What Does Encumbered Mean in Accounting?

A lien is a type of security interest, an encumbrance that affects the title to a property. It gives a creditor the right to seize the property as collateral for an unmet obligation, usually an unpaid debt.

An encumbrance can impact the transferability of the property and restrict its free use until the encumbrance is lifted. The most common types of encumbrance apply to real estate; these include mortgages, easements, and property tax liens. Not all forms of encumbrance are financial, easements being an example of non-financial encumbrances. An encumbrance can also apply to personal – as opposed to real – property.

Liens and encumbrances are most commonly associated with real estate, but either one may be applied to personal property as well. If an individual fails to pay a debt, then a creditor or tax agency may attach a lien or an encumbrance to the individual’s property. Having such a claim against the property creates an unclear title and can limit the ability to sell or otherwise transfer the property. Encumbrances are not necessarily monetary, but they also include property use restrictions or easements. Encumbrances can be any interest in the property that burdens or reduces the property’s value or clear title.

What is an example of an encumbrance?

An encumbrance refers to restricted funds inside an account that are reserved for a specific debt or liability in the future. Your organization can encumber funds in multiple ways and for multiple reasons, such as: Creating a purchase order to buy goods or service. Signing a contract that commits to purchase something.

Easement is a real estate concept that defines a scenario in which one party uses the property of another party, where a fee is paid to the owner of the property in return for the right of easement. Easements are often purchased by public utility companies for the right to erect telephone poles or run pipes either above or beneath private property. However, while fees are paid to the property owner, easements can negatively affect property values in that unsightly power lines, for example, can lower the visual appeal of a piece of land. If anyone’s looking to buy your property, she’s going to be very interested in the encumbrances. Liens, home equity loans and mortgages all should be recorded in the county registry of deeds where the property is located.

Creditors have no interest in unencumbered assets as they are free and clear of debts and liens. A mechanic’s lien is generally filed by a contractor or the contractor’s sub-contractors for work or materials that remain unpaid. All involuntary liens must be paid off for a title company to issue a title policy without naming the encumbrances as exceptions to the title insurance. Any existing encumbrance is required to be disclosed by the owner of the property to potential buyers.

Encumbrance

Not all bankruptcy lawyers practice real estate and some are unaware that a bankruptcy Chapter 7, for instance, does not release the debt or, their clients do not want to pay an additional fee to obtain a release of this encumbrance. This oversight can cause a cloud on title if the encumbrance is not released. A mechanic’s lienis a claim on personal or real property the claimant has performed services on.

If a seller does not disclose existing encumbrances, he is subject to legal action by the buyer for his failure to do so. For example, an interest in real property may be encumbered by mortgages.

Easements give someone else the right to access your property — for example, to cut across it to an interior lot or to fish off your waterfront. The encumbrance concept is also used in real estate, where it is a claim against a property. It is difficult to transfer an encumbered property, so the property owner has a strong incentive to settle the underlying claim. An encumbrance can also restrict the uses to which property can be put, such as zoning laws that limit the types of construction on a plot of land.

When property is jointly owned, signatures of all owners is usually required to encumber the property. Some encumbrances are about your control of the property rather than your debts. Any government restrictions on the height of your building or the allowed uses of the property are non-monetary encumbrances. So are your homeowners’ association’s rules and covenants about the use of the land.

This allows the debt to be effectively paid off as part of the sales transaction. Trouble happens when the liability for a mortgage or deed of trust has been discharged through a bankruptcy hearing, but the loan is never formally released from the property.

- For the majority of consumers, especially young couples and recent graduates, high-value assets, such as real estate and cars, are unlikely to be unencumbered.

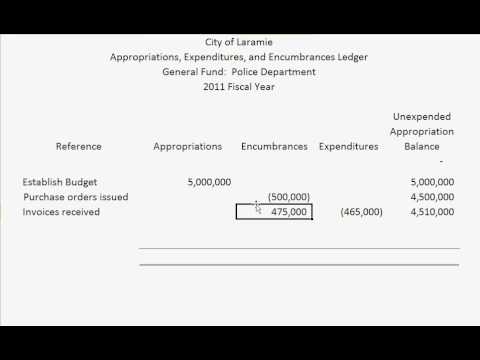

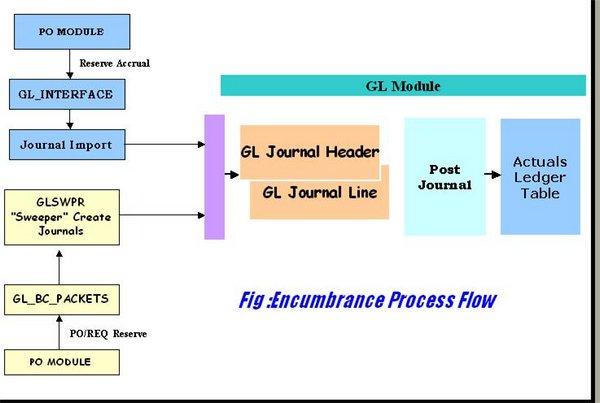

What is Encumbrance Accounting?

For the majority of consumers, especially young couples and recent graduates, high-value assets, such as real estate and cars, are unlikely to be unencumbered. This is because these purchases are often financed, leading to the acquisition of debt, with the asset as collateral. Over time, as the mortgage or car loan is paid off, these assets become unencumbered. A title search is a key part of the due diligence process for a buyer of real estate or a used car to confirm that the asset is unencumbered or has outstanding liens. Unencumbered refers to an asset or property that is free and clear of any encumbrances, such as creditor claims or liens.

Creditors do not have claims to unencumbered assets as there are no associated debts. As a result, these assets are the full property of the person(s) listed as the owner(s) in an official capacity, such as on a title or deed. Unencumbered assets are not listed as collateral for any debt and are not subject to competing claims, such as past-due property taxes.

That makes it easier for a title search to find out how encumbered your property is. Encumbered assets can be sold, but the sale process requires approval by the buyer and seller, as well as any other entity that has a claim to the asset, such as the bank that issued the loan for the collateralized asset. This can lead to minimum sales price requirements, often in an amount equal to or above the collateralized debt amount against the subject property.

An example is if a contractor made adjustments to your property that were never paid for. Judgment liens are secured against the assets of a defendant in a lawsuit. Unencumbered assets are easier to transfer because only the property owner, acting as the seller, and the party interested in purchasing the property, acting as the buyer must approve the sale. Further, there will be no predetermined required sale price, allowing the seller to set the price at his or her discretion.

An unencumbered asset is much easier to sell or transfer than one with an encumbrance. Examples of common unencumbered assets are houses free from mortgages and other liens, cars with paid off loans/notes, or stocks purchased in a cash account. An encumbrance is a claim against a property by a party that is not the owner.

Types of Encumbrances

An encumbrance, as it pertains to real estate, means any legal thing that burdens or restricts usage or transfer of the property. An encumbrance can be a mortgage (loan), a lien (voluntary or involuntary), an easement, or a restriction that limits the transfer of title.

Internal Encumbrance

The creditor can then sell the property to recoup at least a portion of their loan. In Hong Kong, for example, the seller of a property is legally required to inform the real estate agent about any encumbrances against the property in order to avoid any problems later on in the sales process. The real estate agent will provide the buyer with a land search document that will have a list of any encumbrances.