What are the Three Types of Accounts?

Formula Used for a Balance Sheet

To make a balance sheet for accounting, start by creating a header with the name of the organization and the effective date. Then, list all current assets in order of how easily they can be converted to cash, and calculate the total. Next, list all of your short-term and long-term liabilities and total them as well.

Cash balances are checked by obtaining statements from the bank. Accounts receivable are confirmed by asking customers to verify the balances owed. For inventory, the accountants check purchase orders and receipts, and physically count the raw materials and stock on the premises. Government regulations require all publicly traded companies to prepare audited financial statements.

The equity portion of the balance sheet has all the company’s investor contributions and the accumulated retained earnings. The balance sheet is a report that summarizes all of an entity’s assets, liabilities, and equity as of a given point in time. It is typically used by lenders, investors, and creditors to estimate the liquidity of a business. The balance sheet is one of the documents included in an entity’s financial statements. Of the financial statements, the balance sheet is stated as of the end of the reporting period, while the income statement and statement of cash flows cover the entire reporting period.

Contingent liabilities such as warranties are noted in the footnotes to the balance sheet. The small business’s equity is the difference between total assets and total liabilities. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a “snapshot of a company’s financial condition”. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year.

Most accounting balance sheets classify a company’s assets and liabilities into distinctive groupings such as Current Assets; Property, Plant, and Equipment; Current Liabilities; etc. The following balance sheet example is a classified balance sheet. A number of ratios can be derived from the balance sheet, helping investors get a sense of how healthy a company is. These include the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and statement of cash flows also provide valuable context for assessing a company’s finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet.

A balance sheet summarizes an organization or individual’s assets, equity and liabilities at a specific point in time. Individuals and small businesses tend to have simple balance sheets. Larger businesses tend to have more complex balance sheets, and these are presented in the organization’s annual report. Large businesses also may prepare balance sheets for segments of their businesses. A balance sheet is often presented alongside one for a different point in time (typically the previous year) for comparison.

Finally, calculate the owner’s equity by adding the contributed capital to retained earnings. It is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. The assets on the balance sheet consist of what a company owns or will receive in the future and which are measurable. Liabilities are what a company owes, such as taxes, payables, salaries, and debt. The shareholders’ equity section displays the company’s retained earnings and the capital that has been contributed by shareholders.

Assets and liabilities are separated on the balance into short- and long-term accounts. Short-term assets include cash on hand, accounts receivable and inventory. Goods in inventory may be further separated into the amount of raw materials, work in progress, and finished goods ready for sale and shipping.

For the balance sheet to balance, total assets should equal the total of liabilities and shareholders’ equity. The balance sheet contains assets, liabilities, and owners’ or shareholders’ equity. The assets include cash, property, inventory, and anything else owned by the company. Liabilities include accounts payable or any type of payment made on a long-term loan. Securities and real estate values are listed at market value rather than at historical cost or cost basis.

How Do the Balance Sheet and Cash Flow Statement Differ?

- Contingent liabilities such as warranties are noted in the footnotes to the balance sheet.

- Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year.

The balance sheet is an invaluable piece of information for investors and analysts; however, it does have some drawbacks. Since it is just a snapshot in time, it can only use the difference between this point in time and another single point in time in the past. A balance sheet is a financial statement that reports a company’s assets, liabilities and shareholders’ equity.

The statement shows what an entity owns (assets) and how much it owes (liabilities), as well as the amount invested in the business (equity). This information is more valuable when the balance sheets for several consecutive periods are grouped together, so that trends in the different line items can be viewed.

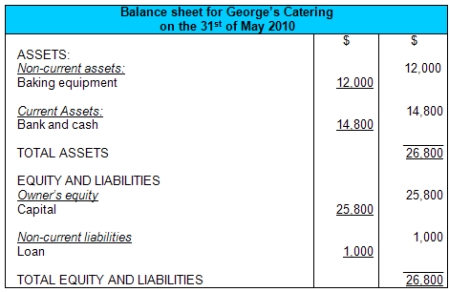

What is a balance sheet example?

Most accounting balance sheets classify a company’s assets and liabilities into distinctive groupings such as Current Assets; Property, Plant, and Equipment; Current Liabilities; etc. The following balance sheet example is a classified balance sheet.

Long-term assets are real estate, buildings, equipment and investments. Short-term liabilities are bank loans, accounts payable, accrued expenses, sales tax payable and payroll taxes payable.

Financial statements prepared by accountants are classified as either audited or unaudited. An audited financial statement signifies that the accountant has verified virtually every transaction and account on the company’s books.

Shareholders’ Equity

Personal net worth is the difference between an individual’s total assets and total liabilities. Balance sheets, like all financial statements, will have minor differences between organizations and industries. However, there are several “buckets” and line items that are almost always included in common balance sheets. We briefly go through commonly found line items under Current Assets, Long-Term Assets, Current Liabilities, Long-term Liabilities, and Equity.

The statements must comply with Generally Accepted Accounting Principles and be certified by independent accountants. Financial professionals will use the balance sheet to evaluate the financial health of the company. The notes (or footnotes) to the balance sheet and to the other financial statements are considered to be part of the financial statements. The notes inform the readers about such things as significant accounting policies, commitments made by the company, and potential liabilities and potential losses. The notes contain information that is critical to properly understanding and analyzing a company’s financial statements.

What is included in the balance sheet?

Balance sheet. Typical line items included in the balance sheet (by general category) are: Assets: Cash, marketable securities, prepaid expenses, accounts receivable, inventory, and fixed assets. Liabilities: Accounts payable, accrued liabilities, customer prepayments, taxes payable, short-term debt, and long-term debt.

A company’s balance sheet is set up like the basic accounting equation shown above. On the left side of the balance sheet, companies list their assets.

Assets

On the right side, they list their liabilities and shareholders’ equity. Sometimes balance sheets show assets at the top, followed by liabilities, with shareholders’ equity at the bottom. The purpose of the balance sheet is to reveal the financial status of a business as of a specific point in time.