What Is a Payback Period? How Time Affects Investment Decisions

The cash flows in net present value analysis are discounted for two main reasons, to adjust for the risk of an investment opportunity, and to account for the time value of money (TVM). A general rule to consider when using the discounted payback period is to accept projects that have a payback period that is shorter than the target timeframe. Net present value method is a tool for analyzing profitability of a particular project.

This is a significant strategic omission, particularly relevant in longer term initiatives. As a result, all corporate financial assessments should discount payback to weigh in the opportunity costs of capital being locked up in the project. The payback period is the time required to earn back the amount invested in an asset from its net cash flows. It is a simple way to evaluate the risk associated with a proposed project.

Payback period formula

This issue is addressed by using DPP, which uses discounted cash flows. Payback also ignores the cash flows beyond the payback period.

The payback method does not specify any required comparison to other investments or even to not making an investment. The payback period is the amount of time for a project to break even in cash collections using nominal dollars. Payback period doesn’t take into consideration the time value of money and therefore may not present the true picture when it comes to evaluating cash flows of a project.

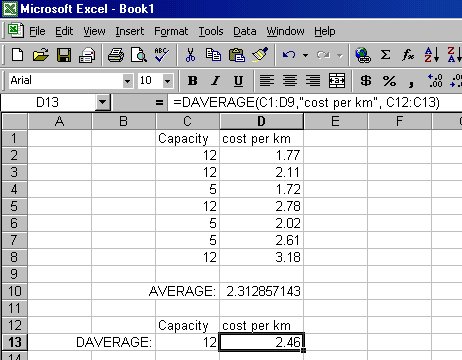

What is the formula for payback period in Excel?

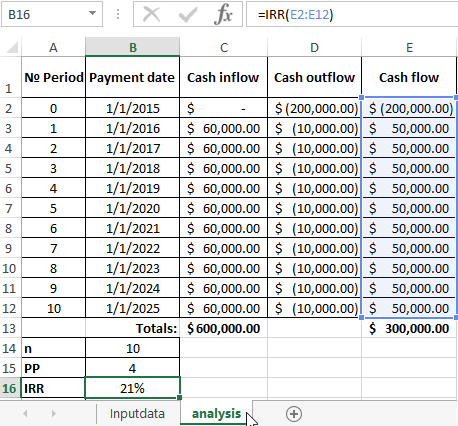

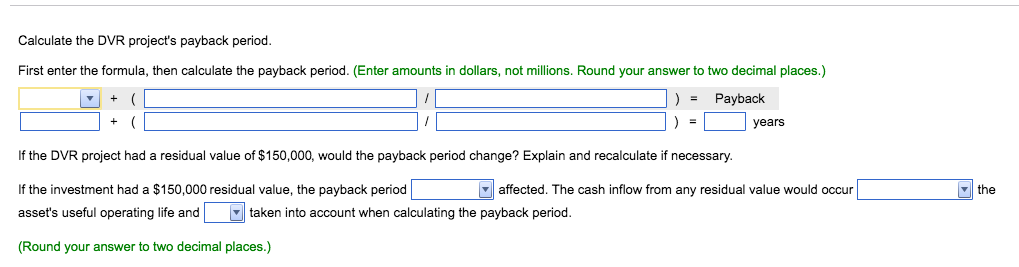

So, the payback period is somewhere in third year. To calculate the fraction, we can simply divide the 120 (cumulative cash flow in year 3) by 220 (cash flow in year 4). Therefore the payback period equals: 3+120/220=3.55 years. Note that payback period can be reported from the beginning of the production.

The presumed rate of return for the reinvestment of intermediate cash flows is the firm’s cost of capital when NPV is used, while it is the internal rate of return under the IRR method. The payback period is the time it will take for a business to recoup an investment. Consider a company that is deciding on whether to buy a new machine. Management will need to know how long it will take to get their money back from the cash flow generated by that asset. The calculation is simple, and payback periods are expressed in years.

How to Calculate Payback Period: Method & Formula

Payback period does not specify any required comparison to other investments or even to not making an investment. While the time value of money can be rectified by applying a weighted average cost of capital discount, it is generally agreed that this tool for investment decisions should not be used in isolation. Alternative measures of ” return ” preferred by economists are net present value and internal rate of return.

Mutually exclusive investments and payback analysis

The method does not take into account the time value of money, where cash generated in later periods is worth less than cash earned in the current period. A variation on the payback period formula, known as the discounted payback formula, eliminates this concern by incorporating the time value of money into the calculation. Other capital budgeting analysis methods that include the time value of money are the net present value method and the internal rate of return. The discounted payback period is a capital budgeting procedure used to determine the profitability of a project. A discounted payback period gives the number of years it takes to break even from undertaking the initial expenditure, by discounting future cash flows and recognizing the time value of money.

Calculating the Payback Period

The payback method should not be used as the sole criterion for approval of a capital investment. They discount the cash inflows of the project by the cost of capital, and then follow usual steps of calculating the payback period. Alternative measures of “return” preferred by economists are net present value and internal rate of return. An implicit assumption in the use of the payback method is that returns to the investment continue after the payback period.

That time value of money deals with the idea of basic depreciation of money due to the passing of time. The present value of a particular amount of money is higher than its future value. In other words, it has been seen that the value of money decreases what time.

- The method does not take into account the time value of money, where cash generated in later periods is worth less than cash earned in the current period.

- A variation on the payback period formula, known as the discounted payback formula, eliminates this concern by incorporating the time value of money into the calculation.

An investment with a shorter payback period is considered to be better, since the investor’s initial outlay is at risk for a shorter period of time. The calculation used to derive the payback period is called the payback method. The payback period is expressed in years and fractions of years.

Advantages of the Payback Method

The metric is used to evaluate the feasibility and profitability of a given project. Whilst the time value of money can be rectified by applying a weighted average cost of capital discount, it is generally agreed that this tool for investment decisions should not be used in isolation. Alternative measures of “return” preferred by economists are net present value and internal rate of return. An implicit assumption in the use of payback period is that returns to the investment continue after the payback period.

Thus in case of payback period or calculating breakeven point in case of a business one must include the relevance of opportunity cost as well. If a payback method does not take into account the time value of money, the real net present value (NPV) of a given project is not being calculated.

Others like to use it as an additional point of reference in a capital budgeting decision framework. There are several types of payback period which are used during the calculation of break-even in business. The net present value of NPV method is one of the common processes of calculating payback period which calculates the future earnings at present value. Discounted payback period is a capital budgeting procedure which is frequently used to calculate the profitability of a project. The net present value aspect of a discounted payback period does not exist in a payback period in which the gross inflow of future cash flow is not discounted.

Most major capital expenditures have a long life span and continue to provide cash flows even after the payback period. Since the payback period focuses on short term profitability, a valuable project may be overlooked if the payback period is the only consideration. It is determined by counting the number of years it takes to recover the funds invested. For example, if it takes five years to recover the cost of an investment, the payback period is five years.

The payback period method is used to quickly evaluate the time it should take for an investor to get back the amount of money put into a project. Those investments with even cash flows are computed by dividing the cost of the investment by the annual net cash flow. Projects with uneven cash flows will require a table to track the cumulative net cash flow and see when the number becomes positive (because we start with a negative number due to the initial investment). They payback method is a handy tool to use as an initial evaluation of different projects. It works very well for small projects and for those that have consistent cash flows each year.

In simple terms, management looks for a lower payback period. Lower payback period denotes quick break even for the business and hence the profitability of the business can be seen quickly. So in the business environment, lower payback period indicates higher profitability from the particular project.

The cash flows in the future will be of lesser value than the cash flows of today. This is a very important aspect and is rightly considered under the NPV method.

However, the payback method does not give a complete analysis as to the attractiveness of projects that receive cash flows after the end of the payback period. And it does not consider the profitability of a project nor its return on investment.

Payback period is the time required to recover the cost of total investment meant into a business. Payback period is a basic concept which is used for taking decisions whether a particular project will be taken by the organization or not.

How do you calculate payback period?

The payback period is expressed in years and fractions of years. For example, if a company invests $300,000 in a new production line, and the production line then produces positive cash flow of $100,000 per year, then the payback period is 3.0 years ($300,000 initial investment ÷ $100,000 annual payback).

Payback period method does not take into account the time value of money. Some businesses modified this method by adding the time value of money to get the discounted payback period. They discount the cash inflows of the project by a chosen discount rate (cost of capital), and then follow usual steps of calculating the payback period.