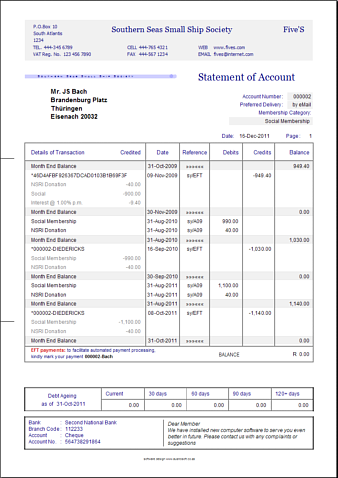

The statement of account

If you purchase goods or services from a vendor, you likely have a vested interest in your monthly transactions with those businesses. The same goes for any customers who buy goods or services from you as a business owner. To provide a detailed accounting of a customer’s or client’s monthly activities, many businesses offer a statement of account. Although some businesses still mail them, they can also be provided by email or a web portal. The document serves as a courtesy, helping your customers balance their own books.

How can I create a statement of account?

If you ever have to take someone to court, a detailed statement of all transactions will be essential. Since account statements can include a bill at the bottom, it can be easily confused with an invoice or bill. This is a bill rather than a statement of account because it doesn’t detail every transaction that came across your account during the statement period. When businesses issue statements of account, they often do so as a convenience to customers even though it costs extra, particularly if you send it via postal mail. The cost efficiency of this type of courtesy may be questionable unless you can tie it directly back to an increase in your customers paying their bills on time.

If they forgot to log a transaction, they’d see it on the statement and be able to quickly fix the error. Similarly, businesses also kept track of their financial transactions in paper-based ledgers and double checked the amounts with the monthly statement. A statement of account provides a list of a customer’s transactions for a designated time frame.

Debit cards are a prominent feature of modern-day personal and small-business banking. The cards allow immediate access to cash, balances and banking services. You can also use most debit cards as credit cards for in-person and online purchases.

The best example of a statement of account is the bank statement you get every month. You’ll get this for all of your accounts, including your personal banking accounts, any investment accounts you own, your credit cards and your own business financial accounts.

Why Is Statement of Account Important?

You swipe the card like a credit card, then enter a personal identification number, or PIN, to carry out your transaction. Debit card information is reported as part of your monthly bank account statement, much as is your savings and checking account information. Customers are increasingly relying on electronic communications for everything, including bills and bank statements.

Optional cookies and other technologies

If the account still isn’t paid over an extended period of time, it will then become necessary to turn the bill over to collections. A statement of account can be used to detail exactly what is owed as it’s turned over to the third-party service that will be attempting to collect. You’ll also need to tack on interest for the overdue payments, as outlined in your invoice or the initial contract you signed with the customer.

- You’ll get this for all of your accounts, including your personal banking accounts, any investment accounts you own, your credit cards and your own business financial accounts.

- The best example of a statement of account is the bank statement you get every month.

Such statements typically list debits paid, incoming funds or credits received by the account holder, and fees associated with maintaining the account. For example, certain types of savings accounts might incur regular maintenance fees unless a certain minimum balance of funds is maintained in the account. Cable television subscriptions may include state taxes and other surcharges that are included in providing regular service.

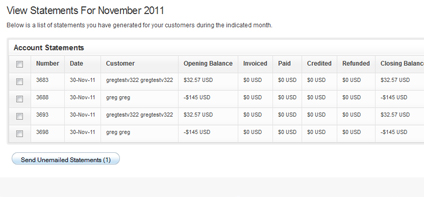

You can email your statement of account to every customer on the designated date, and chances are they’ll be happy with that. However, some businesses have found it more effective to set up an online portal. All regular customers will be given the opportunity to set up a user name and password.

How do I get a statement of account?

A statement of account is a detailed report of the contents of an account. An example is a statement sent to a customer, showing billings to and payments from the customer during a specific time period, resulting in an ending balance. The net remaining balance of all transactions listed.

You can access these statements electronically in many cases, or opt to receive a printed copy by mail each month. Both versions include important information about the account holder, whether it is an individual or a small business. Your name or business name, address, account number, account type and the period covered by the statement are among the data displayed at the top of each one.

With the advent of digital technology, banks don’t issue as many personal account statements anymore. This is because customers can now go online to pay their bills or move their money, and can see transactions right up to the second they log in. Banks will even ask their customers to “switch to paperless” in order to save the cost of printing and mailing a statement of account. They are very similar to the statements generated by businesses for their clients, in that they list every transaction during a specific time period. This is common for any type of account a bank offers – savings account, checking account or brokerage account.

The body of the statement lists deposits, withdrawals, purchases and fees, as well as any interest earnings. A statement of account captures the financial transactions between the two companies during a specific period of time, usually a one month period. The statement of account may show an amount still owing by the client. Customers want to see all the transactions logged on their accounts throughout the year. Before online banking, customers tracked their transactions in a check register and reconciled the amount when that monthly statement came in the mail.

Account statements refer to almost any official summary of an account, wherever the account is held. Insurance companies may provide account statements summarizing paid-in cash values, for example. Statements can be generated for almost any type of accounts that represent ongoing transactions where funds are repeatedly exchanged. This can include online payment accounts such as PayPal, credit card accounts, brokerage accounts, and savings accounts.

A statement of account, or account statement, is issued by a vendor to a client. It lists out all the financial transactions between the two businesses within a specific time period (typically, monthly). The statement may reflect a zero balance, if not, it acts as a reminder to the client that money is due.

Statement of account – What is a statement of account?

It usually has a start to end date, a beginning balance, an ending balance and a log of all transactions that happened during that time frame. As with your business’s statement of account, a bank statement can come by postal mail in paper-based form or be viewed online. If it’s related to your credit card, you’ll likely see an invoice at the bottom of the account statement that includes the amount you should pay and the due date. Unlike statements of account, your bank statement may come even if you had no transactions for the month. Debit card transactions are included in the monthly account statement for your personal or small-business bank account.