Three trend analysis techniques

The key aspect where businesses and marketers are leveraging the personalisation trend is in their delivery of social media ads. Social media platforms have started providing advanced targeting and customisation options for marketers. These let you show the right ads to the right people at the right times. A combination of the ADX indicator and the Moving average gives a clear idea of intraday trend. ADX gives a signal of an uptrend when the +DI line is on top of the –DI line.

What are the three types of trend analysis?

Trend analysis is a technique used in technical analysis that attempts to predict the future stock price movements based on recently observed trend data. Trend analysis is based on the idea that what has happened in the past gives traders an idea of what will happen in the future.

Thus Coca-Cola’s growth in net income far exceeded that of PepsiCo. As mentioned earlier, this huge increase in Coca-Cola’s net income is largely attributable to a one-time gain in 2010 of $4,978,000,000. Trend analysis provides a means to analyze company data over a period of time by focusing on the change in specific line items within the income statement and balance sheet.

Some trends have changed the way people communicate with each other. TradingFuel.com is the free blog site made with the purpose of free- education. Here you will find different blogs for intraday trading, technical analysis. We regularly update blogs to provide more and more knowledge on the stock market. Form beginner to expert we have a range of blogs that help the reader to enhance their knowledge.

This band comprises three lines—the moving average, an upper limit and a lower one. All these are representative of the stock’s standard deviation, which is nothing but the amount by which the price increases or decreases from its average. This provides traders an understanding of the stock’s trading range. ADX calculations are based on a moving average of price range expansion over a given period of time.

There are no criteria to decide how much time required to find out the trend, generally longer the direction more is the reliable considered. Critics of trend analysis, and technical trading in general, argue that markets are efficient, and so they already price in all available information. That means that history does not necessarily need to repeat itself, and that the past does not predict the future. Adherents of fundamental analysis, for example, analyze the financial condition of companies using financial statements and economic models to predict future price.

What is Trend Analysis?

Trend analysis tries to find out a trend lie a bull market run, and make a profit from that trend unless and until data shows a trend reversal can happen, such as a bull to bear market. It is most helpful for the traders because moving with trends, and not going against them, will make a profit to an investor. The trend is the best friend of the traders is a well-known quote in the market. One can be seen by the sheer rise in the number of influencers on social media. Second can be seen by the increase in marketing spend on influencer marketing by businesses.

A trend is nothing but the general direction the market is heading during a specific period of time. Trends can be both growing and decreasing, relating to bearish and bullish markets, respectively.

Using intraday trading indicators help in averting risk and placing appropriate trades based on technical analysis and market sentiments. Angel Broking offers detailed charts and stock analysis reports that comprise these trading indicators. These tools help in planning an effective trading strategy, while minimizing risks. If short-term averages are exceeding the long-term averages, it indicates a bullish market trend. Traders may take a buy call with specific strategies like stop-loss either at the long-term moving average or retracement support and vice versa.

Three trend analysis techniques

There are short-period cycles that are unrelated to the bullish or bearish market trends. In such cases, it is easy for day traders to miss out on such changes, which is when the momentum oscillator is beneficial.

In this article, we’ll examine the value of ADX as a trend strength indicator. One major disadvantage of trend analysis is that it is not 100% accurate.

Also, critics of such a method argue that markets are efficient, and the stock price already reflects all available information. Thus, it is always advisable that one must support technical analysis with extensive research to make a better prediction.

- There are no criteria to decide how much time required to find out the trend, generally longer the direction more is the reliable considered.

- A trend is nothing but the general direction the market is heading during a specific period of time.

This indicator is depicted within a range of 0 to 100 and is advantageous when the price has achieved a new high or low, and one wants to determine whether it will further rise or fall. In other words, the momentum oscillator helps to understand when the market sentiments are undergoing modifications. Traders often hear about daily moving averages (DMA), which is the most common and widely used indicator. The moving average is a line on the stock chart that connects the average closing rates over a specific period. This indicator will help you comprehend the underlying movement of the price, as prices do not move only in one direction.

Trend Following

For these types of investors, day-to-day stock movements follow a random walk that cannot be interpreted as patterns or trends. Trading in the direction of a strong trend reduces risk and increases profit potential.

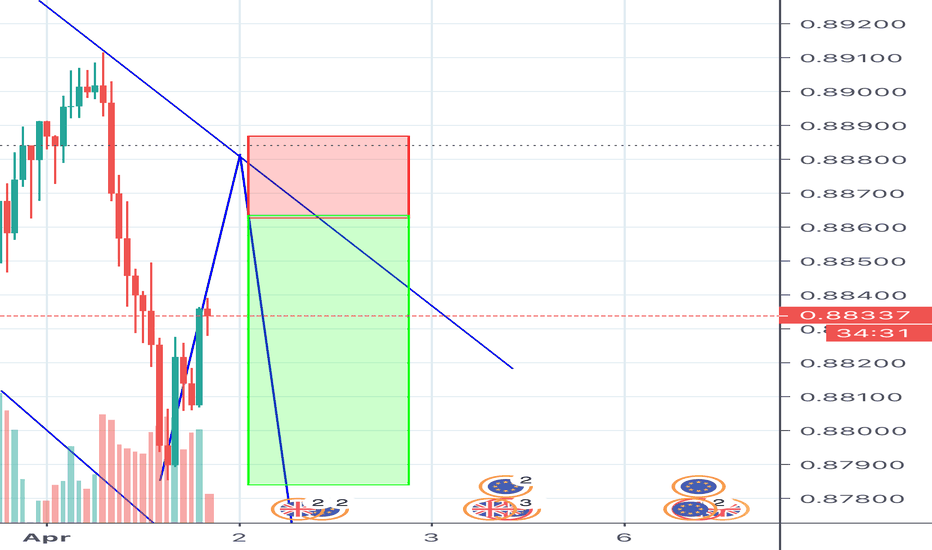

When the –DI line is higher than the + DI line, it gives the signal of a downtrend. When the price is ranging, the +DI and –DI lines stays very close together and hover around the middle.

Cost of goods sold had a corresponding increase of $1,605,000,000, or 14.5 percent. The increase in net sales and related increase in cost of goods sold resulted in an increase in gross margin of $2,524,000,000, or 12.7 percent. This one-time gain caused an unusually large increase in net income for 2010. This is important as we continue our analysis of Coca-Cola Company throughout the chapter.

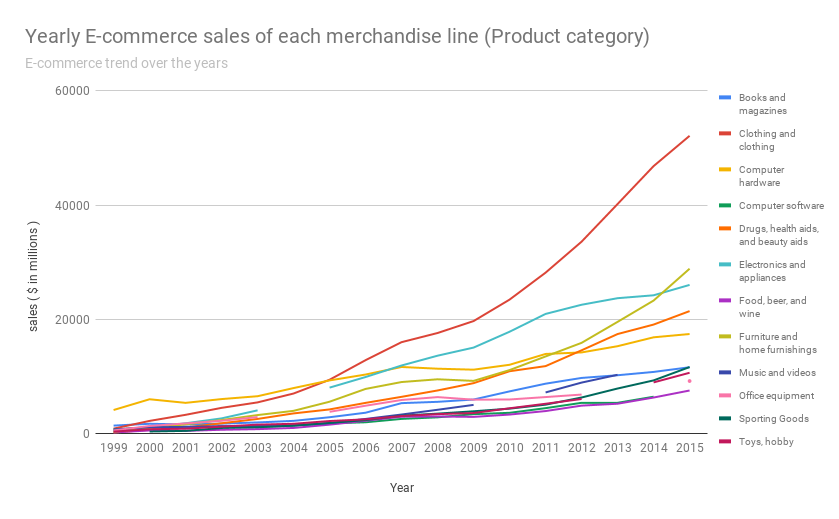

Trends over several years can be evaluated by calculating the trend percentage as the current year divided by the base year. Figure 13.1 “Income Statement Trend Analysis for ” shows that net sales increased by $4,129,000,000, or 13.3 percent.

Trends of data which are taken for comparison will present a misleading result. The identification of patterns and trends are techniques used by analysts studying the supply and demand of an asset traded on an open market. A trend is the general direction of a price over a period of time.

Visit this site regularly to get more and more interesting information like this. I.e. if the trend line is getting flatter – then the market is moving into a range condition. And if the price is touching the trend line and going back to the direction of the trend, then the trend is becoming stronger.

This intraday tip can help traders earn decent profits through intraday trading. This intraday trading indicator is one step ahead of the moving average.

Or, we can say past behavior is not always indicative of the future. This is because several factors affect the price of the security (or revenue and expense), and these factors change over time.

The average directional index (ADX) is used to determine when the price is trending strongly. After all, the trend may be your friend, but it sure helps to know who your friends are.

The default setting is 14 bars, although other time periods can be used. Analysis of trend percentage is useless at the time of price-level change (i.e. in inflation).

Social media websites, including Facebook and Twitter, also helped facilitate trends. Social networking allows people from all around the world to see trends emerging anywhere else. Additionally, social networking allows social trends to last longer and make waves in different parts of the world. Social media websites, like Instagram, also created a new way for people to communicate with each other.

Profit Without Predicting the Market

A pattern is a set of data that follows a recognizable form, which analysts then attempt to find in the current data. It is the trend when financial markets and assets move in upward directions, resulting in an increase in the price. It is usually the time of boom in the economy, where overall sentiments are favorable.