What are the types of transaction in accounting?

AccountingTools

A journal entry is usually printed and stored in a binder of accounting transactions, with backup materials attached that justify the entry. This information may be accessed by the external auditors as part of their year-end investigation of a company’s financial statements and related systems.

What are Accounting Transactions?

When employees are to be paid, the accountant enters the pay rates and hours worked of all employees into the payroll module of the accounting software. The module automatically creates a journal entry that debits the compensation and payroll tax expense accounts, and credits cash.

Sales transactions are recorded in the accounting journal for the seller as a debit to cash or accounts receivable and a credit to the sales account. This lesson will help you learn exactly what a financial transaction is and how it applies to the accounting industry. You will learn the different types of financial transactions and the way that each one affects balance sheet accounts. Marilyn tells Joe that accounting’s “transaction approach” is useful, reliable, and informative.

What is transaction and examples?

Types of Accounting Transactions based on the Exchange of Cash. Based on the exchange of cash, there are three types of accounting transactions, namely cash transactions, non-cash transactions, and credit transactions.

Businesses will have a mixture of cash and credit transactions make up their accounting records. Some businesses may have the majority of their transactions be either one or the other and some will have a more even split. However, you would be hard pressed to find a business that didn’t have at least one cash or credit transaction occur during its lifetime. When suppliers are paid, the accountant checks off the invoice numbers to be paid in the accounts payable module in the accounting software. The software then prints checks or issues electronic payments, while also debiting the accounts payable account and crediting the cash account.

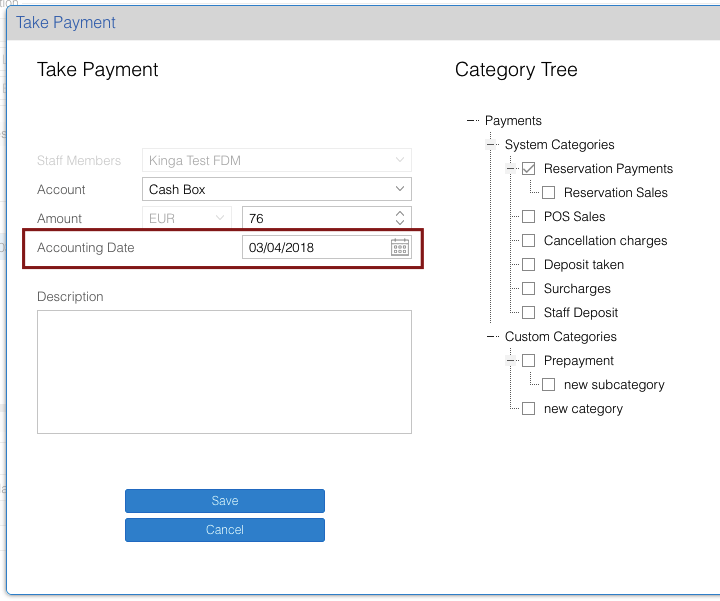

For example, the billing module in the accounting software will debit the accounts receivable account and credit the revenue account every time you create a customer invoice. With thousands of such transactions in a given year, Joe is smart to start using accounting software right from the beginning. Accounting software will generate sales invoices and accounting entries simultaneously, prepare statements for customers with no additional work, write checks, automatically update accounting records, etc. Joe is a hard worker and a smart man, but admits he is not comfortable with matters of accounting. He assumes he will use some accounting software, but wants to meet with a professional accountant before making his selection.

Financial transactions are events that occur that change the value of an asset, a liability, or an owner’s equity. In business, there are four main types of financial transactions, and they include sales, purchases, receipts, and payments.

They are recorded in the accounting journal of the business issuing the payment as a credit to cash and a debit to accounts payable. Purchases are the transactions that are required by a business in order to obtain the goods or services needed to accomplish the goals of the organization. Purchases made in cash result in a debit to the inventory account and a credit to cash.

At his first meeting with Marilyn, Joe asks her for an overview of accounting, financial statements, and the need for accounting software. Based on Joe’s business plan, Marilyn sees that there will likely be thousands of transactions each year.

If a journal entry is created directly in an accounting software package, the software will refuse to accept the entry unless debits equal credits. We now offer eight Certificates of Achievement for Introductory Accounting and Bookkeeping.

All financial transactions that occur have an effect on at least two accounts, depending on the type of transaction. One account will increase in value, while the second account decreases. Accounting transactions are either directly or indirectly recorded with a journal entry. The indirect variety is created when you use a module in the accounting software to record a transaction, and the module creates the journal entry for you.

Types of Accounting Transactions based on Visibility

The certificates include Debits and Credits, Adjusting Entries, Financial Statements, Balance Sheet, Income Statement, Cash Flow Statement, Working Capital and Liquidity, and Payroll Accounting. Accounting rules are statements that establishes guidance on how to record transactions.

There are times when there are more than two accounts that are affected in a single financial transaction. Those who work in the accounting industry have to learn to recognize what type of transaction each one is and what accounts the transaction affects. By doing so and recording the transactions, a company can generate accurate financial statements. Payments are the transactions that refer to a business receiving money for a good or service.

- At his first meeting with Marilyn, Joe asks her for an overview of accounting, financial statements, and the need for accounting software.

There are two basic transactions like debit and credit in any type of accounting. There may be further accounting divisions like payments, receipts, sales, purchase, assets, liability, loss and profit to meet different objectives. As you can see, one business event can often trigger several financial transactions. It is a vital and necessary part of the accounting cycle to recognize and record each individual transaction. Receipts are the transactions that refer to a business getting paid for delivering goods or services to another business.

Free Accounting Courses

She states that accounting software will allow for the electronic recording, storing, and retrieval of those many transactions. Accounting software will permit Joe to generate the financial statements and other reports that he will need for running his business. Some of these, like cash and credit sales as well as credit purchases are more common that the others but depending on what type of transaction we have, we can find a home for it in our accounts. Do you want to find out more about where to record these different types of transactions in your accounting records? We have an exciting set of simple tutorials on the way to teach you bookkeeping basics just like this.

You will also see why two basic accounting principles, the revenue recognition principle and the matching principle, assure that a company’s income statement reports a company’s profitability. When an invoice is to be created for a customer, the accountant enters the relevant information about the price, unit quantity, and applicable sales tax into the billing module in the accounting software. The module automatically creates a journal entry that debits either cash or the accounts receivable account, and credits the sales account.

If the purchase is made with a credit account, the debit entry would still be to the inventory account and the credit entry would be to the accounts payable account. Sales are the transactions in which property is transferred from buyer to seller for money or credit.

The receipt transaction is recorded in the journal for the seller as a debit to cash and a credit to accounts receivable. We will present the basics of accounting through a story of a person starting a new business.

This can be quite a complex entry, since it may also address garnishments and other deductions, and separately record several types of payroll taxes. The most basic method used to record a transaction is the journal entry, where the accountant manually enters the account numbers and debits and credits for each individual transaction. This approach is time-consuming and subject to error, and so is usually reserved for adjustments and special entries. In the following bullet points, we note the more automated approaches used in accounting software to record the more common business transactions.

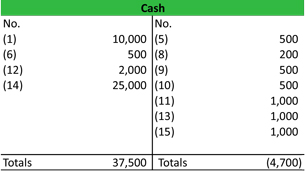

As per accounting rules all the accounting transactions should be recorded in the books of entity using double entry accounting method. Double entry accounting method means for each transaction two (or more) accounts are involved, one account shall be debited and the other account shall be credited with the same amount. The logic behind a journal entry is to record every business transaction in at least two places (known as double entry accounting).

He asks his banker to recommend a professional accountant who is also skilled in explaining accounting to someone without an accounting background. Joe wants to understand the financial statements and wants to keep on top of his new business. His banker recommends Marilyn, an accountant who has helped many of the bank’s small business customers. Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions.

What are the basic accounting transactions?

An accounting transaction is a business event having a monetary impact on the financial statements of a business. It is recorded in the accounting records of the business. Examples of accounting transactions are: Sale in cash to a customer. Sale on credit to a customer.

She has worked with other small business owners who think it is enough to simply “know” their company made $30,000 during the year (based only on the fact that it owns $30,000 more than it did on January 1). Those are the people who start off on the wrong foot and end up in Marilyn’s office looking for financial advice.

For example, when you generate a sale for cash, this increases both the revenue account and the cash account. Or, if you buy goods on account, this increases both the accounts payable account and the inventory account.

A journal entry is used to record a business transaction in the accounting records of a business. A journal entry is usually recorded in the general ledger; alternatively, it may be recorded in a subsidiary ledger that is then summarized and rolled forward into the general ledger. The general ledger is then used to create financial statements for the business.