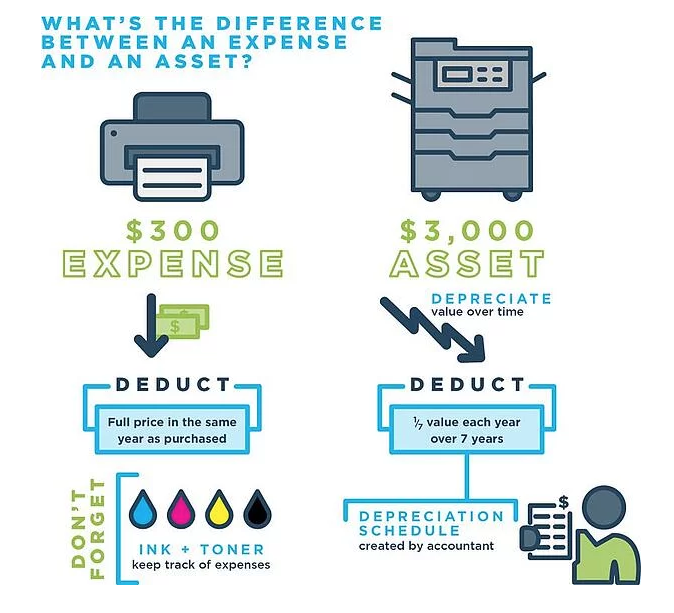

The difference between expenses and assets

The major difference between expenses and assets is that expenses are deducted from income, so they reduce taxable income, but expenses can never be amortized, and assets are not deducted from income, but assets whose value decreases over time can be amortized.

Expenses in the reporting period are money spent or expenses incurred as part of the firm’s operating and non-operating activities during a specific reporting period. Expenses are the costs of running a business, where running a business is the sum of actions aimed at making a profit. Expenses can be in the form of actual payments, such as wages or salaries, or as the amortized cost of an asset or a certain amount used from profit, which is also called bad debt. Business related expenses are included in the income statement as deductions from income before income tax is assessed.

Definition and explanation of business administration related expenses

Administrative and business expenses, or not a product or sale related expenses, are a category of mandatory expenses that arise due to the company’s management processes. These costs cannot be attributed to operating results. The effect of these transactions within an administrative resource does not affect a single division of the business entity, but the entire organization.

The group of administrative costs is characterized by an indirect impact on the efficiency of the entire enterprise. Their inflated value may indicate an irrational use of financial resources of the company, the presence of problems in the personnel policy. Business administration related expenses include expenses for the maintenance of management personnel, consulting services, and payment of utility bills.

Definition and explanation of assets

Assets in accounting are real estate items, goods, raw materials, products, money, and monetary claims to contractors, and other accounting items that a business owns and which are reflected on the left side of the company’s balance sheet

Current assets are those items that are spent in the course of economic activity (for example, inventory, cash, etc.). Non-current assets do not directly participate in the economical turnover of the enterprise (for example, fixed assets, long-term investments, etc.), but are able to bring it profit.

Since current assets are very mobile (as can be seen even from their name), special attention should be paid to them in accounting. Moreover, current assets are a separate group in the company’s balance sheet, and the balance must be correctly indicated for all accounts that are included in it. Based on these data, the liquidity ratio is usually determined.

Assets can be tangible or intangible. Unlike tangible assets, intangible assets include items that do not have a tangible form (for example, property rights, the business reputation of the enterprise, intellectual property). Although intangible assets do not have a form, they can be easily identified (distinguished from other types of property). In this case, the rights to such assets are confirmed only in documentary form.