What Is a Good Liquidity Ratio?

If you do decide to work with a client with a bad credit history, you can draft a contract with amended payment terms. You may wish to ask for more upfront or may demand payment ahead of delivery to reduce the risk of non-payment.

You may wish to create specific deadlines for payment or penalties for late payments as well as limits on balances outstanding. Another option is to reserve the right to not deliver specific services until a balance is paid. Accounts Receivable (AR) represents the credit sales of a business, which are not yet fully paid by its customers, a current asset on the balance sheet. Companies allow their clients to pay at a reasonable, extended period of time, provided that the terms are agreed upon. Along with other standard financial statement analytic tools, the accounts receivable turnover ratio is a useful benchmark for a small business to track regularly.

The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is converted to cash. If the accounts receivable balance is increasing faster than sales are increasing, the ratio goes down.

Should accounts receivable turnover be high or low?

Receivable Turnover Ratio is one of the accounting activity ratios, which measures the number of times, on average, receivables (e.g. Accounts Receivable) are collected during the period. It is calculated by dividing net credit sales (net sales less cash sales) by the average net accounts receivables during the year.

At the end of a set billing period, you will send an invoice to your customers detailing their account number, service or products used, the amount owed and payment due date. Billing and accounting software is available to help maintain this information. It can be difficult to collect on these types of bills if you are dealing with customers with bad credit, or who simply refuse payment.

A low turnover ratio represents an opportunity to collect excessively old accounts receivable that are unnecessarily tying up working capital. Low receivable turnover may be caused by a loose or nonexistent credit policy, an inadequate collections function, and/or a large proportion of customers having financial difficulties. It is also quite likely that a low turnover level indicates an excessive amount of bad debt. Of course, most small business owners wish they could snap their fingers to recoup late payments from clients or to be paid on time.

Accounts receivable turnover ratio

Companies calculate the average collection period to make sure they have enough cash on hand to meet their financial obligations. The accounts receivable turnover ratio is an accounting measure used to quantify a company’s effectiveness in collecting its receivables or money owed by clients. The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is collected or is paid. The receivables turnover ratio is also called the accounts receivable turnover ratio. The accounts receivable turnover ratio measures a company’s effectiveness in collecting its receivables or money owed by clients.

Accounts Receivable Turnover ratio indicates how many times the accounts receivables have been collected during an accounting period. It can be used to determine if a company is having difficulties collecting sales made on credit. The higher the turnover, the faster the business is collecting its receivables. It can be expressed in many forms including accounts receivable turnover rate, accounts receivable turnover in days, accounts receivable turnover average, and more. The average collection period is the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable (AR).

What is a good accounts receivable turnover?

Accounts receivable turnover ratio. Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable. The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner.

If a company has receivables, this means it has made a sale on credit but has yet to collect the money from the purchaser. Postpaid billing is a system in which the customer agrees to pay at a later date for products or services received.

If you engage this kind of billing, consider offering discounts for prompt payment, but be prepared to assign staff to directly contact customers for outstanding bills. In extreme cases, it may become necessary to turn the account over to a collections agency. Increasing the accounts receivable turnover helps businesses operate more efficiently with smoother cash flow. Calculate the ART ratio by dividing annual credit sales by accounts receivable at the end of the year. For example, annual credit sales of $500,000 divided by end of year accounts receivable of $45,000 equals an ART of 11.11.

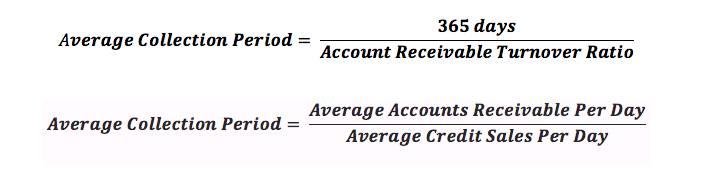

The accounts turnover ratio is calculated by dividing total net sales by the average accounts receivable balance. The average collection period represents the average number of days between the date a credit sale is made and the date the purchaser pays for that sale.

Reduce the time frame a customer is given to pay a bill to improve the ratio (provided the customer actually pays). Diligent follow-up on collections of accounts receivable also is required. Monitoring the ART ratio indicates whether activities implemented are having a positive effect on the accounts receivable turnover. Small business owners often extend credit to customers by allowing them to delay payment for services or products.

- The phrase refers to accounts a business has the right to receive because it has delivered a product or service.

- Accounts receivable refers to the outstanding invoices a company has or the money clients owe the company.

- Accounts receivable, or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period.

Money owed by customers for goods or services already provided is called accounts receivable. Improper management of collecting this money results in problems with cash flow as business owners attempt to balance receivables against payments to suppliers and bills. A/R turnover is an efficiency ratio that tells an analyst how quickly the company is collecting, or turning over, its accounts receivable based on the amount of credit sales it had in the period.

On the other hand, a low accounts receivable turnover ratio suggests that the company’s collection process is poor. This can be due to the company extending credit terms to non-creditworthy customers who experience financial difficulties.

Compare accounts

This figure represents how many times the accounts receivable figure was collected during the year. The average collection period is closely related to the accounts turnover ratio.

On the other hand, if a company’s credit policy is too conservative, it might drive away potential customers to the competition who will extend them credit. If a company is losing clients or suffering slow growth, they might be better off loosening their credit policy to improve sales, even though it might lead to a lower accounts receivable turnover ratio.

The ratio tells a story about the company’s sales and receivables cycle and can give management an early warning of trouble, in time to be able to correct its policies and procedures without serious financial damage. Receivable Turnover Ratio is one of the accounting activity ratios, which measures the number of times, on average, receivables (e.g. Accounts Receivable) are collected during the period.

It is calculated by dividing the total credit sales by the accounts receivable balance. Some companies use the average of the beginning of year A/R and end of year, while others simply use the end of year balance. Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable. The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner. A high turnover ratio indicates a combination of a conservative credit policy and an aggressive collections department, as well as a number of high-quality customers.

Accounts receivable, or receivables represent a line of credit extended by a company and normally have terms that require payments due within a relatively short time period. Further analysis would include days sales outstanding analysis, which measures the average collection period for a firm’s receivables balance over a specified period.

Accounts receivable refers to the outstanding invoices a company has or the money clients owe the company. The phrase refers to accounts a business has the right to receive because it has delivered a product or service.

The two main causes of a declining ratio are changes to the company’s credit policy and increasing problems with collecting receivables on time. If the credit policy has changed to allow customers more time to pay, this can have a significant drag on a company’s resources, because it is money that is not coming in as quickly. If the problem is that customers are simply not paying on time, management needs to review collection policies to correct the problem quickly. The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is collected or being paid. One of the accounts receivable best practices many companies use is to have different contracts for different clients.

While you can’t get it at as quickly as that, with a little work, you can get your receivables flowing and your customers paying. A profitable accounts receivable turnover ratio formula creates survival and success in business. Phrased simply, an accounts receivable turnover increase means a company is more effectively processing credit. An accounts receivable turnover decrease means a company is seeing more delinquent clients.

Accounts receivable turnover is anefficiency ratioor activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. In other words, the accounts receivable turnover ratio measures how many times a business can collect its average accounts receivable during the year. Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt. Furthermore, accounts receivable are current assets, meaning the account balance is due from the debtor in one year or less.

Related

It is calculated by dividing net credit sales (net sales less cash sales) by the average net accounts receivables during the year. Most companies operate by allowing a portion of their sales to be on credit. Sometimes, businesses offer this credit to frequent or special customers that receive periodic invoices. The practice allows customers to avoid the hassle of physically making payments as each transaction occurs. In other cases, businesses routinely offer all of their clients the ability to pay after receiving the service.