The key to data security: Separation of duties

Securing the buy-in from your employees

Examples include surprise cash counts, taking inventory, review and approval of accounting work, internal audits, peer reviews, and enforcement of job descriptions and expectations. For instance, if a cashier does not know when her cash drawer will be counted, she may be more likely to be honest.

Internal controls in accounting: Key benefits

Internal controls are the mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information, promote accountability, and prevent fraud. Internal controls are the processes, checks and balances that need to be put in place as a business grows.

Or products may be received by mistake from a supplier and, without internal controls, the fact that the items were not ordered may be missed. Internal controls are the mechanisms, rules, and procedures implemented by a company to ensure the integrity of financial and accounting information, promote accountability and prevent fraud. Internal audits evaluate a company’s internal controls, including its corporate governance and accounting processes. Internal audits play a critical role in a company’s operations and corporate governance, now that the Sarbanes-Oxley Act of 2002 has made managers legally responsible for the accuracy of its financial statements.

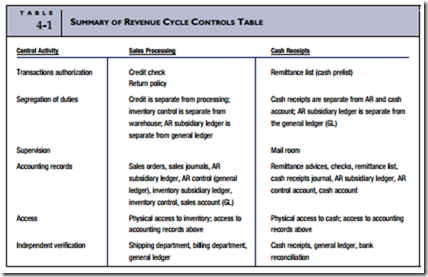

Authorization of invoices and verification of expenses are internal controls. In addition, preventative internal controls include limiting physical access to equipment, inventory, cash, and other assets.

Internal control procedures in accounting can be broken into seven categories, each designed to prevent fraud and identify errors before they become problems. As your business grows and becomes more complex, it is more likely that errors, duplication or omissions can occur. For example, without internal controls to dictate who is responsible for certain purchases, more than one person may make the same purchases, resulting in duplication and waste.

The concept is alternatively called segregation of duties or, in the political realm, separation of powers. In democracies, the separation of legislation from administration serves a similar purpose. The concept is addressed in technical systems and in information technology equivalently and generally addressed as redundancy. It is important to keep in mind that internal controls, while effective, are not a guarantee that a company’s objectives will be met.

Internal controls can relate to any aspect of your business, from human resources to IT. Internal controls in accounting are critical and are used for safeguarding assets. Internal controls are policies and procedures put in place to ensure the continued reliability of accounting systems. Without accurate accounting records, managers cannot make fully informed financial decisions, and financial reports can contain errors.

They range from locking the building before leaving to entering a password before completing a transaction. Preventive control activities aim to deter errors or fraud from happening in the first place and include thorough documentation and authorization practices. And the separation of duties ensures that no single individual is in a position to authorize, record, and be in the custody of a financial transaction and the resulting asset.

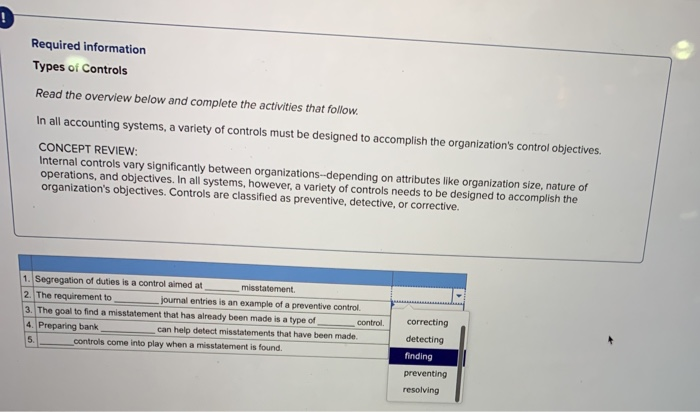

- While detective controls usually occur irregularly, preventative controls usually occur on a regular basis.

- Preventative internal controls are put into place to keep errors and irregularities from happening.

Human errors and computer errors are not accounted for by internal controls. In addition, internal controls assume employees are honest and that they would not bypass guidelines or alter data to benefit themselves. As the name suggests, corrective internal controls are put into place to correct any errors that were found by the detective internal controls. When an error is made, employees should follow whatever procedures have been put into place to correct the error, such as reporting the problem to a supervisor.

Internal controls are policies and procedures companies use to help prevent errors and fraud, which can include theft, embezzlement, favoritism or math errors in financial documents. You don’t need to be a certified public accountant or have a finance degree to institute helpful internal controls in your business or set policies for your employees to follow. Internal controls include the procedures a business implements in order to protect its assets or items of value that it owns as well as its records. Segregation of duties involves dividing employee duties so that the functions of recordkeeping, custody of assets and authorization of asset use are performed by different individuals.

Segregating incompatible functions helps a company prevent becoming a victim of fraud or an intentional attempt to deceive others for the purposes of personal gain. Detective internal controls are designed to find errors after they have occurred. They serve as part of a checks-and-balances system and to determine how efficient policies are.

Why is segregation of duties important in accounting?

The separation of duties concept prohibits the assignment of responsibility to one person for the acquisition of assets, their custody, and the related record keeping. For example, one person can place an order to buy an asset, but a different person must record the transaction in the accounting records.

Preventative internal controls are put into place to keep errors and irregularities from happening. While detective controls usually occur irregularly, preventative controls usually occur on a regular basis.

When having adequate internal controls is not possible

Training programs and progressive discipline for errors are other examples of corrective internal controls. Separation of duties fulfills two purposes, both of which help reduce the risk within an organization. First, it prevents frauds, errors, and abuse of systems and processes, and second, it aids in the discovery of control failures such as theft of information, data breaches, and circumvention of security controls.

Internal controls are the procedures that a business uses to protect its records and its assets or things of value that it owns. Internal controls also help a business ensure that it is using its resources most effectively and it helps to prevent and detect errors. The Sarbanes Oxley Act (SOX), for example, which requires public companies to audit and attest to the strength of their internal controls over financial reporting, effectively mandates that SoD be in effect. A SOX auditor looks for SoD and will rate the company’s controls as “deficient” if SoD is not properly implemented.

Internal control in accounting includes procedures and policies that increase the reliability of your financial data and help prevent fraud. They include processes like separating duties and steps, keeping employees accountable, securing your cash and monitoring financial transactions.

SoD compliance, therefore, is the process of getting SoD into sufficient shape to meet compliance requirements. Separation of duties (SoD; also known as Segregation of Duties) is the concept of having more than one person required to complete a task. In business the separation by sharing of more than one individual in one single task is an internal control intended to prevent fraud and error.

In addition, managers alone might also make decisions to override your accounting internal controls, whether for fraudulent purposes or other reasons. For example, managers could let certain employees bypass steps while away on vacation, or they could override controls to manipulate financial data and steal from the business. Regardless of the policies and procedures established by an organization, only reasonable assurance may be provided that internal controls are effective and financial information is correct.