Using QuickBooks Desktop for Contractors to Serve Niche Construction Clients

A number of forward-thinking businesses have already applied an accounting software, and have not only seen efficiencies in accounting but in other aspects areas of their company as well. For more information on software, check out our Top 10 Construction Software Solutions and our Top 10 HVAC Software Solutions. Construction accounting has a steep learning curve, but you can climb it.

What does a construction accountant do?

Construction accounting is a form of project accounting in which costs are assigned to specific contracts. When the amount billed on a construction project is greater than the cost incurred, the difference is treated as a liability of the contractor until the cost incurred catches up with the billing.

Revenue recognition and retainage practices track with long-term contracts paid over time. Plus, construction payroll gives them more than enough to stay busy. Cash basis accounting is the easiest and simplest method to use in construction. It allows accountants to record revenue when received, as well as when expenses are paid. Although revenue is recognized and recorded, you must allocate expenses evenly over the entire period of benefit when applied to a multi-year contract.

There are many perks to using software, such as automated job costing, better financial tracking, and workers in the office and field having instant access to files like timecards and change orders. Depending on the software, it can also include security and auditing features to help avoid risks. Overall, utilizing a software with accounting integration can help to improve the speed and accuracy of your reports. Within a single construction business, they may be balancing a variety of projects and jobs that vary in length and size.

The total expenses incurred on the job can be divided by the total estimated job expenses to determine the profit or loss of a given job. Multiplying the estimated gross profit by the percentage complete to determine the estimated gross profit.

This makes it difficult to match the exact expenses to their respective revenue source. Because of the number of transactions that occur during the course of a given project, job costing is an essential practice in accounting. Job costing is defined as allocating all direct and indirect expenses and revenues to each respective job. Not only will job costing simplify tax preparation for accountants, it provides detailed information regarding the profitability of a given contract. Essentially, job costing is incredibly efficient and a necessary step to help track down income and expenses across each construction project.

This ensures that the final service price covers all overhead expenses, while ensuring a profit is made. Click the link for more tips onimproving cash flow and strategies you may want to consider.

In addition to the fundamentals of general accounting, like debits, credits and financial statements, contractors have many additional aspects they have to manage and account for. Job costing helps stay on top of the numerous variables of running a project-centered, decentralized business.

Project-Based

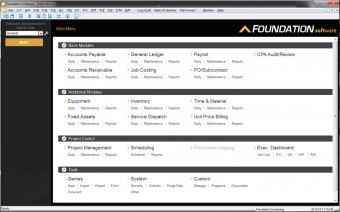

A construction payroll service that can handle multiple states, unions and certified payrolls can save a tremendous amount of time. And integrated job cost accounting software is incredibly important for contractors who outgrow small business software like QuickBooks® and need more robust reporting.

- Percentage of completion refers to a construction business’ ability to match revenues and expenses.

For the construction industry, it provides construction quote templates, contractor invoice templates, along with a robust online invoice generator. The integration engine carefully looks for and eliminates double entries. Major construction applications are covered, from WorkflowMax, ServiceM8 to simPro. With this information, the company can get an accurate measure of the percentage of completion (POC), and, by looking at their billing, should be able to see if they are under- or overbilled and by how much. Knowing all of this financial information is imperative – we simply can’t state this enough.

Job costing is the practice in construction accounting of tracking costs to particular projects and production activities. To ease the stresses and simplify the accounting processes, construction companies should consider implementing an accounting software.

The Foundation for Construction Accounting

Calculating profits based on the percentage completed is an accurate way for accountants to keep track of a given project. Although they provide estimates, the calculations are often not far off, and provide pertinent financial data for the company even before a project is completed. For most businesses, the accounting general ledger (G/L) is all they need. This lets them track transactions that impact the whole company’s financial picture. However, because construction accounting is project-centered and production is de-centralized, contractors also need a way to track and report transactions specific to each job.

AccountingTools

As it stands, there is a variety of software available that caters to all types of construction businesses of all sizes. Many of the methods discussed in this article, including job costing and financial tracking can all be done through integrated construction software. Other features of software include security and auditing to avoid risks, as well as fast, real-time reporting.

Construction Accounting 101: A Basic Guide for Contractors

Construction companies cannot use cash basis accounting on their tax returns if job materials cover up to more than 15% of the total cost to the customer. If your business makes less than 1 million dollars in annual revenue, you are exempt from this rule. The most important thing for contractors, whether experienced in the industry or just starting out, is to have help. A construction-specific CPA is an absolutely essential business partner.

Percentage of completion refers to a construction business’ ability to match revenues and expenses. This is often difficult because of the varying lengths of contracts and high number of jobs. Throughout the construction process however, contractors are able to use the percentage of completion method to determine whether or not a specific project is on track to make profit or loss.

CIP accounting describes the methods used to properly show construction in progress on the financial statements. Some of the costs of constructing additional PP&E (property, plant and equipment) are capitalized to depreciate over time, and some are expensed in the current accounting period. The capital costs are held in the construction in progress account, which is a fixed asset account shown on the balance sheet as a subaccount of property, plant and equipment. The capital costs include construction costs such as materials, labor and benefits, freight costs, interest incurred on construction loans, costs to prepare the site and professional fees related to the project. Expenses that are not specifically tied to the asset should be expensed in the accounting period they occur.