The Seven Most Popular Types of Businesses

An LLC is not incorporated; hence, it is not considered a corporation. But, the owners enjoy limited liability like in a corporation. An LLC may elect to be taxed as a sole proprietorship, a partnership, or a corporation.

In a general partnership, each partner is liable for the activities of the other partners, while only the general partner (who runs the business) is liable in a limited partnership. Limited liability companies (LLCs) in the USA, are hybrid forms of business that have characteristics of both a corporation and a partnership.

Sole Proprietorship

Generally, the liability of the members is limited to their investment and they may enjoy the pass-through tax treatment afforded to partners in a partnership. As a result of federal tax classification rules, an LLC can achieve both structural flexibility and favorable tax treatment. Nevertheless, persons contemplating forming an LLC are well advised to consult competent legal counsel. A limited liability company can be managed by managers or by its members. The management structure must be stated in the certificate of formation.

These include S Corporations, and Limited Liability Companies (LLC’s). Where S-Corps are a Federal Entity, LLC’s are regulated by the various states. LLC’s give the option for profits from the business to pass through to the owner’s individual income tax return. A limited partnership is a partnership formed by two or more persons and having one or more general partners and one or more limited partners. This type of business ownership operates in accordance with a partnership agreement, written or oral, of the partners as to the affairs of the limited partnership and the conduct of its business.

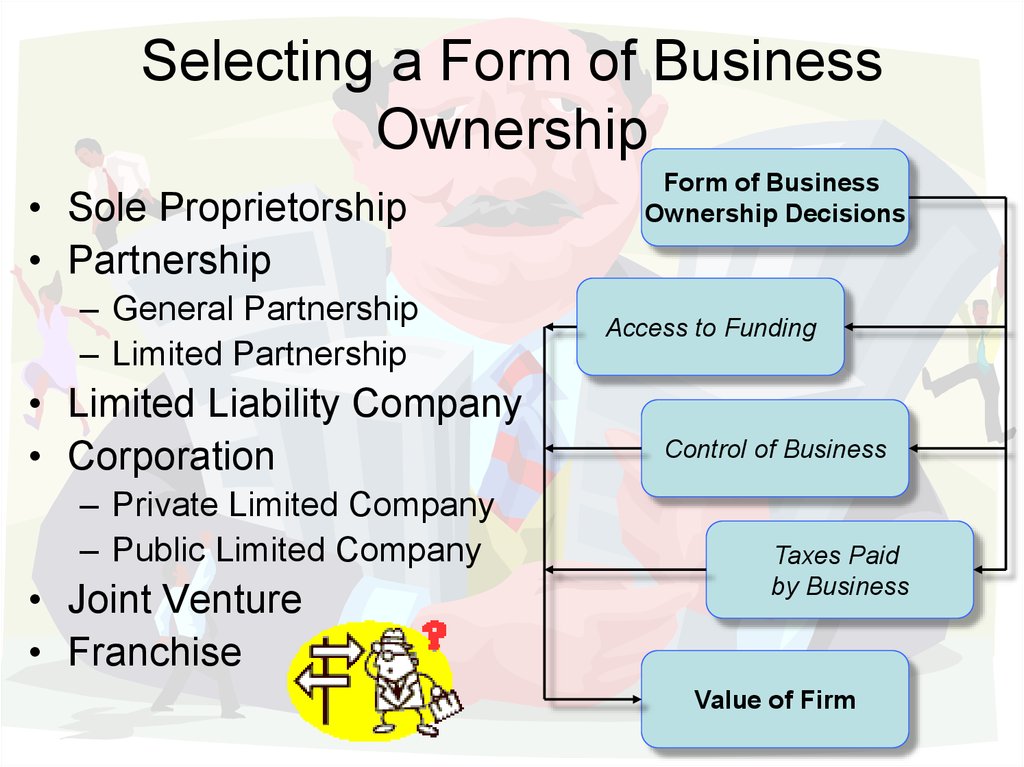

The main difference between an LLC and a corporation is that LLCs aren’t taxed as a separate business entity. Instead, all profits and losses are moved from the business to the LLC members, who report profits and losses on a personal federal tax return. LLCs are another of the most common types of online businesses, since they allow small groups of people to easily form a company together. It is important that the business owner seriously considers the different forms of business organization—types such as sole proprietorship, partnership, and corporation. Which organizational form is most appropriate can be influenced by tax issues, legal issues, financial concerns, and personal concerns.

A limited liability company, in most states, can be owned and operated by an individual. However, with that control, limited tax benefits are realized versus a sole proprietorship or general partnership. Most states also require the operating agreements of an LLC to set a limit to the company’s existence, preventing long-term family ownership of the business. A partnership is a form of business organization in which owners have unlimited personal liability for the actions of the business.

- An LLC is a newer type of business that is a blend between a partnership and a corporation.

- Next on our list of business types is a Limited Liability Company, better known as an LLC.

While the partnership agreement is not filed for public record, the limited partnership must file a certificate of formation with state. General partners are fully liable for the debts of the partnership, while limited partners are not liable for the debts of the partnership, but may not participate in management of the business.

The owners of a partnership have invested their own funds and time in the business, and share proportionally in any profits earned by it. There may also be limited partners in the business, who contribute funds but do not take part in day-to-day operations. If there are limited partners, there must also be a designated general partner that is an active manager of the business; this individual has essentially the same liabilities as a sole proprietor. The most daunting disadvantage of organizing as a sole proprietorship is the aspect of unlimited liability.

Management structure is a determination that is made by the LLC and its members. In a limited liability company, profits are distributed through the LLC, and each business member or owner pays taxes individually. Another perk is that the personal liability is limited to the individual’s investments in the company. Also, members are eligible for participating fully in managing the company.

Next on our list of business types is a Limited Liability Company, better known as an LLC. An LLC is a newer type of business that is a blend between a partnership and a corporation. Instead of shareholders, LLC owners are referred to as members. No matter how many members a particular LLC has, there must be a managing member who takes care of the daily business operations.

What is a partnership business organization?

A partnership is a form of business organization in which owners have unlimited personal liability for the actions of the business. The owners of a partnership have invested their own funds and time in the business, and share proportionally in any profits earned by it.

As for who LLC members can be, they can include partnerships and corporations, and no maximum limit exists on the number of LLC members. Within a partnership, members are vulnerable to unlimited liability for their overall actions. Every partner is personally liable for any company debts and responsibilities. If the company lacks the assets to cover an organizational debt, then creditors can seize the partners’ personal assets to cover that debt. One way to cover this disadvantage is to form a partnership between two corporations.

The limited liability company (LLC) is not a partnership or a corporation but rather is a distinct type of entity that has the powers of both a corporation and a partnership. The owners of an LLC are called “members.” A member can be an individual, partnership, corporation, trust, and any other legal or commercial entity.

Limited Liability Company (LLC)

Most of these structures have some disadvantages if the entity is successful and wishes to grow and attract capital from outside investors. Partnership structures provide the best legal protection to minority owners, but leave all the owners exposed to unlimited liability. Limited partnership shield limited partners from liability, but limited partners are prohibited from active participation in management. A limited liability company is created by filing a documents with the state.

Partnership advantages and disadvantages

For the purpose of this overview, basic information is presented to establish a general impression of the business organization. Choosing among the types of business ownership involves a balancing of competing concerns.

An advantage of a sole proprietorship is filing taxes as an individual rather than paying corporate tax rates. Some hybrid forms of business organization may be employed to take advantage of limited liability and lower tax rates for those businesses that meet the requirements.