Understanding and Fixing Opening Balance Equity in QuickBooks

AccountingTools

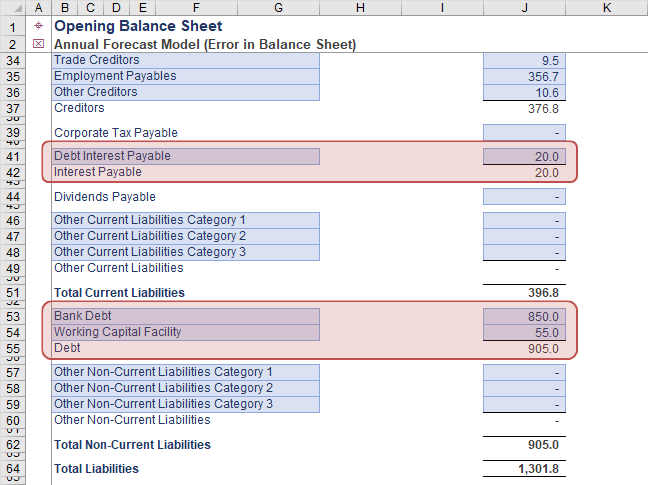

Now, post one journal entry with all assets, all liabilities, and owner’s equity dated at the end of last month and you have your beginning balances. The Opening Balance Equity account has a very specific function within QuickBooks.

For Transactions which occurred after your start date:

In QuickBooks, both the Accounts Payable and Accounts Receivable are considered different. It is created by QuickBooks when you enter opening balance in the balance sheet account for the first time. In addition to this, when you enter the opening balances, Opening balance Equity is recorded by the QuickBooks. This is done to ensure that you receive a good balance sheet for your company.

If repayment is necessary within one year, the credit entry you make must be to a current liability account, such as short-term debt obligations. However, if the loan is long-term, you make the corresponding credit entry to a noncurrent liability.

You then depreciate the equipment over its useful life and expense the depreciation amount and set up another fixed asset account titled accumulated depreciation. Accumulated depreciation will show up with a negative balance once the depreciation is recorded reducing the value of the equipment.

Once both sides of the entry are complete, your balance sheet will reflect the inflow of cash from the loan but also increase the liabilities of the company. The equipment is listed as long-term liabilities on the balance sheet. Each time I make a payment (split between principal and interest) the amount of the liability decreases until it hits $0.

Opening balance equity/account setup

I would think the end of last month would be better as you have a period end and you don’t have to enter all transactions from the beginning of the year. Make a list of all assets (car, house, boat, bank accounts, investments) and a list of all liabilities (Mortgage, car loan, student loans, credit card balances).

Opening Balance Equity is an account in QuickBooks that is not well understood by most QuickBooks users. In this video, you will learn what the account is and how it is created. Once you understand what the Opening Balance Equity is, you will also learn some best practices to clean up any outstanding balances in the account. Cleaning up this account is an important step in making your Balance Sheet clean and presentable to banks, investors, auditors and other third parties that depend on your accounting to make decisions.

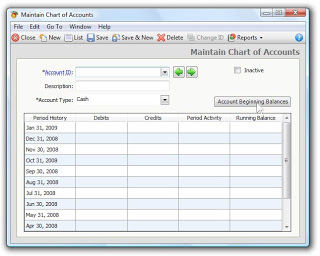

Enter Opening Balance in QuickBooks Desktop

- When your company receives part of the cash as a result of a loan or other bank financing, the credit side of the journal entry must increase a liability account to reflect the debt.

Fixing Opening Balance Equity Account by Closing Opening Balance Equity to Retained Earnings Once you have verified the account balances, create a journal entry to close the balance of Opening Balance Equity to Retained Earnings. If the company is a sole proprietorship Opening Balance Equity will be closed to the Owner’s Equity account. If the company is a partnership, the balance will be closed to the individual partner’s equity accounts by ownership percent. You would not debit opening balance equity when the original loan was recorded. The correct debit would be to a fixed asset account since you purchased equipment.

When you start a new company, the first journal entry you make must reflect the sources of your initial opening cash balance regardless of whether it’s from a loan or an investor. However, once you begin operations, it’s also important to understand the journal entries that are necessary to account for the inflows and outflows of cash. Each piece of equipment has a loan and is listed as a long-term liability with a balance on the balance sheet. To enter the loan, I debited the long-term liability account associated with each piece of equipment and credited the Fixed Asset account for that particular piece of equipment.

Now, create a final journal entry in order to distribute any remaining balance in the opening balance equity account among other retained earnings and equity accounts as desired. While entering an opening balance for Equity, Fixed Asset, other Asset, Current Asset, and Other Current Liability, be careful as it is possible that you may create a double accounting entry.

However, there is also a Fixed Assets section on the balance sheet and for each piece of equipment, it shows the original purchase price. We also take the full 179 depreciation so what I am needing to do now is figure out how to depreciate the equipment to show a value of $0 since we don’t spread it out through the uselife life of the item and just take it all on once. To do so, I debit the deprecation expense account and credit accumulated deprecation for the full amount of the depreciation/deduction, correct? I am a little confused by your answer since you said that the Fixed Assets section on the balance sheet shouldn’t have a positive balance. The balances that are showing under the Fixed Assets section are the original purchase of the equipment rather that the amount reflected under long-term liabilities which is the current remaining balance.

When your company receives part of the cash as a result of a loan or other bank financing, the credit side of the journal entry must increase a liability account to reflect the debt. Before making the credit entry, you must evaluate whether the debt must be repaid within one year or at some time after.

The most common reason for a balance in the Opening Balance Equity account is the result of a bank reconciliation that was not balanced to zero prior to completion. The process of entering the ending balance, marking the items that have cleared the bank, and reconciling the difference to zero is the correct procedure. For financial accounting purposes, journal entries provide the basis for all changes in the cash balance that companies report on a balance sheet.

It allows you to easily add a beginning balance to an asset, liability or equity account in your balance sheet and have QuickBooks take care of the bookkeeping entry that needs to be made. Opening balance equity is the offsetting entry used when entering account balances into the Quickbooks accounting software.

What kind of account is opening balance equity?

Opening balance equity. Opening balance equity is the offsetting entry used when entering account balances into the Quickbooks accounting software. This account is needed when there are prior account balances that are initially being set up in Quickbooks.

This account is needed when there are prior account balances that are initially being set up in Quickbooks. It is used to provide an offset to the other accounts, so that the books are always balanced. At a more specific level, the negative balance term commonly refers to the checking account, where you have a negative balance if you have issued checks for a larger amount of cash than is available in the checking account. Let’s make that there are no transactions linked to that account to delete the opening balance equity in QuickBooks Online. Opening Balance Equity is a special QuickBooks account in the equity section of the Balance Sheet.