The difference between gross and net income

Thus, an alternate rendering of the gross margin equation becomes gross profit divided by total revenues. As shown in the statement above, Apple’s gross profit figurewas $88 billion (or $229 billion minus $141 billion). Profit margin is a percentage measurement of profit that expresses the amount a company earns per dollar of sales. If a company makes more money per sale, it has a higher profit margin.

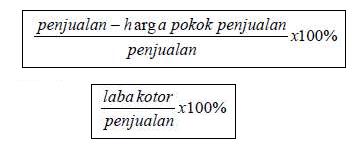

Calculate profit margin to see profitability during a specific time period. The gross profit margin is a metric used to assess a firm’s financial health and is equal to revenue less cost of goods sold as a percent of total revenue. In other words, the profit margin ratio shows what percentage of sales are left over after all expenses are paid by the business.

Gross profit is calculated before operating profit or net profit. The concepts of gross and net income have different meanings, depending on whether a business or a wage earner is being discussed. For a company, gross income equates to gross margin, which is sales minus the cost of goods sold. Thus, gross income is the amount that a business earns from the sale of goods or services, before selling, administrative, tax, and other expenses have been deducted.

Here, we can gather all of the information we need to plug into the net profit margin equation. We take our total revenue of $6,400 and deduct variable costs of $1,700 as well as fixed costs of $350 to arrive at a net income of $4,350 for the period. If Jazz Music Shop also had to pay interest and taxes, that too would have been deducted from revenues. Net profit margin can be influenced by one-off items like the sale of an asset, which would temporarily boost profits. Net profit margin doesn’t hone in on sales or revenue growth, nor does it provide insight as to whether management is managing its production costs.

For a company, net income is the residual amount of earnings after all expenses have been deducted from sales. In short, gross income is an intermediate earnings figure before all expenses are included, and net income is the final amount of profit or loss after all expenses are included.

The process of organizing revenue and costs and assessing profit typically falls to accountants in the preparation of a company’s income statement. One step further, subtracting fixed costs, gets you operating profit. Once irregular revenue and expenses are added, you get bottom-line net profit. Apple’s net profit margin is calculated by dividing its net income of $19.965 billion by its total net sales of $84.310 billion. Total net sales are used as the top line for companies that have experience customer returns of their merchandise, which are deducted from total revenue.

Ideally, investors want to see a track record of expanding margins meaning that net profit margin is rising over time. Gross profit margin does not help you measure your business’s overall profitability. To know how profitable your company is, you must look at net profit margin.

Profit margin is a metric you can use to see how much money your business is making. It measures how well you use earnings to pay for outgoing expenses. In other words, the profit margin determines what percentage of revenue your business keeps.

Generally, a net profit margin in excess of 10% is considered excellent, though it depends on the industry and the structure of the business. It is wise to compare the margins of companies within the same industry and over multiple periods to get a sense of any trends. The gross profit is the absolute dollar amount of revenue that a company generates beyond its direct production costs.

How do I send an invoice?

Net profit margin is one of the most important indicators of a company’s financial health. By tracking increases and decreases in its net profit margin, a company can assess whether current practices are working and forecast profits based on revenues. Because companies express net profit margin as a percentage rather than a dollar amount, it is possible to compare the profitability of two or more businesses regardless of size. The net profit margin is intended to be a measure of the overall success of a business. A high net profit margin indicates that a business is pricing its products correctly and is exercising good cost control.

The gross margin result is typically multiplied by 100 to show the figure as a percentage. The COGS is the amount it costs a company to produce the goods or services that it sells. Overhead refers to the ongoing administrative cost when it comes to operating the business. Cost of goods sold refers to the direct expenses or costs needed to produce the product or goods. Interest payable, on the other hand, refers to the amount or percentage of money the company owes to different parties specified for settlement at a certain period.

- Also called the net profit margin, this profitability metric is the most comprehensive evaluative ratio used in corporate finance.

- COGS are raw materials and expenses associated directly with the creation of the company’s primary product, not including overhead costs such as rent, utilities, freight, or payroll.

- Gross profit marginis the proportion of money left over from revenues after accounting for the cost of goods sold (COGS).

Gross profit marginis the proportion of money left over from revenues after accounting for the cost of goods sold (COGS). COGS are raw materials and expenses associated directly with the creation of the company’s primary product, not including overhead costs such as rent, utilities, freight, or payroll. Also called the net profit margin, this profitability metric is the most comprehensive evaluative ratio used in corporate finance.

Accounting Terms

Most of the time, net profit margin is what people talk about to determine profitability. The gross profit margin is calculated by taking total revenue minus the COGS and dividing the difference by total revenue.

How do you calculate net profit ratio?

The net profit percentage is the ratio of after-tax profits to net sales. It reveals the remaining profit after all costs of production, administration, and financing have been deducted from sales, and income taxes recognized.

Overhead costs tend to be low as well; agents can work from almost anywhere. This guide will cover formulas and examples, and even provide an Excel template you can use to calculate the numbers on your own. Net profit margin is your metric of choice for the profitability of the firm, because it looks at total sales, subtractsbusiness expenses, and divides that figure by total revenue.

While initial costs can be steep – even in rural areas, warehouse spaces are rarely cheap – the initial investment can be easily offset by rental revenue. In many applications, renting warehouse space can be fairly hands-off; clients pay rent and are then free to do with the available space what they will. With an average net profit margin of 17.4 percent for leasing and 14.8 percent in sales, real estate has a lot to offer.

Gross profit is your company’s profit before subtracting expenses. With an average net profit margin of 11.6 percent, warehouse and storage companies are able to turn building ownership into a lucrative business.

What is net profit?

Gross profit margin is the gross profit divided by total revenue and is the percentage of income retained as profit after accounting for the cost of goods. Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold (COGS). The gross profit margin reflects how successful a company’s executive management team is in generating revenue, considering the costs involved in producing their products and services.

Net profit ratio

Gross profit margin and net profit margin, on the other hand, are two separate profitability ratios used to assess a company’s financial stability and overall health. Gross profit is the direct profit left over after deducting the cost of goods sold, or “cost of sales”, from sales revenue. It’s used to calculate the gross profit margin and is the initial profit figure listed on a company’s income statement.

In short, the higher the number, the more efficient management is in generating profit for every dollar of cost involved. Net profit margin is the percentage of profit generated from revenue after accounting for all expenses, costs, and cash flow items. Investors can assess if a company’s management is generating enough profit from its sales and whether operating costs and overhead costs are being contained. For example, a company can have growing revenue, but if its operating costs are increasing at a faster rate than revenue, its net profit margin will shrink.

The net income of a company is the result of a number of calculations, beginning with revenue and encompassing all expenses and income streams for a given period. All the money that flows in and out of a company is accounted for via this sum. Gross profit is your business’s revenue minus the cost of goods sold. Your cost of goods sold (COGS) is how much money you spend directly making your products. But, your business’s other expenses are not included in your COGS.