Variable Costs Definition & Example

Variable vs Fixed Costs

You will need to know either fixed costs or variable costs incurred during production in order to calculate the other. To calculate total cost for a personal budget, start by tracking your spending for 1 month to determine your average monthly expenses. Next, add up your variable costs for 1 month, such as nights out, clothing, and vacations.

What is an example of a fixed cost for a business?

Examples of fixed costs include rental lease payments, salaries, insurance, property taxes, interest expenses, depreciation, and potentially some utilities.

The proportion of variable vs. fixed costs a company incurs and their allocations can depend on the industry they are in. Variable costs are costs directly associated with production and therefore change depending on business output.

For example, raw materials, packaging and shipping, and workers’ wages are all variable costs. The implications of fixed costs will become clearer when you’ve learned about overhead costs, variable costs and the total cost formula.

This is because fixed costs are now being spread thinner across a larger production volume. For example, if a business that produces 500,000 units per years spends $50,000 per year in rent, rent costs are allocated to each unit at $0.10 per unit. If production doubles, rent is now allocated at only $0.05 per unit, leaving more room for profit on each sale.

As an outside investor, you can use this information to predict potential profit risk.If a company primarily experiences variable costs in production, they may have a more stable cost per unit. This will lead to a steadier stream of profit, assuming steady sales.This is true of large retailers like Walmart and Costco. Their fixed costs are relatively low compared to their variable costs, which account for a large proportion of the cost associated with each sale. Fixed costs are those that will remain constant even when production volume changes. Whether you produce 1 unit or 10,000, these costs will be about the same each month.

This will give you an idea of how much of costs are variable costs. You can then compare this figure to historical variable cost data to track variable cost per units increases or decreases.

Fixed costs can be a contributor to better economies of scale because fixed costs can decrease per unit when larger quantities are produced. Fixed costs that may be directly associated with production will vary by company but can include costs like direct labor and rent. Companies have some flexibility in breaking down costs on their financial statements. As such fixed costs can be allocated throughout the income statement.

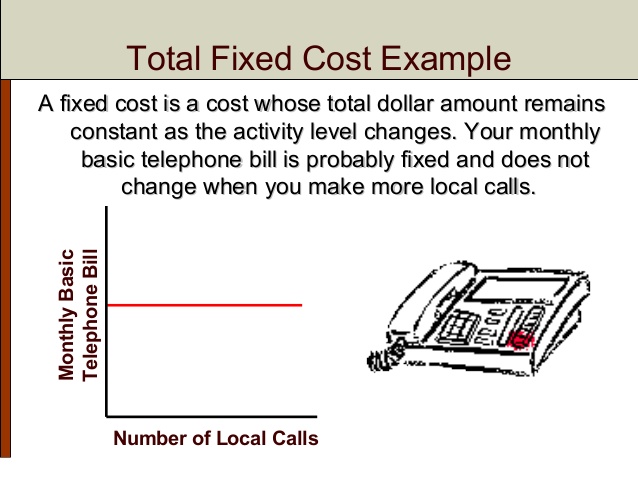

For the purposes of this lesson, the important thing to remember is simply fixed costs are costs that do not change based on production, such as assets like buildings and equipment. Unless you’re already practicing very good financial habits, you may not keep track of every single expense in a given month. This means that you can run into problems when you have to total up all of your expenses at the end of the month.

What Is a Fixed Cost?

Variable costs fluctuate according to the amount of output produced. If you pay an employee a salary that isn’t dependent on the hours worked, that’s a fixed cost.

Fixed costs are usually negotiated for a specified time period and do not change with production levels. Fixed costs, however, can decrease on a per unit basis when they are associated with the direct cost portion of the income statement, fluctuating in the breakdown of costs of goods sold.

In general, companies can have two types of costs, fixed costs or variable costs, which together result in their total costs. A company’s total variable cost is the expenses that change in relation to the total production during a given time period. These costs are directly connected to a business’ volume of production and may increase or decrease depending on how much a company produces. Unlike fixed costs, which stay the same regardless of production, variable costs can vary greatly depending on a company’s productivity. To calculate fixed and variable costs, you will need more information than just the total cost and quantity produced.

- A fixed cost is a cost that does not change with an increase or decrease in the amount of goods or services produced or sold.

- Fixed costs are expenses that have to be paid by a company, independent of any specific business activities.

Responses to Variable vs Fixed Costs

Companies have a wide range of different costs associated with their business. These costs are broken out by indirect, direct, and capital costs on the income statement and notated as either short-term or long-term liabilities on the balance sheet. Together both fixed costs and variable costs make up the total cost structure of a company.

Finally, add your fixed costs to your variable costs to get your total costs. A business is sometimes deliberately structured to have a higher proportion of fixed costs than variable costs, so that it generates more profit per unit produced. Of course, this concept only generates outsized profits after all fixed costs for a period have been offset by sales. In most cases, increasing production will make each additional unit more profitable.

Cost analysts are responsible for analyzing both fixed and variable costs through various types of cost structure analysis. In general, costs are a key factor influencing total profitability. In order to calculate volume produced, you will need enough information. If you know the total variable cost (TVC) and unit variable cost (UVC), you can divide them(TVC/UVC) to get the volume produced.

What Are the Types of Costs in Cost Accounting?

A fixed cost is a cost that does not change with an increase or decrease in the amount of goods or services produced or sold. Fixed costs are expenses that have to be paid by a company, independent of any specific business activities.

All Costs

Other types of compensation, such as piecework or commissions are variable. Variable costs are corporate expenses that vary in direct proportion to the quantity of output. Unlike fixed costs, which remain constant regardless of output, variable costs are a direct function of production volume, rising whenever production expands and falling whenever it contracts. Examples of common variable costs include raw materials, packaging, and labor directly involved in a company’s manufacturing process.

Companies can associate both fixed and variable costs when analyzing costs per unit. As such, cost of goods sold can include both variable and fixed costs.

What are some examples of fixed and variable costs?

If a company rents a warehouse, it must pay rent for the warehouse whether it is full of inventory or completely vacant. Other examples of fixed costs include executives’ salaries, interest expenses, depreciation, and insurance expenses. Examples of variable costs include direct labor and direct materials costs.

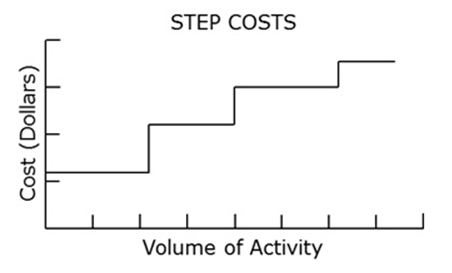

Variable costs, if known, can be combined with fixed costs to carry out a break-even analysis on a new project. A manager can scale up the number of units produced and estimate the fixed and variable costs for production at each step. This will allow them to see which level of production, if any, are most profitable. However, a company with a higher proportion of fixed costs would more easily be able to take advantage of economies of scale (greater production leading to lower per-unit costs).

To remove guesswork from the equation, try actively tracking your expenses for one full month. Groceries can be a little messier to keep track of, but if you keep your receipts or monitor your checking account transactions online, it shouldn’t be hard to get an accurate total. In the world of finance, when someone refers to “total cost,” she can be talking about several things. Business planning requires breaking expenses down into fixed and variable costs.

Comprehensively, all costs directly associated with the production of a good are summed collectively and subtracted from revenue to arrive at gross profit. Variable and fixed cost accounting will vary for each company depending on the costs they are working with. Economies of scale can also be a factor for companies who can produce large quantities of goods.