Types of expenses Flashcards

In order to calculate volume produced, you will need enough information. If you know the total variable cost (TVC) and unit variable cost (UVC), you can divide them(TVC/UVC) to get the volume produced. Variable costs, if known, can be combined with fixed costs to carry out a break-even analysis on a new project. A manager can scale up the number of units produced and estimate the fixed and variable costs for production at each step.

Piecework labor, where pay is based on the number of items made, is variable – so are sales commissions. If you must have a minimum number of employees to keep the sales office or the production line running, their pay may be a fixed cost. If you pay someone a mix of fixed salary plus commission, then they represent both fixed and variable costs. Business planning requires breaking expenses down into fixed and variable costs. Variable costs fluctuate according to the amount of output produced.

Variable vs Fixed Costs Definition

Thus, decreasing costs usually means decreasing variable costs. A company with a relatively large amount of variable costs may exhibit more predictable per-unit profit margins than a company with a relatively large amount of fixed costs. This means that if a firm has a large amount of fixed costs, profit margins can really get squeezed when sales fall, which adds a level of risk to the stocks of these companies.

Semi-variable costs

If you pay an employee a salary that isn’t dependent on the hours worked, that’s a fixed cost. Other types of compensation, such as piecework or commissions are variable. It would not be the fixed costs related to the operationsthat cannot be altered and will not change with the level of production. Therefore, in most straightforward instances, fixed costsare not relevant for productiondecision, and incremental costs, or variable costs, are relevant for these decisions.

This will allow them to see which level of production, if any, are most profitable. Conversely, when fewer products are produced, the variable costs associated with production will consequently decrease. Examples of variable costs are sales commissions, direct labor costs, cost of raw materials used in production, and utility costs. The total variable cost is simply the quantity of output multiplied by the variable cost per unit of output. Examples of fixed costs are rent, employee salaries, insurance, and office supplies.

What are some examples of fixed and variable costs?

If a company rents a warehouse, it must pay rent for the warehouse whether it is full of inventory or completely vacant. Other examples of fixed costs include executives’ salaries, interest expenses, depreciation, and insurance expenses. Examples of variable costs include direct labor and direct materials costs.

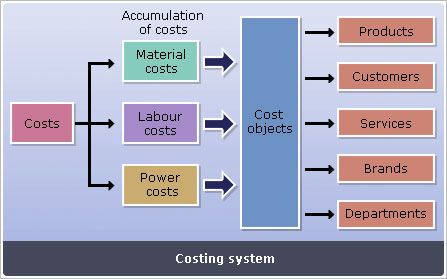

Variable costs are inventoriable costs – they are allocated to units of production and recorded in inventory accounts, such as cost of goods sold. Fixed costs, on the other hand, are all costs that are not inventoriable costs.

Fixed cost vs variable cost is the difference in categorizing business costs as either static or fluctuating when there is a change in the activity and sales volume. In accounting, all costs can be described as either fixed costs or variable costs.

Also note that many cost items have both fixed and variable components. For example, management salaries typically do not vary with the number of units produced. However, if production falls dramatically or reaches zero, layoffs may occur. They earn the same amount regardless of how your business is doing. Employees who work per hour, and whose hours change according to business needs, are a variable expense.

Conversely, the same high-fixed-costs company will experience magnification of profits because any revenue increases are applied across a constant cost level. Thus, as you can see in the example, fixed costs are an important part of profit projections and the calculation of break-even points for a business or project. Some fixed costs change in a stepwise manner as output changes and therefore may not be totally fixed.

- Variable costs go up when a production company increases output and decrease when the company slows production.

- In accounting, variable costs are costs that vary with production volume or business activity.

Variable expenses are tied in to your business’s productivity. The amount of raw materials and inventory you buy and the costs of shipping and delivery are all variable. The more in demand your products are, the more the costs go up. Fixed costs include rent, utilities, payments on loans, depreciation and advertising. You can change a fixed cost – move to somewhere with lower rent, for instance – but the costs don’t fluctuate otherwise.

However, a company with a higher proportion of fixed costs would more easily be able to take advantage of economies of scale (greater production leading to lower per-unit costs). This will lead to a steadier stream of profit, assuming steady sales.This is true of large retailers like Walmart and Costco. Their fixed costs are relatively low compared to their variable costs, which account for a large proportion of the cost associated with each sale. A company can increase its profits by decreasing its total costs. Since fixed costs are more challenging to bring down (for example, reducing rent may entail the company moving to a cheaper location), most businesses seek to reduce their variable costs.

Variable costs and fixed costs

Fixed costs, on the other hand, are all coststhat are not inventoriable costs. Fixed costs include indirect costs and manufacturing overhead costs. Naturally, whether you spend more on fixed or variable costs depends on how many sales you make. Variable costs change directly with the output – when output is zero, the variable cost will be zero.

A company must still pay its rent for the space it occupies to run its business operations irrespective of the volume of product manufactured and sold. Although fixed costs can change over a period of time, the change will not be related to production. A variable cost is a corporate expense that changes in proportion to production output.

If the company would continue to incur the cost, it is a fixedcost. If the company no longer incurs the cost, then it is most likely a variable cost. In accounting, a distinction is often made between the variablevsfixed costs definition. In comparison, fixed costs remain constant regardless of activity or production volume. While variable costs tend to remain flat, the impact of fixed costs on a company’s bottom line can change based on the number of products it produces.

The total variable cost to a business is calculated by multiplying the total quantity of output with the variable cost per unit of output. Using the same example above, suppose company ABC has a fixed cost of $10,000 per month for the rent of the machine it uses to produce mugs. If the company does not produce any mugs for the month, it would still have to pay $10,000 for the cost of renting the machine. On the other hand, if it produces one million mugs, its fixed cost remains the same.

Rent and administrative salaries are examples of fixed costs. Whether you produce 1 unit or 10,000, these costs will be about the same each month. For example, raw materials, packaging and shipping, and workers’ wages are all variable costs. The total expenses incurred by any business consist of fixed costs and variable costs. Fixed costs are expenses that remain the same regardless of production output.

The price of a greater amount of goods can be spread over the same amount of a fixed cost. The calculations can then be applied to determine the minimum price levels for products to ensure profitability. Now that we have a pretty solid grasp of the 3 types of expenses in your business, let’s examine a little more in-depth about how variable expenses can affect your business budget. Overhead variable costs – like those listed above – are harder to adjust. Which also makes them harder to plan for in your annual or month budget.

The variable costs change from zero to $2 million in this example. Then, divide that by your production volume for that same time period to get your variable cost per unit produced. You can then multiply your variable cost per unit produced by the total number of additional units you want to produce to get your total variable costs of producing more. To calculate fixed and variable costs, you will need more information than just the total cost and quantity produced. You will need to know either fixed costs or variable costs incurred during production in order to calculate the other.

For example, if a business that produces 500,000 units per years spends $50,000 per year in rent, rent costs are allocated to each unit at $0.10 per unit. If production doubles, rent is now allocated at only $0.05 per unit, leaving more room for profit on each sale. This will give you an idea of how much of costs are variable costs. You can then compare this figure to historical variable cost data to track variable cost per units increases or decreases. Fixed costs are those that will remain constant even when production volume changes.

All costs that do not fluctuate directly with production volume are fixed costs. Fixed costs include various indirect costs and fixed manufacturing overhead costs. Variable costs include direct labor, direct materials, and variable overhead. The difference between fixed and variable costs is essential to know for your business’s future.

In accounting, variable costs are costs that vary with production volume or business activity. Variable costs go up when a production company increases output and decrease when the company slows production. Variable costs are in contrast to fixed costs, which remain relatively constant regardless of the company’s level of production or business activity. Combined, a company’s fixed costs and variable costs comprise the total cost of production.

Whether a firm makes sales or not, it must pay its fixed costs, as these costs are independent of output. In accounting, all costs are either fixed costs or variablecosts. That means accountants allocate fixed costs to units of production. Then they are recorded in inventory accounts, such as cost of goods sold.

Examples of variable costs

Even if the economy craters and your sales drop to zero, fixed costs don’t disappear. A business is sometimes deliberately structured to have a higher proportion of fixed costs than variable costs, so that it generates more profit per unit produced. Of course, this concept only generates outsized profits after all fixed costs for a period have been offset by sales. In most cases, increasing production will make each additional unit more profitable. This is because fixed costs are now being spread thinner across a larger production volume.