Variance and Standard Deviation

What Is A Spending Variance?

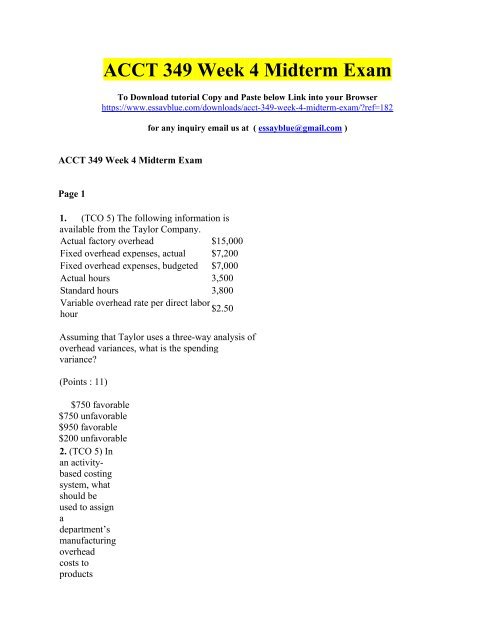

The difference in manufacturing overhead can be divided into spending, efficiency, and volume variances. In budgeting (or management accounting in general), a variance is the difference between a budgeted, planned, or standard cost and the actual amount incurred/sold.

It can be favorable when the budgeted fixed overhead is less than the actual fixed overhead or adverse when the actual costs are more than the budgeted. Managers acknowledge that it is impossible to exactly attain budgeted estimates, such as targeted profits.

A favorable variance results when the actual hours used are less than the budgeted while an adverse variance results from use of more hours than the budgeted. By looking at the unfavorable unit-level cost variances in Exhibit 3, we can tell that there is no idle capacity.

What is the fixed overhead spending variance?

The fixed overhead spending variance is the difference between the actual amount of fixed overhead and the budgeted amount of fixed overhead. If the company spent more than it should have (according to the standard, which is set by management) on fixed overhead, then the fixed overhead spending variance is unfavorable.

Variance analysis is important to assist with managing budgets by controlling budgeted versus actual costs. In program and project management, for example, financial data are generally assessed at key intervals or milestones. For instance, a monthly closing report might provide quantitative data about expenses, revenue and remaining inventory levels. Variances between planned and actual costs might lead to adjusting business goals, objectives or strategies. This is the difference between the actual and budgeted variable overhead costs that result from inefficient use of indirect materials and indirect labor.

The fixed overhead volume variance is obtained by subtracting actual units produced from budgeted units and then multiplying the result with standard fixed cost per unit. The standard fixed cost per unit is obtained by dividing the budgeted fixed overhead by the budgeted production. It can also be obtained by subtracting actual hours incurred in production from the budgeted hours and then multiplying the result with the standard fixed cost per hour. It is favorable when the actual units produced are more than the budgeted units and adverse when the number of units produced are less than the budgeted.

For example, the difference in materials costs can be divided into a materials price variance and a materials usage variance. The difference between the actual direct labor costs and the standard direct labor costs can be divided into a rate variance and an efficiency variance.

These variances are calculated using machine hours as the cost driver. The favorable VO spending variance can be attributed to generating the budgeted variable overhead costs ($1,845,000) despite using extra machine hours. The unfavorable efficiency variance is due to the actual use of 59,000 machine hours instead of the budgeted 57,600 hours. It measures the difference between the budgeted and the actual level of activity valued at the standard fixed cost per unit.

The traditional variance analysis presented below is based on Exhibit 2, p. 41. The variable overhead (VO) spending variance is $44,844F and the variable overhead efficiency variance is $44,844U.

- The variable overhead (VO) spending variance is $44,844F and the variable overhead efficiency variance is $44,844U.

- The traditional variance analysis presented below is based on Exhibit 2, p. 41.

How do you calculate spending variance?

A spending variance is the difference between the actual and expected (or budgeted) amount of an expense. The spending variance for fixed overhead is known as the fixed overhead spending variance, and is the actual expense incurred minus the budgeted expense.

Factory Overhead Variances

The overhead rate is the rate at which you apply variable overhead to production and units of output based on the cost driver activity. Fixed overhead refers to the overhead not related to or applied to production. These costs do not fluctuate with production activity and are reported as period costs.

This compares the actual variable overhead for production achieved with the budgeted. It is calculated by deducting the actual variable overhead incurred from a product of standard variable overhead rate and actual hours incurred. The cost driver is an activity that can be used to quantify and apply variable costs.

Variance calculation should always be calculated by taking the planned or budgeted amount and subtracting the actual/forecasted value. Thus a positive number is favorable and a negative number is unfavorable.

A variance is a difference between the actual figures and budgeted estimates. Overhead variance arises due to the differences between actual overhead variances and the budgeted or the absorbed variances. Actual overhead variances are those that have been incurred and can be known at the end of a particular accounting period after the accounts have been prepared. Absorbed overheads are overheads charged to a product based on a predetermined overhead rate, which is the standard overhead absorption rate. Variance analysis is usually associated with explaining the difference (or variance) between actual costs and the standard costs allowed for the good output.

Variable overhead refers to the overhead that is applied to production. Also apply units of output using a cost driver and an overhead rate.

The standard rates calculated for batch and product level activities do not vary with production volume. This is a fundamental difference between ABC and traditional variance analysis.

This is the difference between the budgeted fixed overhead expenditure and the actual fixed overhead incurred. It arises due to changes in the cost of fixed overhead during the period. Fixed overhead expenditure variance is calculated by subtracting the actual fixed overhead cost from the budgeted fixed overhead cost.

Do Unfavorable Variances Signal Finance Trouble?

Your variable components may consist of things such as indirect material, and direct labor, and supplies. Fixed overhead may include rent, car insurance, maintenance, depreciation and more. Variance analysis for overhead is split between variances related to variable and fixed costs. Variance analysis helps management to understand the present costs and then to control future costs.

Therefore, the more boards produced, the more machine hours needed. This may tell managers to expect a greater number of machine hours in the future. The first step in activity-based variance analysis is to assign all overhead costs to a level of activity. To reach this standard rate, the annual overhead cost is divided by the cost center’s practical capacity. Practical capacity is used so that idle capacity may be found and put to better use.