What are operating expenses?

Operating Expense vs. Non-operating Expense

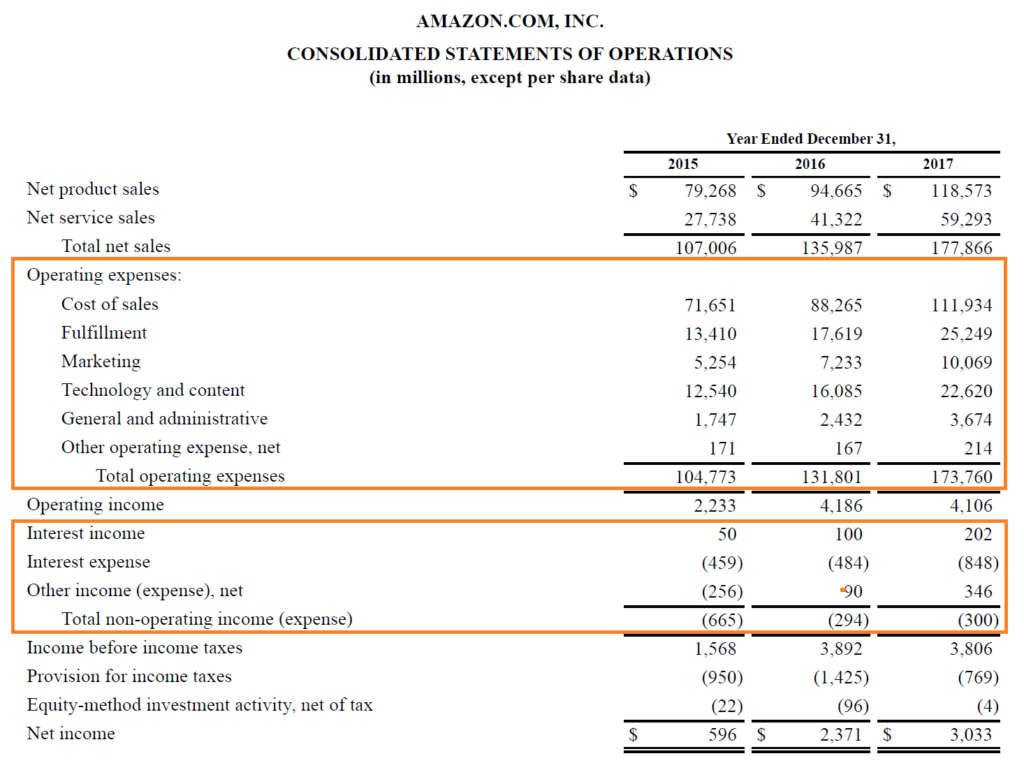

Every year, businesses realize income or experience losses related to their maintenance of cash accounts in banks. Usually, banks pay businesses interest on their account balances, and in some cases, businesses realize dividends or other returns on securities investments they own.

Accountants sometimes remove non-operating expenses to examine the performance of the business, ignoring effects of financing and other irrelevant issues. In some cases, non-operating items are referred to as income from secondary activities, while the business’s normal operations are considered primary activities.

What is included in the operating expenses?

Operating expenses are incurred in the regular operations of business and include rent, equipment, inventory costs, marketing, payroll, insurance, and funds allocated for research and development. Operating expenses are necessary and mandatory for most businesses.

A non-operating expense is a business expense unrelated to the core operations. The most common types of non-operating expenses are interest charges and losses on the disposition of assets. Accountants sometimes remove non-operating expenses and non-operating revenues to examine the performance of the business, ignoring effects of financing and other irrelevant issues.

What are operating expenses examples?

An expense incurred in carrying out an organization’s day-to-day activities, but not directly associated with production. Operating expenses include such things as payroll, sales commissions, employee benefits and pension contributions, transportation and travel, amortization and depreciation, rent, repairs, and taxes.

Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid. Non-operating expenses are deducted from operating profits and accounted for at the bottom of a company’s income statement.

If your business is healthy and successful, the amounts you spend on salaries, wages and operating expenses add value to your bottom line. Direct labor included in cost of goods sold should go into creating products that you can sell for more than the cost of the materials and payroll that went into them. These sales typically translate into assets that improve your company’s net worth. Salaries, wages and expenses are vital components of your income statement, which lists everything you earned and everything you spent during a given period, and then calculates the difference as net profit or loss.

Non-operating items on an income statement includes anything that does not relate to the business’s main profit-seeking operations, such as interest, dividends and capital gains or losses. Income statements can provide critical insight for investors regarding the health of a company, if they know how to read them. It’s important to consider both operating and non-operating items on a income statement because a business could seem profitable in its primary activities and still be facing huge losses from non-operating expenses. Understanding some of the non-operating items on an income statement and the risks they present is important for most private investors. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement.

- The company starts the preparation of its income statement with top-line revenue.

- When looking at a company’s income statement from top to bottom, operating expenses are the first costs displayed just below revenue.

In some cases, taxes will be separated between operating and non-operating income statements, with taxes on activities like owning property and making sales included as an operating item. Other taxes, like income, franchise and excise taxes, are itemized as as non-operating expense. Operating and non-operating expenses are listed in different sections of a firm’s income statement.

The portion of salaries and wages that go directly toward producing the products or services you sell are listed at the top of the statement as part of COGS, or cost of goods sold. The portion of wages and salaries that go to other business activities, such as sales and bookkeeping, are listed with your other expenses and are categorized as indirect costs. A company’s operating margin, also known as return on sales, is a good indicator of how well it is being managed and how risky it is. It shows the proportion of revenues that are available to cover non-operating costs, like paying interest, which is why investors and lenders pay close attention to it.

At the top the income statement, the cost of goods sold is subtracted from revenues to find the gross profit. The amount remaining after all operating expenses are subtracted is called operating income. In short, all the expenses that are revenue in nature and have a supporting role in the operations of business are operating expenses. It is important to understand that the expenses incurred on the initial repairs of the asset to make it useable or the legal costs in the acquiring of assets are not operating expenses. Similarly, the costs incurred in the issuance of shares, debentures are also capital expenditures, and they cannot be treated as operating expenses and deducted from the income statement.

These costs are reported as operating expenses on the income statement because they pertain to operating the main business during that accounting period. These costs are expenses because they may have expired, may have been used up, or may not have a future value that can be measured.

The purpose is to allow financial statement users to assess the direct business activities that appear at the top of the income statement alone. It is important for a business’ future outlook that its core business operations generate a profit. Losses from taxes — or income from tax refunds — generally are not considered an operating activity, even though businesses pay taxes or claim tax credits in every accounting year. The term “earnings before interest and taxes” is often used interchangeably with net operating income.

This kind of income is not usually considered part of their normal business, so it will be itemized on the income statement as non-operating or secondary income. Investments in assets that the business uses in its primary activities — such as plant assets — are not part of this item.

The Difference Between an Operating Expense vs. a Capital Expense

Operating expenses are the costs that have been used up (expired) as part of a company’s main operating activities during the period shown in the heading of its income statement. Operating expenses can greatly impact the profitability of a business and how much cash it has. Operating expenses are the costs a company incurs that are not related to the production of a product. These expenses include items like payroll, rent, office supplies, utilities, marketing, insurance and taxes. Operating income is an accounting figure that measures the amount of profit realized from a business’s operations, after deducting operating expenses such as wages, depreciation, and cost of goods sold (COGS).

By the same token, looking at a company’s past operating margins is a good way to gauge whether a big improvement in earnings is likely to last. Operating margin is widely considered to be one of the most important accounting measurements of operational efficiency. It measures an organization’s operating income, which is total revenue over an accounting period minus operating expenses, and divided by net sales.

These expenses, such as staff and advertising, are known as operating expenses. Businesses also have non-operating expenses and perhaps some non-operating revenue as well, such as the cost and possible income stemming from a lawsuit. When you prepare an income statement for a business, it is good accounting practice to distinguish between operating and non-operating expenses and list them separately. Non-operating expense, like its name implies, is an accounting term used to describe expenses that occur outside of a company’s day-to-day activities.

What Is Operating Expense?

These types of expenses include monthly charges like interest payments on debt but can also include one-off or unusual costs. For example, a company may categorize any costs incurred from restructuring, reorganizing, costs from currency exchange, or charges on obsolete inventory as non-operating expenses. By contrast, a non-operating expense is an expense incurred by a business that is unrelated to the business’ core operations. The most common types of non-operating expenses are depreciation, amortization, interest charges or other costs of borrowing.

After gross income is calculated, all operating costs are then subtracted to get the company’s operating profit, or earnings before interest, tax, depreciation, and amortization (EBITDA). Then, after operating profit has been derived, all non-operating expenses are recorded on the financial statement. Non-operating expenses are subtracted from the company’s operating profit to arrive at its earnings before taxes (EBT). Non-operating expenses are recorded at the bottom of a company’s income statement.

When looking at a company’s income statement from top to bottom, operating expenses are the first costs displayed just below revenue. The company starts the preparation of its income statement with top-line revenue. The firm’s cost of goods sold (COGS) is then subtracted from its revenue to arrive at its gross income.