements automatically, the report is rarely used for this purpose.

- The trial balance simply records all of the transactions listed in your general ledger accounts on a separate spreadsheet so you can ensure that your journal entries are balanced and accurate.

- You should try to create a trial balance at least once every reporting period.

- In this example, the debits equal credits ($120,000 and $120,000), which suggests that the debit and credit entries are accurate.

- Accounting and bookkeeping professionals might use a trial balance to perform an internal audit of the company’s finances.

Adjusted trial balances are a type of trial balance issued after the initial trial balance is prepared. The adjusted trial balance accounts for information that is missing or misrepresented in the general ledger and can correct for errors identified in the initial report. If you’ve followed the above method, you can simply and quickly calculate all of the credit balances in your credit entry column. If you’re preparing your trial balance with a spreadsheet software program like Microsoft Excel, you can insert a formula that will perform the calculation for you. You can perform an adjusted trial balance once your book is balanced.

Trial Balance vs. Balance Sheet

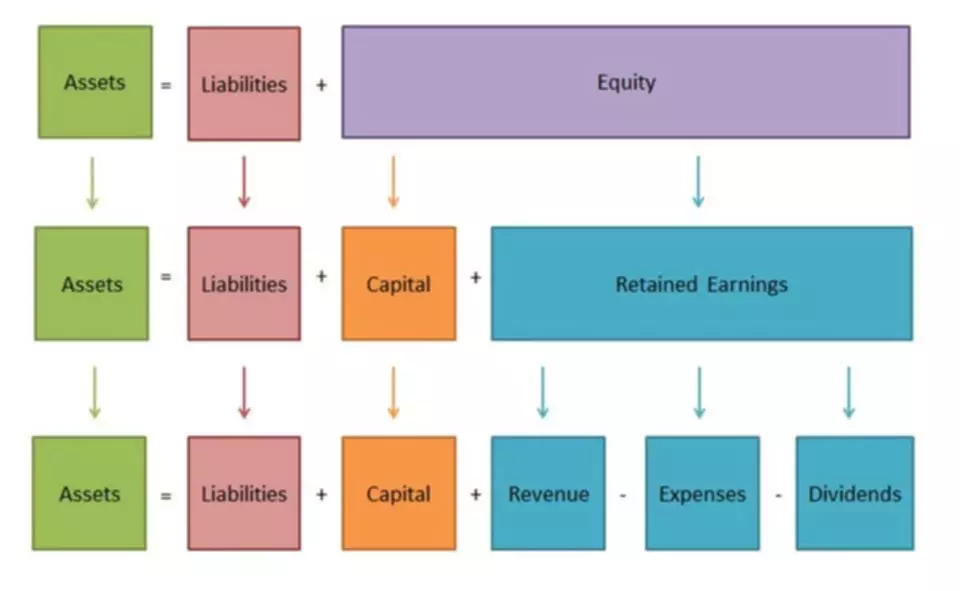

Such uniformity guarantees that there are no unequal debits and credits that have been incorrectly entered during the double entry recording process. However, a trial balance cannot detect bookkeeping errors that are not simple mathematical mistakes. At the end of an accounting period, the accounts of asset, expense, or loss should each have a debit balance, and the accounts of liability, equity, revenue, or gain should each have a credit balance.

According to a study from Indiana University, roughly 60% of accounting errors come from basic bookkeeping mistakes. You can prevent many of these mistakes by relying on a trial balance to keep track of your financial transactions. The following trial balance example combines the debit and credit totals into the second column, so that the summary balance for the total is (and should be) zero.

How to prepare a trial balance

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on, for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. BILL assumes no responsibility for any inaccuracies or inconsistencies in the content. All information in this site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied. Certain links in this site connect to other websites maintained by third parties over whom BILL has no control.

What are the three trial balances?

Your business transactions are initially recorded in your general ledger. Each transaction will receive its own journal entry connected to the corresponding account name. An entry could have been made in reverse, where the amount to be debited was actually credited, while the account to be credited was debited.