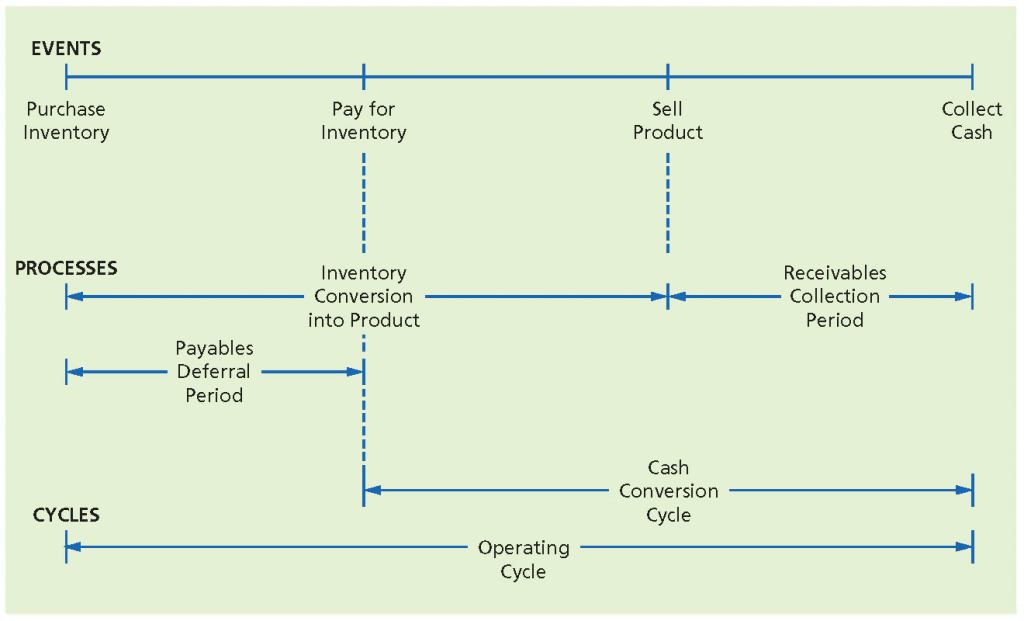

The operating cycle of a business

How do you calculate the cash conversion cycle for a company that has no inventory? With no inventory, you can’t compute days inventory outstanding (DIO), and without cost of goods sold, you can’t compute days payables outstanding (DPO). The Operating cycle definition establishes how many days it takes for a company to turn purchases of inventory into cash receipts from its eventual sale. It is also known as cash operating cycle or cash conversion cycle or asset conversion cycle. Operating cycle has three components of payable turnover days, Inventory Turnover days and Accounts Receivable Turnover days.

AccountingTools

These come together to form the complete measurement of operating cycle days. The operating cycle formula and operating cycle analysis stems logically from these. To be more specific, the payable turnover days are the period of time a company keeps track of how quickly they can pay off their financial obligations to suppliers. The third stage focuses on the current outstanding payable for the business.

The second stage focuses on the current sales and represents how long it takes to collect the cash generated from the sales. This figure is calculated by using the Days Sales Outstanding (DSO), which divides average accounts receivable by revenue per day. A lower value is preferred for DSO, which indicates that the company is able to collect capital in a short time, un turn enhancing its cash position. DIO and DSO are associated with the company’s cash inflows, while DPO is linked to cash outflow.

Beyond the monetary value involved, CCC accounts for the time involved in these processes that provides another view of the company’s operating efficiency. The figure also helps assess theliquidity risklinked to a company’s operations. This is what a company currently owns—both tangible and intangible—that it can easily turn into cash within one year or one business cycle, whichever is less. Other examples include current assets of discontinued operations and interest payable. Current assets do not include long-term or illiquid investments such as certain hedge funds, real estate, or collectibles.

Another way to look at the formula construction is that DIO and DSO are linked to inventory and accounts receivable, respectively, which are considered as short-term assets and are taken as positive. DPO is linked to accounts payable, which is a liability and thus taken as negative. The cash conversion cycle (CCC) is a metric that expresses the time (measured in days) it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

The more days that your business goes without cash, the longer it takes to you to pay your creditors and keep operations going. Days inventory outstanding is the average number of days required for the company to convert its inventory into sales. A lower DIO speaks of the efficient use of the inventory since it signifies lower holding period and little chance of inventory becoming obsolete. Automobile companies usually maintain just-in-time production system by maintaining minimum inventory levels and thus lower DIO.

If DPO of a company is lower than industry benchmark, that would indicate that the company is not using its cash as efficiently as its competitors. It follows the cash as it’s first converted intoinventoryand accounts payable, then into expenses for product or service development, through to sales and accounts receivable, and then back into cash in hand. Essentially, CCC represents how fast a company can convert the invested cash from start (investment) to end (returns).

Operating Cycle and Its Functions

By maximizing this number, the company holds onto cash longer, increasing its investment potential. The cash conversion cycle (CCC) is an important metric for a business owner to understand. This cycle tells a business owner the average number of days it takes to purchase inventory, and then convert it to cash. That is, it measures the time it takes a business to purchase supplies, turn them into a product or service, sell them, and collect accounts receivable (if needed). Also known as a cash conversion cycle, a cash cycle represents the amount of time it takes a company to convert resources to cash.

Inventory management, sales realization, and payables are the three key ingredients of business. If any of these goes for a toss – say, inventory mismanagement, sales constraints, or payables increasing in number, value, or frequency – the business is set to suffer.

The cash cycle calculates the time during which each dollar is committed to various production and sales processes before it is then converted to cash in the form of accounts receivable, or paid invoices. The cash cycle begins when a company pays to purchase inventory and ends when that money is recovered by receiving payment from customers.

- Inventory management, sales realization, and payables are the three key ingredients of business.

- If any of these goes for a toss – say, inventory mismanagement, sales constraints, or payables increasing in number, value, or frequency – the business is set to suffer.

What is the operating cycle formula?

The operating cycle is the average period of time required for a business to make an initial outlay of cash to produce goods, sell the goods, and receive cash from customers in exchange for the goods.

When a company’s cash is committed to production and sales processes, it is, by default, unavailable for other purposes, including investment and growth. A shorter cash cycle, therefore, indicates that a company has more reliable access to cash on hand, and more opportunities to use that cash to further the business.

What Does Operating Cycle Mean?

Current assets usually consist of cash, marketable securities, receivables and inventory. A major component of current liabilities, on the other hand, is the payables. The Days Payable Outstanding (DPO) is the average length of time it takes a company to purchase from its suppliers on accounts payable—your business owes money—and pay for them. The amount of available cash your business has on hand at any given time provides an indication of your company’s ability to operate on a day-to-day basis and meet its obligations.

It takes into account the amount of money the company owes its current suppliers for the inventory and goods it purchased, and represents the time span in which the company must pay off those obligations. This figure is calculated by using the Days Payables Outstanding (DPO), which considers accounts payable.

Therefore, cash isn’t a factor until the company pays the accounts payable and collects the accounts receivable. The cash conversion cycle (CCC) is a metric that expresses the length of time (in days) that it takes for a company to convert its investments in inventory and other resources into cash flows from sales. Working capital in common parlance is the difference between current assets and current liabilities.

Also called the Net Operating Cycle or simply Cash Cycle, CCC attempts to measure how long each net input dollar is tied up in the production and sales process before it gets converted into cash received. A healthy business will have ample capacity to pay off its current liabilities with current assets.

It is “net” because it subtracts the number of days of Payables the company has outstanding from the Operating Cycle. The logic behind this is that Payables are really viewed as a source of operating cash or working capital for the company.

A higher ratio of above 1 means a company’s assets can be converted into cash at a faster rate. The higher the ratio, the more likely a company can pay off its short-term liabilities and debt. Boosting sales of inventory for profit is the primary way for a business to make more earnings. If cash is easily available at regular intervals, one can churn out more sales for profits, as frequent availability of capital leads to more products to make and sell.

By contrast, Receivables, or cash the company has not received yet, decreases working capital available to the company to finance operations. Days Payable outstanding or the creditor’s payment period is the average number of days taken by a company to pay its invoices from trade creditors. DPO gives an indication of the efficiency in cash flow management of a company. While longer payment periods would leave higher free cash flow with the company, future credit terms may be less favorable for the company and discounts for timely payments may not be available.

A company can acquire inventory on credit, which results inaccounts payable (AP). A company can also sell products on credit, which results inaccounts receivable(AR).