Variance Analysis Formula with Example

CMA Exam

With standard costing, the general ledger accounts for inventories and the cost of goods sold contain the standard costs of the inputs that should have been used to make the actual good output. Differences between the actual costs and the standard costs will appear as variances, which can be investigated. The costs that should have occurred for the actual good output are known as standard costs, which are likely integrated with a manufacturer’s budgets, profit plan, master budget, etc. The standard costs involve the product costs, namely, direct materials, direct labor, and manufacturing overhead. The primary objective of variance analysis is to exercise cost control and cost reduction.

Material Usage Variance

In program and project management, for example, financial data are generally assessed at key intervals or milestones. For instance, a monthly closing report might provide quantitative data about expenses, revenue and remaining inventory levels.

A standard cost variance can be unusable if the standard baseline is not valid. For example, a purchasing manager may negotiate a high standard cost for a key component, which is easy to match. Or, an engineering team assumes too high a production volume when calculating direct labor costs, so that the actual labor cost is much higher than the standard cost. Thus, it is essential to understand how standard costs are derived before relying upon the variances that are calculated from them.

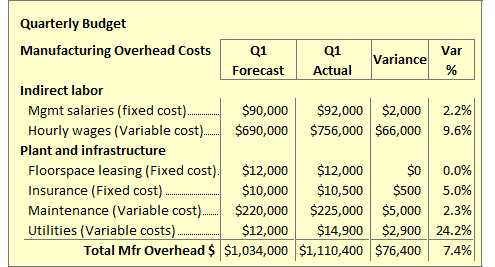

In budgeting (or management accounting in general), a variance is the difference between a budgeted, planned, or standard cost and the actual amount incurred/sold. The standard costs associated for a company’s products allows management to set benchmarks, so that the actual costs can eventually be compared. If not, and there is an unfavorable variance, then the company can try to determine efficiencies in the production process to lower those costs in the future. Standard costs are estimates of the actual costs in a company’s production process, because actual costs cannot be known in advance. Later, when the actual costs are determined, the company can see if it has a favorable budget variance (meaning, actual costs did not exceed standard costs) or unfavorable budget variance (the standard costs were exceeded).

This reserve has the effect of adjusting the company’s inventory balances to “actual,” which is appropriate under GAAP. Negative variances result when sales fall below budget, or expenses exceed budget. Both positive and negative variances can result from either controllable internal events or uncontrollable, often externally driven, events. Depending upon the type of company, such as a service business versus a business that manufactures a product, you might perform variance analysis on only a few of the most relevant line items on the income statement. For example, a manufacturer might focus on variances in its inventory purchase price or material yield, while a service-based company might look more at its labor efficiency variance.

Variances between planned and actual costs might lead to adjusting business goals, objectives or strategies. Whenever the actual costs are more than the standard costs at predetermined level of activity, such variances termed as unfavorable variances. These variances indicate the inefficiency of business operation and need deeper analysis of these variances.

When you compare the actual costs to the standard costs and examine the variances between them, it allows managers to look for ways to improve cost control, cost management, and operational efficiency. Variance analysis is important to assist with managing budgets by controlling budgeted versus actual costs.

Given that GAAP requires actual costs (or a close alignment thereto) and it may not be practical or cost-effective to obtain actual cost data in real time, what is the solution? Without completely altering the company’s existing cost structure, there are ways to manage standard costs and help them more closely approximate actual costs.

Whenever the actual costs are lower than the standard costs at per-determined level of activity, such variances termed as favorable variances. The management is concentrating to get actual results at costs lower than the standard costs.

A standard costing system involves estimating the required costs of a production process. In addition, these standards are used to plan a budget for the production process.

It is used by the management of the company for planning the process of future production, ways to increase the efficiencies, and to determine the reasonability of the actual costs of the period. However, the task of setting the standard cost of production is difficult one as it requires a high degree of technical skill and the efforts of the person responsible for setting the same. Taking the time to continuously update actual costs means a lot of number adjustments for a company’s accountant. As a result, the required financial reports for a company’s management can be generated easier and faster. The difference between the standard cost of direct materials and the actual cost of direct materials that an organization uses for production is known as Material Cost Variance.

Overhead variance is the difference between the standard cost of overhead allowed for actual output (in terms of production units or labour hours) and the actual overhead cost incurred. Review the company’s capitalizable costs – When setting standard costs, have all appropriately capitalizable costs been considered such as incoming freight for procured inventories or overhead for produced inventories? For instance, freight is subject to potentially significant variations due to factors such as the carrier or the quantities being ordered. After setting standard for each element of cost, a standard cost card is prepared showing therein the unit standard cost for each element of cost.

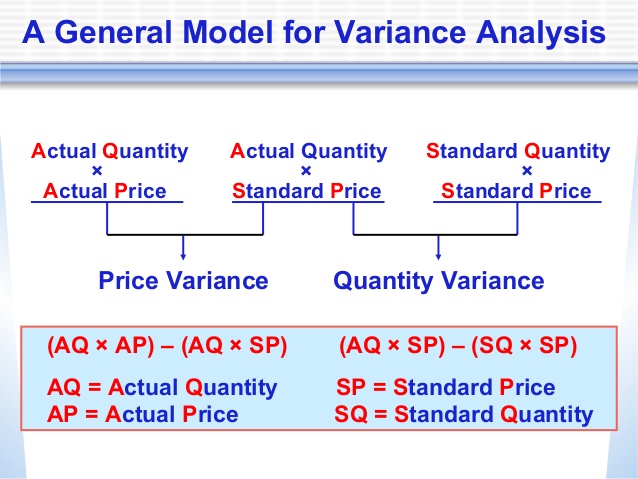

- Variance analysis is usually associated with explaining the difference (or variance) between actual costs and the standard costs allowed for the good output.

Difference between the standard and the actual cost helps the management in knowing how close actual expenses matched with it expected to be and deciding the future course of action. For example, if the actual cost of the material is much higher then the management may investigate the reason for the excess cost. The variance derived is then used by the management of the company for knowing and correcting the cause, making a further estimation for the coming years and for decision making related to business. Variance analysis works well as a tool to alert management to potential business issues that could impact sales or costs. Use objective, accurate, direct and unemotional language to present and explain variances, because getting overly involved in detailed explanations makes it difficult to identify the precise issue and appropriate solution.

Standard costing is a technique which uses standards for costs and revenues for the purpose of control through variance analysis. Standard is a predetermined measurable quantity set in defined conditions against which actual performance can be compared, usually for an element of work, operation or activity.

The difference between the actual direct labor costs and the standard direct labor costs can be divided into a rate variance and an efficiency variance. The difference in manufacturing overhead can be divided into spending, efficiency, and volume variances. At the end of the year (or accounting period) if the standard costs are higher than the actual expenses, than the company is considered to have a favorable variance. If the company’s actual costs were higher, then the company would have an unfavorable variance. These variances can be drilled down to find specifically where in the manufacturing process the actual cost differences lie between standard and actual; for instance, labor cost variances, material cost variances, etc.

At the end of the accounting period, use the actual amounts and costs of direct material. Then utilize the actual amounts and pay rates of direct labor to compare it to the previously set standards.

How do you calculate standard cost variance?

Standard costing is the establishment of cost standards for activities and their periodic analysis to determine the reasons for any variances. If actual cost exceeds the standard costs, it is an unfavorable variance. On the other hand, if actual cost is less than the standard cost, it is a favorable variance.

Under standard costing system, the management by exception principle is applied through variance analysis. A variance is the difference between an actual measured result and a basis, such as a budgeted amount. In many accounting applications, a variance is considered to be the difference between an actual cost and a standard cost. Variance reporting is used to maintain a tight level of control over a business.

Material Price Variance

Variance analysis is usually associated with explaining the difference (or variance) between actual costs and the standard costs allowed for the good output. For example, the difference in materials costs can be divided into a materials price variance and a materials usage variance.

Variance Analysis Formula with Example

Companies use variance analysis to compare financial performance changes from one month to the next, or perhaps from one quarter to another or year to year. Typically, actual financial results are compared to a budget, or a budget is compared to a forecast. This comparison process and the resulting variances help management identify problems, investigate issues and make changes rapidly.

Variance analysis, also described as analysis of variance or ANOVA, involves assessing the difference between two figures. It is a tool applied to financial and operational data that aims to identify and determine the cause of the variance. In applied statistics, there are different forms of variance analysis.

What is standard costing and variance analysis?

A standard cost variance is the difference between a standard cost and an actual cost. This variance is used to monitor the costs incurred by a business, with management taking action when a material negative variance is incurred. The standard cost of labor is based on a time and motion study, adjusted for down time.

In case the actual cost of the company is higher than the standard cost then the company has an unfavorable variance whereas if the actual cost is less than the standard cost then the company has a favorable variance. The variances so arrived help the management in evaluating the reason for variances so that appropriate actions could be taken. It almost always varies from the actual costs because the situation keeps on changing involving different unpredictable factors. It is used by the management in order to determine the reasonability of the actual costs of the period.

Responses to Standard Costing System

If the company spends more for the direct materials, direct labor, and/or manufacturing overhead than should have been spent, the company will not meet its projected net income. In other words, analysis of variances will direct management’s attention to the production inefficiencies or higher input costs. In turn, management can take action to correct the problems, seek higher selling prices, etc.

In project management, variance analysis helps maintain control over a project’s expenses by monitoring planned versus actual costs. Effective variance analysis can help a company spot trends, issues, opportunities and threats to short-term or long-term success. If feasible, at the end of every reporting period an analysis of purchase and production costs for capitalizability should be performed. When complete, capitalizable variances should be recorded in a “standard-to-actual” reserve within inventory on the balance sheet with the remainder being appropriately expensed through the income statement.