What is a Credit Memo?

It is something that can be done easily and professionally. Invoicera an online invoicing software easily help you to create professional looking invoices, credit notes and other memos with ease of a few clicks. So now you know, what is an Invoice and its role in your business. If everything is perfect, the items on the Purchase Order match perfectly with that of the invoice and products are received, the invoice is processed for the payment.

AccountingTools

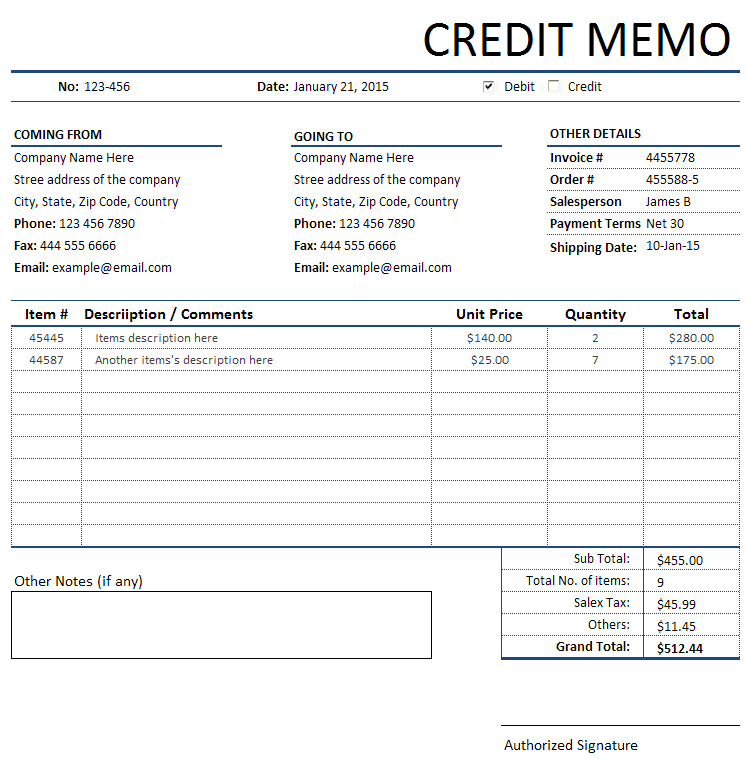

The debit memo is usually issued in the same format used for an invoice. When issued, debit memos typically appear on the monthly statements of outstanding accounts receivable that are sent to customers.

A debit memorandum, or “debit memo,” is a document that records and notifies a customer of debit adjustments made to their individual bank account. The adjustments made to the account reduce the funds in the account but are made for specific purposes and used only for adjustments outside of any normal debits. The reasons a debit memorandum would be issued relate to bank fees, undercharged invoices, or rectifying accidental positive balances in an account. The opposite of a debit memorandum is a credit memorandum. One type of credit memo is issued by a seller in order to reduce the amount that a customer owes from a previously issued sales invoice.

But if, there appears any discrepancy, such as the items received are not in good order or wrong items are supplied, then the items are returned to the supplier. A credit memo (aka a credit note) is the official notice from a business or a bank that documents a refund. Their primary responsibility is to bring new “relationships” to the bank, which includes both deposit and loan accounts.

Our firm of accountants can even help business owners at tax time. A credit memo is one example of a typical document that our accountants deal with. Check out some information on credit memos and learn how they are used by businesses. Within a firm, a debit memo can be created to offset a credit balance that exists in a customer account.

What is the use of credit memo?

A credit memo is a contraction of the term “credit memorandum,” which is a document issued by the seller of goods or services to the buyer, reducing the amount that the buyer owes to the seller under the terms of an earlier invoice.

For instance, if ABC Co. fills an order for XYZ Inc. and invoices the customer in an amount that is short of the agreed amount, ABC Co. will issue a debit memo to XYZ Inc. to indicate and explain the balance due. The difficulties of terms don’t make the task difficult for you as the sole owner or small business.

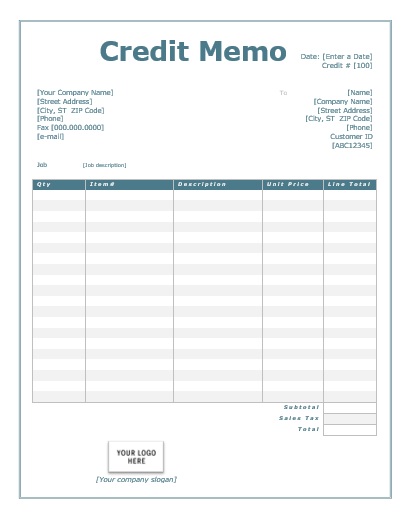

A credit memo, or credit memorandum, is sent to a buyer from a seller. This document is issued to a buyer after an invoice is sent out.

Owners of small- to medium-sized businesses get orders from customers, send out invoices, receive payments, and deal with correspondence from vendors. In short, business owners have a wide variety of accounting matters that demand their time and attention. That’s where the team of expert accountants at Ignite Spot comes in. We have experience handling many types of bookkeeping tasks for small business owners. Our online services include assistance with accounts payable and receivable as well as credit card management, payroll, and more.

A credit note or credit memo, on the other hand, is a document you attach to invoices. These are typically used when a customer returns items to the vendor.

A credit memo is issued when the client has paid advance payments to the vendors. For example, Cindy works for Fluffy Stuffs Inc. as a part of its sales staff. The company has recently sent an order to Toys N’ More for a price based upon last month’s prices. Cindy just received the new prices the sales staff is supposed to charge customers. These prices are much lower than the past due to a drop in the market price for stuffing.

Now, if you run into a client that doesn’t pay your invoice on time, you don’t use a credit note. Instead, you label the invoice as “Bad Debt.” You write bad debts off as business expenses. In the event you’re using an invoicing software, you’ll find that you can’t edit an invoice that’s already been issued. In this case, you’ll need a credit note to show the changes.

- A credit memo, or credit memorandum, is sent to a buyer from a seller.

- A credit memo may reduce the price of an item purchased by a buyer or eliminate the entire cost of an item.

- This document is issued to a buyer after an invoice is sent out.

What’s the difference between a credit memo, credit, and a refund?

Most of the time, the loan request is brought into the bank through the relationship manager. This can be an alternative version of an invoice to a customer, and is used when the amount billed on the original invoice was too low. Thus, the debit memo is essentially an incremental billing for the amount that should have been included in the original invoice. This usage is not common, since many companies simply re-issue the original invoice with an adjustment, or issue an invoice for the incremental amount, rather than use a debit memo.

Tools For Creating Credit Note

An invoice is an itemized bill issued by a business against the services offered. Whereas, a credit note is a promissory note offered to clients in exchange for returned orders. So, what is the role of this note and how it represents invoice vs credit memo? The Accounts Payable Department of a company uses both the invoice and the credit note for the payment processing. It deducts the amount of the credit memo from that of the invoice and clears the payment for the vendor.

Credit Note Or Credit Memo – What Is It? When To Use It And View Sample Credit Notes

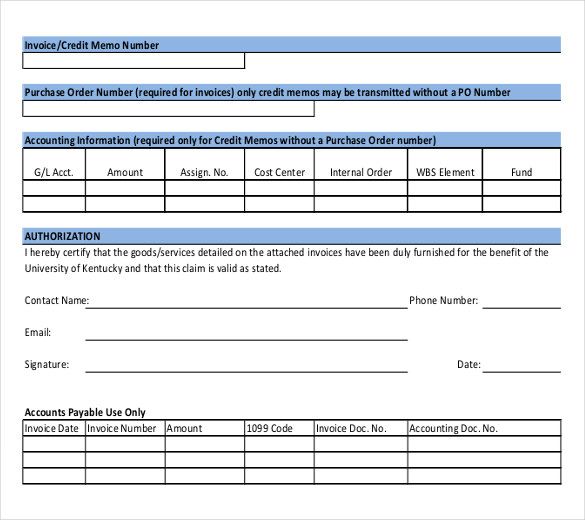

Credit memo request is a sales document used in complaints processing to request a credit memo for a customer. If the price calculated for the customer is too high, for example, because the wrong scale prices were used or a discount was forgotten, you can create a credit memo request. The credit memo request is blocked for further processing so that it can be checked. The system uses the credit memo request to create a credit memo. The seller records the credit memo as a reduction of its accounts receivable balance, while the buyer records it as a reduction in its accounts payable balance.

Therefore Cindy sends a credit memo form to Toys N’ More informing them that they should reduce the amount that they owe to Fluffy Stuffs. Fluffy Stuffs will also reduce its accounts receivable by the same amount. A credit memo is often issued when a seller has made some sort of mistake, or extenuating circumstances have been brought to light which require an adjustment towards a sale. When the latter occurs the bank will transfer the collection of funds into the depositor’s account.

As the vendor, you create a credit note and attach it to the original invoice to nullify it or to subtract the items returned. Or if you accidentally send duplicate items or the wrong items, credit notes can be used as well. Assume that SellerCorp had issued a sales invoice for $800 for 100 units of product that it shipped to BuyerCo at a price of $8 each. BuyerCo informs SellerCorp that one of the units is defective.

Credit Note Body (Middle Section)

Another type of credit memo, or credit memorandum, is issued by a bank when it increases a depositor’s checking account for a certain transaction. You can use any word processor or spreadsheet software program to create a credit note. However these programs have limitations in that you cannot easily adjust inventory, deduct sales value or track whether a credit note has been net off from receivable account. Also searching for a credit note means searching files in your hard disk and opening them one at a time. You can overcome these limitations by using a designated invoicing or billing software which has inbuilt Credit Note features such as Instant Invoice n Cashbookor Ezy Invoice.

A credit memo may reduce the price of an item purchased by a buyer or eliminate the entire cost of an item. When a seller issues a credit memo, it’s put toward the existing balance on a buyer’s account to reduce the total. A customer who receives a refund for a purchase gets actual money back from the seller. Our knowledgeable accountants can help business owners with basic tasks such as issuing credit memos, keeping track of sales, and sending out invoices. Business owners who choose to have their accounting tasks outsourced to Ignite Spot are able to spend more time doing what they do best to boost company profits.

If a customer pays more than an invoiced amount, intentionally or not, the firm can choose to issue a debit memo to offset the credit to eliminate the positive balance. If the credit balance is considered material, the company would most likely issue a refund to the customer instead of creating a debit memo. In business-to-business transactions, a debit memo is issued as an adjustment procedure following an inadvertent under-billing of goods or services provided to a customer. In formal parlance, it is notifying a customer that the debit memorandum will be increasing their accounts payable.