Types of government budget: What are the three types of government budgets?

The allocation results in the overallocation or underallocation of fixed overhead when actual volume is not equal to budgeted volume. A flexible budget shows the budget figures for each line item from the static budget, the actual figures as shown on business statements, and the variances between the figures. Line items vary by business type but commonly include individual overhead costs, such as materials, and labor costs.

By incorporating these changes into the budget, a company will have a tool for comparing actual to budgeted performance at many levels of activity. Some costs are variable — they change in response to activity levels — while other costs are fixed and remain the same. For example, direct materials are variable costs because the more goods you make, the more materials you need. Business owners and their managers use budgets as a roadmap for allocating their firms’ resources.

The two types of manufacturing overhead—indirect manufacturing costs—are variable costs and fixed costs. If actual production is higher (lower) than the budgeted level of production, total variable manufacturing overhead costs are expected to be higher (lower) than budgeted. However, total fixed manufacturing overhead costs aren’t expected to change unless the actual level of production takes the company out of its relevant range. After all, portions of overhead, such as indirect materials, appear to be variable costs. If Skate increased production from 100,000 units to 125,000 units, these variable costs should also increase.

An unfavorable variance occurs when the actual fixed costs or component exceed the budgeted fixed cost or component. Analyzing fixed cost variances helps companies determine how well they allocate fixed costs to activities and pinpoints where they may need to make adjustments. The fixed overhead variances are the fixed overhead cost variance and the fixed overhead volume variance.

Most costs exhibit characteristics of both fixed and variable characteristics. Therefore, some firms that use flexible budgeting only forecast costs with a strong variable component as a percentage and hold the other, less variable costs as fixed.

Flexible budget variance

In the original budget, making 100,000 units resulted in total variable costs of $130,000. Dividing total cost of each category by the budgeted production level results in variable cost per unit of $0.50 for indirect materials, $0.40 for indirect labor, and $0.40 for utilities. The fixed overhead volume variance is not a flexible budget variance (whereas the fixed overhead cost variance and the cost and efficiency variances for variable manufacturing inputs are).

The factory overhead budget should provide a schedule of all manufacturing costs other than direct materials and direct labor. Using the contribution approach to budgeting requires the development of a predetermined overhead rate for the variable portion of the factory overhead.

Fixed cost budget variances arise when a company pays more or less than planned for overhead items. A favorable variance occurs when the actual fixed cost or fixed cost component a company incurs is less than its budgeted fixed cost.

This allows for an infinite series of changes in budgeted expenses that are directly tied to actual revenue incurred. However, this approach ignores changes to other costs that do not change in accordance with small revenue variations. Consequently, a more sophisticated format will also incorporate changes to many additional expenses when certain larger revenue changes occur, thereby accounting for step costs.

The material price variance calculation tells managers how much money was spent or saved, but it doesn’t tell them why the variance happened. One common reason for unfavorable price variances is a price change from the vendor. Companies typically try to lock in a standard price per unit for raw materials, but sometimes suppliers raise prices due to inflation, a shortage or increasing business costs. If there wasn’t enough supply available of the necessary raw materials, the company purchasing agent may have been forced to buy a more expensive alternative. If the company bought a smaller quantity of raw materials, they may not have qualified for favorable bulk pricing rates.

On the other hand, supervisory salaries, rent, and depreciation are fixed. Steve recomputes variable costs with the assumption that the company makes 125,000 units. However, much to the disappointment of Steve and Kira, the overhead budget report reported major overruns. For each category of overhead, Steve computed a variance, identifying unfavorable variances in indirect materials, indirect labor, supervisory salaries, and utilities.

- However, total fixed manufacturing overhead costs aren’t expected to change unless the actual level of production takes the company out of its relevant range.

- The two types of manufacturing overhead—indirect manufacturing costs—are variable costs and fixed costs.

A direct materials cost variance is favorable (unfavorable) if the actual direct materials cost per unit is less (greater) than the standard direct materials cost per unit. The direct materials efficiency variance measures how well the company keeps the actual usage of direct materials within standard.

A favorable (unfavorable) fixed overhead volume variance indicates that total fixed overhead cost allocated to units manufactured was greater (less) than the total budgeted fixed overhead cost. Sensitivity analysis is a what-if technique that asks what a result will be if a predicted amount is not achieved or if an underlying assumption changes. But actual results often differ from plans, so managers need to know how budgeted income and cash flows would change if key assumptions or predicted amounts in the master budget (a static budget) turn out to be incorrect.

A direct materials efficiency variance is favorable (unfavorable) if the total quantity of direct materials actually used is less (greater) than the total allowed to manufacture the actual total quantity of units. To compute the value of the flexible budget, multiply the variable cost per unit by the actual production volume. Here, the figure indicates that the variable costs of producing 125,000 should total $162,500 (125,000 units x $1.30).

A favorable variance works to the business’s advantage by increasing overall income, while an unfavorable variance represents unexpected costs or cost increases that negatively affected profit levels. Unfavorable variances represent areas the business must work on to improve profits and reduce overhead. For Skate, an analysis indicates that indirect materials, indirect labor, and utilities are variable costs.

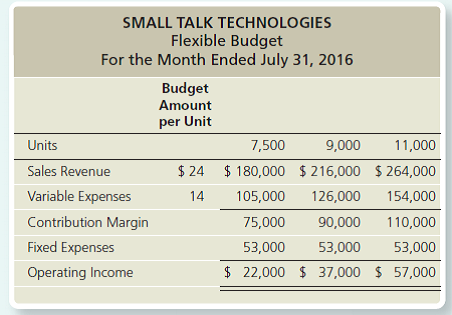

Because a flexible budget is prepared for various levels of sales volume, it is useful for sensitivity or what-if analysis and allows managers to plan for various sales levels. ABC Company has a budget of $10 million in revenues and a $4 million cost of goods sold. Of the $4 million in budgeted cost of goods sold, $1 million is fixed, and $3 million varies directly with revenue.

In developing the cash budget, we must remember that depreciation does not entail a cash outlay and therefore must be deducted from the total factory overhead in computing cash disbursement for factory overhead. A flexible budget varies to adjust for fluctuations or shifts in the volume of sales-related activity. Instead of static forecasts, a flexible budget — also referred to as a flex budget or variable budget– shows costs as a percentage of sales. Costs go up or down accordingly as the company records actual sales numbers.

Once the budget period has been completed, ABC finds that sales were actually $9 million. If it used a flexible budget, the fixed portion of the cost of goods sold would still be $1 million, but the variable portion would drop to $2.7 million, since it is always 30% of revenues. The result is that a flexible budget yields a budgeted cost of goods sold of $3.7 million at a $9 million revenue level, rather than the $4 million that would be listed in a static budget. In its simplest form, the flex budget uses percentages of revenue for certain expenses, rather than the usual fixed numbers.

Most businesses use budgets with fixed estimates for revenues and expenses, by category or sub-category. However, some businesses use flexible budgets, which vary the expense level with the dollar amount of sales. A fixed cost flexible budget variance is the variance between the actual and budgeted amounts for a fixed cost in a flexible budget. The direct materials variances are the direct materials cost variance and the direct materials efficiency variance. The direct materials cost variance measures how well the company keeps the actual direct materials cost per unit within standard.

Flexible Budget Variance

The fixed overhead cost variance measures how well the company keeps total fixed overhead cost within standards. A fixed overhead cost variance is favorable (unfavorable) if the actual total fixed overhead cost is less (greater) than the budgeted total fixed overhead cost. It is a volume variance and explains why fixed overhead is overallocated or underallocated. A fixed overhead volume variance is favorable (unfavorable) if the number of units actually manufactured is greater (less) than the number of units budgeted.

Separate fixed and variable costs

The two components of the overall static budget variance are the flexible budget variance and the sales volume variance. The flexible budget variance is the difference between actual operating income for the number of units actually sold and expected operating income in the flexible budget for the number of units actually sold. The individual flexible budget variances arise when the actual sales price per unit, variable cost per unit, and/or total fixed costs differ from those expected for the number of units actually sold.

How do you calculate flexible budget variance?

To compute the value of the flexible budget, multiply the variable cost per unit by the actual production volume. Here, the figure indicates that the variable costs of producing 125,000 should total $162,500 (125,000 units x $1.30).