What is a Purchase?

Accounting Principles I

Capital expenditures—any outlay made by your company to procure fixed assets, such as the long-term use of machinery or property—are assumed to be consumed over their useful life and are expensed gradually, via their depreciation value. Company B’s brand-new research facility, for instance, would be a capital expenditure. The costs of running the machinery in it, on the other hand, would be revenue expenditures. Examples of capital expenses include the purchase of fixed assets, such as new buildings or business equipment, upgrades to existing facilities, and the acquisition of intangible assets, such as patents.

As the average payment period increases, cash should increase as well, but working capital remains the same. Most companies try to decrease the average payment period to keep their larger suppliers happy and possibly take advantage of trade discounts. When a business purchases capital assets, the Internal Revenue Service (IRS) considers the purchase a capital expense. In most cases, businesses can deduct expenses incurred during a tax year from their revenue collected during the same tax year, and report the difference as their business income. However, most capital expenses cannot be claimed in the year of purchase, but instead must be capitalized as an asset and written off to expense incrementally over a number of years.

Purpose of the Accounts Payable Turnover Ratio

The rate at which a company chooses to depreciate its assets may result in a book value that differs from the current market value of the assets. Essentially, a capital expenditure represents an investment in the business.

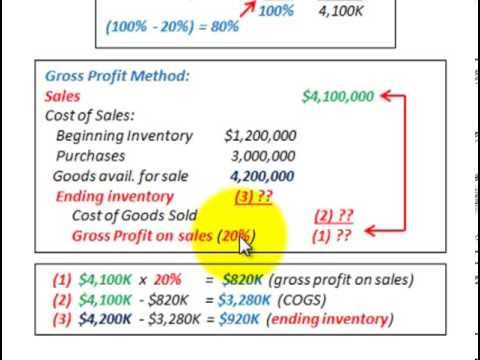

Operating expenses are incurred during regular business, such as general and administrative expenses, research and development, and the cost of goods sold. Add your ending inventory to the cost of goods sold and then subtract the amount of purchases you made in the accounting period. The beginning inventory is especially important when it comes to calculating the cost of goods sold. To calculate the cost of goods sold, you start out with the beginning inventory, add any purchases made during the period, and subtract the ending inventory. A purchase return occurs when a buyer returns merchandise that it had purchased from a supplier.

The purpose of depreciating an asset over time is to align the cost of the asset to the same year as the revenue generated by the asset, in line with the matching principle of U.S. generally accepted accounting principles (GAAP). This means that each year that the equipment or machinery is put to use, the cost associated with using up the asset is recorded.

Capital assets are significant pieces of property such as homes, cars, investment properties, stocks, bonds, and even collectibles or art. For businesses, a capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation. For example, if one company buys a computer to use in its office, the computer is a capital asset. If another company buys the same computer to sell, it is considered inventory.

Operating expenses includea wide range of expense types, from office supplies and travel and distribution expenses tolicensing fees, utilities, property insurance, and property taxes. If equipment is leased instead of purchased, it is typically considered an operating expense. General repairs and maintenance of existing fixed assets such as buildings and equipment are also considered operating expenses unless the improvements will increase the useful life of the asset.

Purchase Discounts and Purchase Returns and Allowances (which are contra accounts to Purchases) are expected to have credit balances. Purchase credit journal entry is recorded in the books of accounts of the company when the goods are purchased by the company on credit from the third party (vendor).

- Operating expenses are expenses incurred during regular business, such as general and administrative expenses, research and development, and the cost of goods sold.

Net Purchases and Goods Purchased

What is net credit purchases?

Net Purchases and Goods Purchased. Net purchases is found by subtracting the credit balances in the purchases returns and allowances and purchases discounts accounts from the debit balance in the purchases account The cost of goods purchased equals net purchases plus the freight‐in account’s debit balance.

Capital expenses are recorded as assets on a company’s balance sheet rather than as expenses on the income statement. The asset is then depreciated over the total life of the asset, with a period depreciation expense charged to the company’s income statement, normally monthly. Accumulated depreciation is recorded on the company’s balance sheet as the summation of all depreciation expenses, and it reduces the value of the asset over the life of that asset. DefinitionThe average payment period (APP) is defined as the number of days a company takes to pay off credit purchases.

Since the return of purchased merchandise is time consuming and costly, under the periodic inventory system there will be an account Purchases Returns. This allows the company’s management to see the magnitude of the returns that occurred. When an asset is impaired, its fair value decreases, which will lead to an adjustment of book value on the balance sheet.

These two types of expenses are treated differently when it comes to accounting and financial statements. However, a company can sometimes choose whether an expense will be an operating or capital expense, for example, whether a needed asset is leased or bought. Capital expenses include the purchase of fixed assets, such as new buildings or business equipment, upgrades to existing facilities, and the acquisition of intangible assets, such as patents.

If a firm purchased machinery for $500,000 and incurred transportation expenses of $10,000 and installation costs of $7,500, the cost of the machinery will be recognized at $517,500. Capital assets are assets that are used in a company’s business operations to generate revenue over the course of more than one year. When adding a COGS journal entry, you will debit your COGS Expense account and credit your Purchases and Inventory accounts.

If you are purchasing a fixed asset or inventory, then the purchase transaction would be a reduction in cash and an increase in either a current asset (inventory) or fixed asset (equipment, vehicle, etc). Inventory is not an expense on your income statement (cost of goods sold) until you sell it.

Revenue accounts carry a natural credit balance; purchase discounts has a debit balance as a contra account. On the income statement, purchase discounts goes just below the sales revenue account. Accounts receivable is a current asset included on the company’s balance sheet. Exceptions to this list would be contra accounts such as Allowance for Doubtful Accounts (a contra account to the asset Accounts Receivable) and Accumulated Depreciation (a contra account to depreciable assets).

Which Industries Have the Highest Inventory Turnover?

How do you calculate net purchases?

Net purchases is defined as the gross amount of purchases made, less deductions for purchase discounts, returns, and allowances.

The first section of an income statement reports a company’s sales revenue, purchase discounts, sales returns and cost of goods sold. This information directly affects a company’s gross and operating profit. A purchase discount is a small percentage discount a company offers to a buyer to induce early payment of goods sold on account. The accounts payable turnover ratio treats net credit purchases as equal to the cost of goods sold (COGS) plus ending inventory, less beginning inventory. This figure, otherwise called total purchases, serves as the numerator in the accounts payable turnover ratio.

Operating expenses are expenses incurred during regular business, such as general and administrative expenses, research and development, and the cost of goods sold. Operating expenses are much easier to understand conceptually than capital expenses since they are part of the day-to-day operations. All operating expenses are recorded on a company’s income statement as expenses in the period when they were incurred. Using depreciation, a business expenses a portion of the asset’s value over each year of its useful life, instead of allocating the entire expense to the year in which the asset is purchased.

An operating expense (OPEX) is an expense required for the day-to-day functioning of a business. In contrast, a capital expense (CAPEX) is an expense a business incurs to create a benefit in the future. Operating expenses and capital expenses are treated quite differently for accounting and tax purposes. If you are purchasing something expendable like office supplies the entry would be to office expense on your income statement and a reduction in cash on your balance sheet.

Purchasing departments handle all of the paperwork involved with purchasing and delivery of supplies and materials. In a small business, this means working closely with the accounting department to ensure that there is sufficient capital to buy the items purchased and that cash is flowing smoothly and all payments are made on time. The cost for capital assets may include transportation costs, installation costs, and insurance costs related to the purchased asset.