What are Land Improvements?

Personal property and land improvements are eligible for bonus, though building core and shell assets are not. Unless or until Congress passes a technical correction bill, QIP is ineligible for bonus, and it remains firmly among 39-year assets unless accelerated to 5- or 7-year class lives through a Cost Segregation Study. It is crucial for taxpayers to understand that, at this point, the only way to claim bonus on tenant-improvements is through the aforementioned Cost Segregation Study.

What are Land Improvements?

The Internal Revenue Service (IRS) allows building owners the opportunity under the Modified Accelerated Cost Recovery System (MACRS) to depreciate certain land improvements and personal property over a shorter period than 39 or 27.5 years. Certain land improvements can be depreciated over 15 years at 150% DB, with certain personal property depreciated over 7 or 5 years at 200% DB. This depreciation analysis is known as a cost segregation study.

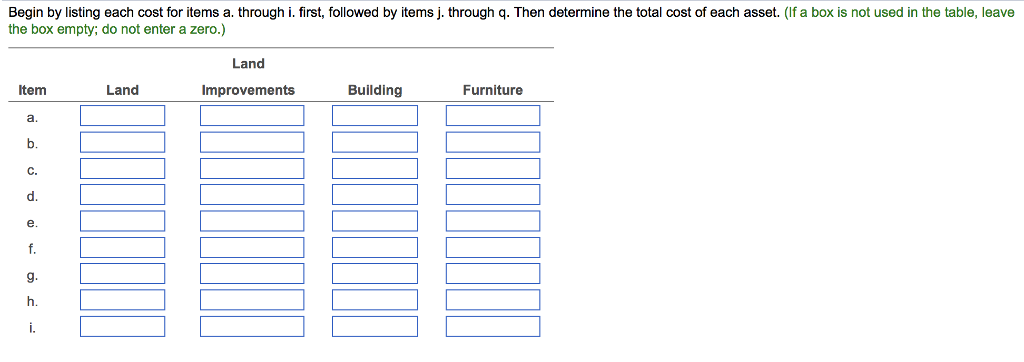

The Cost of Property, Plant, Equipment

Consider the new construction of a multifamily garden-style apartment complex with a depreciable basis of $5 million. In a cost segregation study, 15% of assets were moved into 5-year class life, and another 10% moved into 15-year class life. The impact of 100% bonus depreciation under the TCJA is staggering. Cost Segregation is an engineering-based analysis in which fixed assets are isolated and reclassified into shorter-lived tax categories, resulting in accelerated depreciation, tax deferral, and increased cash flow.

If impairment of that value is suspected, a recoverability test is applied to determine whether sufficient cash will be generated by the asset to recover its current net book value. If not, a fair value test is then applied and the asset’s net book value is reduced to fair value if that number is lower. During construction of property and equipment, interest is capitalized rather than expensed because revenues are not being generated. The matching principle requires that recognition of this expense be deferred until revenue is earned. For that reason, interest incurred during construction is added to the cost of the asset.

Bonus depreciation was introduced by Congress in 2001, in an attempt to stimulate the economy following the attacks of September 11th. Bonus depreciation is a tax incentive that permits owners of qualified property (that is, property with a recovery period of 20 years or less) to immediately deduct a percentage of the asset’s depreciable basis.

The TCJA added QIP as a category of property under section 179 that is eligible for immediate deduction, when a taxpayer elects to include QIP costs in its section 179 deduction calculation. So, even though there is currently no bonus depreciation eligibility for QIP, there is still an opportunity to deduct costs related to QIP for smaller taxpayers.

Examples of Commercial Buildings

The average of the fixed assets for this period is $1.1 million. For example, trees, shrubbery, and sewer systems might be viewed as normal and necessary costs to get land in the condition and position to generate revenues rather than serving as separate assets. GAAP does not provide absolute rules so such costs may be carried within the land account and not depreciated or reported as land improvements subject to depreciation. One asset category that should have qualified for 100% bonus depreciation is Qualified Improvement Property (QIP).

QIP is defined as any improvement to an interior portion of a building which is nonresidential real property if the improvement is placed-in-service after the date the building was first placed-in-service by any taxpayer. Under the TCJA, QIP replaced Qualified Leasehold Improvement, Qualified Restaurant Improvement, and Qualified Retail Improvement Property.

- “Land improvements” is an asset category that includes property attached to land (such as a fence, sidewalk, or sewer system) that has a finite life and should be depreciated.

Commercial Property and Real Estate Depreciation Defined

Such flexibility in accounting is more prevalent than might be imagined. The tax reform bill known as the Tax Cuts and Jobs Act (TCJA) was signed into law on Dec. 22, 2017. But that language did not get added to the final bill, so now we have QIP as a separate category of non-residential real property, but as of Jan. 1, 2018 has a 39 year GDS life and no bonus eligibility.

The only way that QIP can have its bonus eligibility re-established is through a technical correction, and that has to be accomplished through the normal legislative process. It can’t be cured administratively by the IRS since the law is clear that QIP is not bonus eligible because it is not classified as 15 year property. The final bonus regulations (TD 9874) that were issued on Sept. 13, 2019 confirm this. However, there is an opportunity for smaller taxpayers to take immediate deductions on QIP.

In some cases, a distinction between land and improvements is difficult to draw. Accounting rules do not always provide clear guidance for every possible situation.

What Does Land Improvement Mean?

“Land improvements” is an asset category that includes property attached to land (such as a fence, sidewalk, or sewer system) that has a finite life and should be depreciated. Unfortunately, the distinction between land and land improvements is sometimes difficult to draw. The accountant must determine whether the cost of property, such as shrubbery, is a separate asset or a cost to get the land into the condition to be used to generate revenues. Over time, property and equipment can lose a significant amount of value for many reasons.

indicates the efficiency by which a company uses its property and equipment to generate sales revenues. If a company has large amounts reported for various fixed assets but fails to create high revenue balances, the ability of management to make good use of those assets has to be questioned. This figure is calculated by taking net sales for a period and dividing it by the average net book value of the company’s property and equipment (fixed assets). For example, a company with $1 million reported for these assets at the beginning of the year but $1.2 million at the end of the year that is able to generate $6.16 million in net sales has a fixed asset turnover of 5.6 times per year.

This may include bonus depreciation if the taxpayer did not elect out in any eligible year. Taxpayers should also ensure that, when the 15-year life is applied to QLHI, the straight-line method is used rather than the 150DB/STL method used for land improvements. A quick fixed asset review could have a significant impact on a taxpayer’s current year taxable income. Commercial and residential building assets can be depreciated either over 39-year straight-line for commercial property, or a 27.5-year straight line for residential property as dictated by the current U.S.

For example, trees, shrubbery, and sewer systems might be viewed as normal and necessary costs to get land into the condition and position to generate revenues rather than serving as separate assets. Is a sewer system a cost incurred so that land can be utilized or is it truly a distinct asset? Such costs may be carried within the land account and not depreciated or reported as land improvements subject to depreciation.