What Are the 4 Major Business Organization Forms?

Importance/need of business entity concept

The primary characteristic an LLC shares with a corporation is limited liability, and the primary characteristic it shares with a partnership is the availability of pass-through income taxation. As a business entity, an LLC is often more flexible than a corporation and may be well-suited for companies with a single owner. S corporations may not specially allocate profits, losses and other tax items under US tax law.

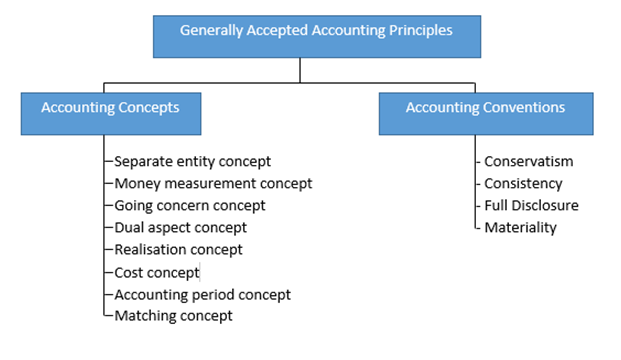

What is the accounting entity concept?

The business entity concept states that the transactions associated with a business must be separately recorded from those of its owners or other businesses. Doing so requires the use of separate accounting records for the organization that completely exclude the assets and liabilities of any other entity or the owner.

To do so, he would file Form 8832 to make his choice known to the IRS. An anonymous Limited Liability Company is a LLC for which ownership information is not made publicly available by the state. Anonymity is possible in states that do not require the public disclosure of legal ownership of a LLC, or where a LLC’s identified legal owners are another anonymous company.

Use ‘legal entity’ in a Sentence

A Series LLC is a special form of a Limited liability company that allows a single LLC to segregate its assets into separate series. For example, a series LLC that purchases separate pieces of real estate may put each in a separate series so if the lender forecloses on one piece of property, the others are not affected. Taxing jurisdictions outside the US are likely to treat a US LLC as a corporation, regardless of its treatment for US tax purposes—for example a US LLC doing business outside the US or as a resident of a foreign jurisdiction.

A corporation is a business entity that is legally separate from the business owners and their finances. The activities of a corporation are regulated by its charter, by-laws, and a board of directors who are required to hold formal organizational meetings. When a business entity is incorporated, there are a number of steps to take to incorporate a business.

The LCC business owner entity can choose to be taxed as a corporation, partnership, or a single-member LLC. For each of these types of taxation, the owner of the LCC will be charged similarly to the business entity type it chooses.

The first state to enact a law authorizing limited liability companies was Wyoming in 1977. The form did not become immediately popular, in part because of uncertainties in tax treatment by the Internal Revenue Service. After an IRS ruling in 1988 that Wyoming LLCs could be taxed as partnerships, other states began enacting LLC statutes.

State statutes typically provide automatic or “default” rules for how an LLC will be governed unless the operating agreement provides otherwise, as permitted by statute in the state where the LLC was organized. Limited partnerships require a formal agreement between the partners. They must also file a certificate of partnership with the state.

These entities all have names that may differ from the names of their owners. The entities may independently own assets and incur obligations, though some entity structures (such as the sole proprietorship and some forms of partnership) may allow owners to also be liable for the obligations of their business entities.

This is very likely where the country (such as Canada) does not recognize LLCs as an authorized form of business entity in that country. Effective August 1, 2013, the Delaware Limited Liability Company Act provides that the managers and controlling members of a limited liability company owe fiduciary duties of care and loyalty to the limited liability company and its members. LLCs are subject to fewer regulations than traditional corporations, and thus may allow members to create a more flexible management structure than is possible with other corporate forms. As long as the LLC remains within the confines of state law, the operating agreement is responsible for the flexibility the members of the LLC have in deciding how their LLC will be governed.

Business entity concept

The limited liability company (“LLC”) has grown to become one of the most prevalent business forms in the United States. Even the use of a single member LLC affords greater protection for the assets of the member, as compared to operating as an unincorporated entity. Similar to a limited partnership, an LLC provides owners with limited liability while providing some of the income advantages of a partnership. Essentially, the advantages of partnerships and corporations are combined in an LLC, mitigating some of the disadvantages of each. The corporate entity owns its own assets and has liability for its own debts.

- An LLC is not a corporation under state law; it is a legal form of a company that provides limited liability to its owners in many jurisdictions.

- A limited liability company (LLC) is the US-specific form of a private limited company.

A limited liability company (LLC) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under state law; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. A limited liability company (LLC) is a hybrid version of a partnership and a corporation that has limited a liability exposure.

For example, suppose John is the sole-owner of XYZ LLC. As a single-member limited liability company, XYZ would be a disregarded entity. The IRS would expect John to report his business income and expenses on a Schedule C filed with his personal Form 1040. In other words, XYZ LLC is being treated as a sole proprietorship by default. John could choose to treat XYZ LLC as if it were a corporation.

It combines the simplicity and flexibility of an LLC with the tax benefits of an S-corporation (self-employment tax savings). For federal income tax purposes, some business entities are, by default, considered not to be separate from their owner. Such is the case with sole proprietors and single-member limited liability companies. The income and deductions related to these entities are normally reported on the same tax return as the owner of the business. The IRS calls these disregarded entitiesbecause it “disregards” the separate name and structure of the business.

In addition, the limitation of personal liability of members does not extend to professional malpractice claims. Although there is no statutory requirement for an operating agreement in most jurisdictions, members of a multiple member LLC who operate without one may encounter problems. In the absence of such statutory provisions, members of an LLC must establish governance and protective provisions pursuant to an operating agreement or similar governing document.

LLCs are created under state law by registering according to the LLC statutes of the company’s home state. The LLC entity owners’ liability is limited to their financial investment in the company, and they are not held personally liable for the company’s financial obligations. A limited liability company (LLC) is a hybrid legal entity having certain characteristics of both a corporation and a partnership or sole proprietorship (depending on how many owners there are). An LLC is a type of unincorporated association distinct from a corporation.

An entity may also be required to submit tax returns and pay governments for their income earned. Types of business entities includecorporations,partnerships,limited liability companies,limited liability partnerships, and sole proprietorships. An accounting entity is a business for which a separate set of accounting records is maintained.

The stock shareholders are considered the legal owners of the company. However, they are not held responsible for the corporation’s debts and taxes. Usually, professions where the state requires a license to provide services, such as a doctor, chiropractor, lawyer, accountant, architect, landscape architect, or engineer, require the formation of a PLLC. However, some states, such as California, do not permit LLCs to engage in the practice of a licensed profession. Typically, a PLLC’s members must all be professionals practicing the same profession.

This article is about the United States of America-specific business entity form. For a general discussion of entities with limited liability, see Private limited company. Corporations are, for tax purposes, separate entities and are considered a legal person. This means, among other things, that the profits generated by a corporation are taxed as the “personal income” of the company. Then, any income distributed to the shareholders as dividends or profits are taxed again as the personal income of the owners.

Understanding the framework of business entities and how they fit in with national and state laws as well as tax laws are useful for making a decision about entity selection. For the sake of saving time and money, business entity owners and potential business entity owners must be sure to do their due diligence on the form their company should take. A personal service corporation (PSC) is a C corporation established to provide professional services such as medical or legal work. PSCs are useful in limiting the owners’ liability for debts accrued by the business while still maintaining the business owners’ malpractice liability. Of the major business entity types, C and S corporations have the most involved requirements for owners.

The organization should engage in clearly identifiable economic activities, control economic resources, and be segregated from the personal transactions of its officers, owners, and employees. Examples of accounting entities are corporations, partnerships, and trusts. An LLC with either single or multiple members may elect to be taxed as a corporation through the filing of IRS Form 8832. Some commentators have recommended an LLC taxed as a S-corporation as the best possible small business structure.

Although LLCs and corporations both possess some analogous features, the basic terminology commonly associated with each type of legal entity, at least within the United States, is sometimes different. Similarly, when issued in physical rather than electronic form, a document evidencing ownership rights in an LLC is called a “membership certificate” rather than a “stock certificate”.