The difference between bad debt and doubtful debt

Regardless of company policies and procedures for credit collections, the risk of the failure to receive payment is always present in a transaction utilizing credit. Thus, a company is required to realize this risk through the establishment of the allowance account and offsetting bad debt expense.

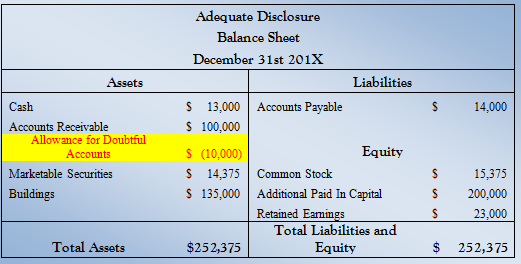

In accordance with the matching principle of accounting, this ensures that expenses related to the sale are recorded in the same accounting period as the revenue is earned. An allowance for doubtful accounts is a contra-asset account that nets against the total receivables presented on the balance sheet to reflect only the amounts expected to be paid.

Percentage of Sales Method

The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400. The allowance is established by recognizing bad debt expense on the income statement in the same period as the associated sale is reported. Only entities that extend credit to their customers use an allowance for doubtful accounts.

The estimated may be a percentage of total credit sales or total trade receivables balance. The main logic behind the creation of this provision is to accommodate the bad debts expense in the accounting period which they relate. Eventually, if the money remains unpaid, it will become classified as “bad debt”. This means the company has reached a point where it considers the money to be permanently unrecoverable, and must now account for the loss. However, without doubtful accounts having first accounted for this potential loss on the balance sheet, a bad debt amount could have come as a surprise to a company’s management.

Two primary methods exist for estimating the dollar amount of accounts receivables not expected to be collected. The financial accounting term allowance method refers to an uncollectible accounts receivable process that records an estimate of bad debt expense in the same accounting period as the sale. The allowance method is used to adjust accounts receivable appearing on the balance sheet.

Hold this estimated amount in an account called “allowance for doubtful accounts.” When you determine that one of your customers is actually unable to pay, remove, or write off, the bad debt from your accounting records. Even though the accounts receivable is not due in September, the company still has to report credit losses of $4,000 as bad debts expense in its income statement for the month. If accounts receivable is $40,000 and allowance for credit losses is $4,000, the net amount reported on the balance sheet will be $36,000. The Allowance for Doubtful Accounts reports on the balance sheet the estimated amount of uncollectible accounts that are included in Accounts Receivable. Balance sheet accounts are almost always permanent accounts, meaning their balances carry forward to the next accounting period.

A bad debt expense occurs when a customer who owes you money is unable to pay. Using the allowance method of accounting for bad debt expense, estimate the portion of your customer invoices that will be uncollectible each accounting period before the customers fail to pay.

How to Evaluate a Company’s Balance Sheet

Where is allowance for doubtful accounts on the balance sheet?

An allowance for doubtful accounts is a contra-asset account that nets against the total receivables presented on the balance sheet to reflect only the amounts expected to be paid. The allowance for doubtful accounts is only an estimate of the amount of accounts receivable which are expected to not be collectible.

The Allowance for Doubtful Accounts is used when Bad Debt Expense is recorded prior to knowing the specific accounts receivable that will be uncollectible. For example, a company might have 500 customers purchasing on credit and they owe the company a total of $1,000,000. The $1,000,000 is reported on the company’s balance sheet as accounts receivable. The sales method applies a flat percentage to the total dollar amount of sales for the period. For example, based on previous experience, a company may expect that 3% of net sales are not collectible.

Later, when you identify a specific customer invoice that is not going to be paid, eliminate it against the provision for doubtful debts. If you are using accounting software, create a credit memo in the amount of the unpaid invoice, which creates the same journal entry for you. When sales transactions are recorded, a related amount of bad debt expense is also recorded, on the theory that the approximate amount of bad debt can be determined based on historical outcomes. This is recorded as a debit to the bad debt expense account and a credit to the allowance for doubtful accounts.

- The $1,000,000 is reported on the company’s balance sheet as accounts receivable.

- The Allowance for Doubtful Accounts is used when Bad Debt Expense is recorded prior to knowing the specific accounts receivable that will be uncollectible.

Any subsequent write-offs of accounts receivable against the allowance for doubtful accounts only impact the balance sheet. Use the percentage of bad debts you had in the previous accounting period and apply it to your estimate. For example, if 2% of your sales were uncollectible, you could set aside 2% of your sales in your ADA account. Let’s say you have a total of $50,000 in accounts receivable ($50,000 X 2%).

In other words, they are not closed and their balances are not reset to zero. For example, ABC International has $100,000 of accounts receivable, of which it estimates that $5,000 will eventually become bad debts. It creates a credit memo for $1,500, which reduces the accounts receivable account by $1,500 and the allowance for doubtful accounts by $1,500. The organization should make this entry in the same period when it bills a customer, so that revenues are matched with all applicable expenses (as per the matching principle).

Especially since the debt is now being reported in an accounting period later than the revenue it was meant to offset. The only impact that the allowance for doubtful accounts has on the income statement is the initial charge to bad debt expense when the allowance is initially funded.

Historically, ABC usually experiences a bad debt percentage of 1%, so it records a bad debt expense of $10,000 with a debit to bad debt expense and a credit to the allowance for doubtful accounts. In the following months, an invoice for $2,000 is declared not collectible, so it is removed from the company’s records with a debit of $2,000 to the allowance for doubtful accounts and a credit to accounts receivable. The allowance for doubtful accounts is a reduction of the total amount of accounts receivable appearing on a company’s balance sheet, and is listed as a deduction immediately below the accounts receivable line item. The allowance represents management’s best estimate of the amount of accounts receivable that will not be paid by customers. It does not necessarily reflect subsequent actual experience, which could differ markedly from expectations.

Allowance for doubtful accounts calculation

The actual elimination of unpaid accounts receivable is later accomplished by drawing down the amount in the allowance account. An allowance for doubtful debt is an estimate of how much of the trade receivables balance of a business will become irrecoverable in the next accounting period. It is exactly what it sounds like, an allowance for debts which are considered doubtful. An allowance for doubtful debt can be either a specific debt which is suspected will go unpaid, or a more general allowance based on a percentage of the total receivables.

Allowance For Doubtful Accounts

If actual experience differs, then management adjusts its estimation methodology to bring the reserve more into alignment with actual results. Since a certain amount of credit losses can be anticipated, these expected losses are included in a balance sheetcontra asset account. The line item can be called allowance for credit losses, allowance for uncollectible accounts, allowance for doubtful accounts, allowance for losses on customer financing receivables or provision for doubtful accounts. The company doesn’t know specifically which customer will not pay, but it estimates that a few customers out of the 500 will not be paying the full amount they owe. Rather than waiting until those specific customers are identified, the company makes an accounting entry that debits Bad Debt Expense and credits Allowance for Doubtful Accounts.

The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Thus, the net impact of the provision for doubtful debts is to accelerate the recognition of bad debts into earlier reporting periods. As an example of the allowance method, ABC International records $1,000,000 of credit sales in the most recent month.

The allowance for doubtful accounts is only an estimate of the amount of accounts receivable which are expected to not be collectible. The actual payment behavior of customers may differ substantially from the estimate. Because the allowance for doubtful accounts is established in the same accounting period as the original sale, an entity does not know for certain which exact receivables will be paid and which will default. Therefore, generally accepted accounting principles (GAAP) dictate that the allowance must still be established in the same accounting period as the sale but can be based on an anticipated and estimated figure. The allowance can accumulate across accounting periods and may be adjusted based on the balance in the account.

If the total net sales for the period is $100,000, the company establishes an allowance for doubtful accounts for $3,000 while simultaneously reporting $3,000 in bad debt expense. If the following accounting period results in net sales of $80,000, an additional $2,400 is reported in the allowance for doubtful accounts, and $2,400 is recorded in the second period in bad debt expense.