What Does Discounts Received & Allowed Mean?

What is the Journal Entry for Discount Received?

Sales discounts (along with sales returns and allowances) are deducted from gross sales to arrive at the company’s net sales. Hence, the general ledger account Sales Discounts is a contra revenue account. There are two primary types of discounts that might occur in your small business — trade discounts and cash discounts.

Examples – Journal Entry for Discount Received

You must record cash discounts in a separate account in your records and report the amount on your income statement. The assets account includes everything that your company owns. Examples of tangible assets include desktop computers, laptops, cars, cash, equipment, buildings and more.

Example of Sales Discounts

You can also calculate the sale price automatically, instead of subtracting the discount from the original price. For example, if your discount is 30 percent, your remaining price will be 70 percent of its original price. Then, use the same methods to calculate 70 percent of the original price to find your new price. Asset accounts, for example, can be divided into cash, supplies, equipment, deferred expenses and more.

Calculating a discount is one of the most useful math skills you can learn. You can apply it to tips at a restaurant, sales in stores, and setting rates for your own services. The basic way to calculate a discount is to multiply the original price by the decimal form of the percentage. To calculate the sale price of an item, subtract the discount from the original price. You can do this using a calculator, or you can round the price and estimate the discount in your head.

How do you record sales discounts?

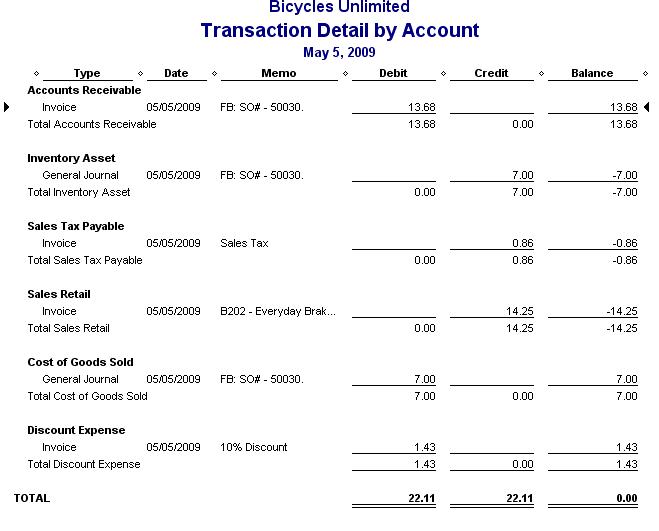

Debit the sales discounts account by the amount of the discount. A debit increases both of these accounts. In this example, debit cash by $99 and debit sales discounts by $1. Credit the accounts receivable account in the same journal entry by the full invoice amount.

- The basic way to calculate a discount is to multiply the original price by the decimal form of the percentage.

- You can apply it to tips at a restaurant, sales in stores, and setting rates for your own services.

- Calculating a discount is one of the most useful math skills you can learn.

Equity accounts may include retained earnings and dividends. Revenue accounts can include interest, sales or rental income. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses. Their role is to define how your company’s money is spent or received.

Your trademark, logo, copyrights and other non-physical items are considered intangible assets. Business owners either handle their accounting themselves or they hire someone else to do it.

In a T-account, their balances will be on the right side. In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance. Recording sales returns and allowances in a separate contra‐revenue account allows management to monitor returns and allowances as a percentage of overall sales.

Debit $100 to accounts receivable and credit $100 to the sales revenue account. To subtract decimals, line up the decimal points and subtract as you would whole numbers. Be careful to drop the decimal point down into your answer. For example, understanding which assets are current assets and which are fixed assets is important in understanding the net working capital of a company. In the scenario of a company in a high-risk industry, understanding which assets are tangible and intangible helps to assess its solvency and risk.

High return levels may indicate the presence of serious but correctable problems. The first step in identifying such problems is to carefully monitor sales returns and allowances in a separate, contra‐revenue account. Sales discounts are also known as cash discounts or early payment discounts.

Revenue, one of the primary types of accounts in accounting, includes the money your company earns from selling goods and services. This term is also used to denote dividends and interest resulting from marketable securities. When you’re starting a business, it’s your responsibility to list the types of assets that your company has. Every time you purchase new products, add them to your list.

Let your accountant know about it so he or she can deduct any expenses that are considered necessary for your business. Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to be recorded. So a typical sales journal entry debits the accounts receivable account for the sale price and credits revenue account for the sales price. Cost of goods sold is debited for the price the company paid for the inventory and the inventory account is credited for the same price. If you’re new to accounting, you may wonder how to record discounts allowed.

A trade discount occurs when you reduce your sales price for a wholesale customer, such as on a bulk order. This type of discount does not appear in your accounting records or on your financial statements. A cash, or sales, discount is one you offer to a customer as an incentive to pay an invoice within a certain time.

Each category can be further broken down into several categories. Debit the accounts receivable account in a journal entry in your records by the full invoice amount of a sale before a cash discount. Credit the sales revenue account by the same amount in the same journal entry.

What are sales discounts?

Cash discounts will go under Debit in the Profit and Loss account. Trade discounts are not recorded in the financial statement. The discount allowed journal entry will be treated as an expense, and it’s not accounted for as a deduction from total sales revenue. Revenues and gains are recorded in accounts such as Sales, Service Revenues, Interest Revenues (or Interest Income), and Gain on Sale of Assets. These accounts normally have credit balances that are increased with a credit entry.

A debit increases accounts receivable, which is an asset account. Unlike an asset account, sales revenue is increased by a credit. For example, assume your small business sold $100 in products to a customer who will pay the invoice at a later date.

To calculate a discount, start by converting the discount percentage to a decimal. Think of the percent number with a decimal to the right of the last digit, then move the decimal point two places to the left to convert it. Next, multiply the original price by the decimal either by hand or by using a calculator. This gives you the discount amount, or what value is being taken off the original price. Then, subtract the discount amount from the original price to figure out the discounted price.