What are Fixed, Savings, and Variable Costs?

What is a flexible budget?

A flexible budget cannot be preloaded into the accounting software for comparison to the financial statements. Only then is it possible to issue financial statements that contain budget versus actual information, which delays the issuance of financial statements.

Compare the flexible budget to actual results

How do you calculate a flexible budget?

Definition and example. A flexible budget is a budget or financial plan that varies according to the company’s needs. Flexible budgets calculate, for example, different levels of expenditure for variable costs. These levels vary depending on the changes in revenue.

Flexible budgeting can be used to more easily update a budget for which revenue or other activity figures have not yet been finalized. Under this approach, managers give their approval for all fixed expenses, as well as variable expenses as a proportion of revenues or other activity measures. Then the budgeting staff completes the remainder of the budget, which flows through the formulas in the flexible budget and automatically alters expenditure levels. Lenders closely examine current sources of income and monthly expenses.

This approach varies from the more common static budget, which contains nothing but fixed amounts that do not vary with actual revenue levels. This means that the variances will likely be smaller than under a static budget, and will also be highly actionable. Enter actual activity measures into the model after an accounting period has been completed.

Separate fixed and variable costs

Traditional budgeting analyzes only new expenditures, while ZBB starts from zero and calls for a justification of old, recurring expenses in addition to new expenditures. Zero-based budgeting aims to put the onus on managers to justify expenses, and aims to drive value for an organization by optimizing costs and not just revenue. An initial static budget for your small business assumes an expected level of production. This number can, however, vary greatly from your actual production for the year. When evaluating your financial performance, directly comparing your actual expenses and revenues to the expected is meaningless if there is a large production difference.

Fixed costs will be constant within relevant range of operations where the variable costs will continue to increase as production increases. A flexible budget, on the other hand, is a series of budgets prepared for various levels of activities, revenues and expenses. Flexible budgets get modified during the year for actual sales levels, changes in cost of production and virtually any other change in business operating conditions. This flexibility to adapt to change is useful to owners and managers.

The alternative, static budgeting, can’t account for unexpected expenses or changing income. A flexible budget is about more than just making sure you don’t go into the red in any given month.

Flexible budgets are particularly useful for organizations that have variable cost structures. Flexible budgets are not rigid as static budgets; thus, are an appropriate tool for performance measurement to evaluate the performance of the managers.

- Instead of preparing a budget on a yearly basis, King’s Apparel switches over to a monthly budget.

- It finds this change very useful as it can alter its budgeted expenses to take its new orders into account.

What is flexible budget example?

A flexible budget is a budget that adjusts or flexes with changes in volume or activity. The flexible budget is more sophisticated and useful than a static budget. (The static budget amounts do not change. They remain unchanged from the amounts established at the time that the static budget was prepared and approved.)

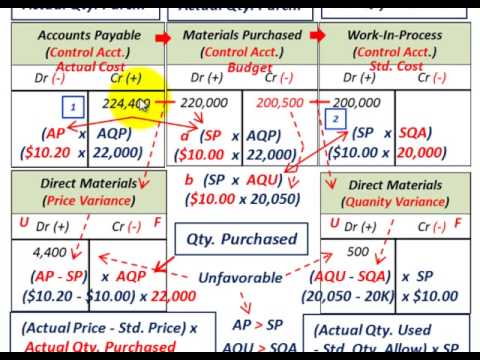

If the volume is fixed, then the managers can later claim that the demand and cost forecasts significantly changed from the budgeted levels and they were unable to achieve the budget. Flexible budgets are most appropriate for organizations that operate with an increased variable cost structure where the costs are mainly associated with the level of activity. On the other hand, flexible budgets are time-consuming and require more planning due to the alterations in activity levels. A flexible budget is usually designed to predict effects of changes in volume and how that affects revenues and expenses. In order to accurately predict the changes in costs, management has to identify thefixed costsand thevariable costs.

A flexible budget performance report will scale your initial budget to allow for a meaningful comparison. Master budgets are usually presented in monthly or quarterly formats, for the entire financial year. Various other documents can also be presented along with the master budget in order to assist informed decision making.

In business, a flexible budget is one that you adjust based on changing costs and revenue. You build your budget at the beginning of the fiscal year, accounting for how much money your business has, needs and expects to make. Some companies have so few variable costs of any kind that there is little point in constructing a flexible budget. Instead, they have a massive amount of fixed overhead that does not vary in response to any type of activity. In this situation, there is no point in constructing a flexible budget, since it will not vary from a static budget.

A document that consists of key financial ratios calculated based on information is included in the budget. These ratios will help to understand whether the master budget has been prepared realistically based on the actual past results. Financial budget outlines how the company earns and spend funds at the corporate level. This includes capital expenditure (funds assigned to acquire and maintain fixed assets) and revenue forecasts from the core business activity.

This is particularly important when you’re hoping to build savings or work towards a larger financial goal. When you must adjust your spending on an ad hoc basis, most often you end up short-changing your savings. The biggest advantage to a flexible budget is that it more accurately reflects the state of your finances.

However, all the entries in a flexible budget may not be so easy to compute. Certain expenses may not vary in direct proportion to the level of activity. Employee costs may remain the same at different levels of production. But they may rise by a large amount if additional staff is recruited. A flexible budget will help you track where you can adjust spending each month.

The difference between master budget and flexible budget mainly depends on the purpose they are prepared for. If budgets are used effectively, they enable a wider range of benefits including revenue growth and effective cost control.

Lenders require established proof of ongoing income and employment stability. Equated monthly installment (EMI) indicates the loan payment amount in order to pay off a mortgage or other loan on time. A borrower’s EMI amount depends on the interest rate and the length of the loan. Lenders also check credit history and loan repayment history. Unpaid debts can affect a credit score for up to seven years, which can reduce the score and limit loan eligibility.

Irregular Expenses – How to Budget Your Money Properly

Both these budgets are considered important milestones in the budgetary control process. They are equipped with a number of uses such as cost control and performance measurement. Thus, a flexible budget gives different budgeted costs for different levels of activity.

A flexible budget is a budget that adjusts or flexes for the changes in the activity level. Unlike in a static budget, which is prepared for a single activity level, a flexible budget is more sophisticated and useful. Here, irrespective of the budgeted volume of output, the revenues and costs will be compared with the adjusted results to the actual volume.

It finds this change very useful as it can alter its budgeted expenses to take its new orders into account. Instead of preparing a budget on a yearly basis, King’s Apparel switches over to a monthly budget. It also classifies each expense into “fixed,” “variable,” and “semi-variable.” This allows it to make accurate adjustments based on the level of activity.

Even if the applicant has strong earnings, lenders measure debt by evaluating the amount on credit cards as well as inflexible expenses. The debt-to-income ratio (DTI) equals total monthly debt payments divided by gross monthly income. For example, a borrower with $6,000 in monthly income and $2,000 in monthly debt payments has a DTI ratio of 33 percent. Lenders look for a DTI ratio of no more than 43 percent, which is the maximum mortgage lenders allow applicants to have.