The Contribution Margin Income Statement – Accounting In Focus

Contribution margin income statement

The total contribution margin generated by an entity represents the total earnings available to pay for fixed expenses and to generate a profit. The contribution margin concept is useful for deciding whether to allow a lower price in special pricing situations. If the contribution margin at a particular price point is excessively low or negative, it would be unwise to continue selling a product at that price.

A company’s operating profit is the difference between gross profit and total operating expenses. Non-operating items, such as interest and taxes, are below the operating income line. The net income from continuing operations is the operating income minus non-operating items. The final section lists extraordinary items, such as flood damage, and the bottom line is the net income or loss for the period. The contribution margin is computed by using a contribution income statement, a management accounting version of the income statement that has been reformatted to group together a business’s fixed and variable costs.

The contribution margin can be calculated in dollars, units, or a percentage. The contribution margin format also starts with revenue as the top line. However, instead of showing cost of goods and operating expenses, a contribution margin statement breaks out the variable and fixed expenses separately. Variable expenses include variable production costs, such as raw materials and direct labor, and variable marketing and administrative expenses, such as commission expenses and the salaries of supervisors. The contribution margin is the difference between revenues and variable expenses.

The Best Accounting Software of 2020

In the contribution margin income statement, we calculate total contribution margin by subtracting variable costs from sales. When calculating your contribution margin, be careful to subtract only variable costs from your revenue or sales. These are items located below the line (i.e. below “gross profit”) on your company’s income statement. The expenses considered variable as opposed to fixed can be misleading. The contribution margin is computed as the selling price per unit, minus the variable cost per unit.

Total Fixed Costs$ 96,101Net Operating Income$ 62,581The Beta Company’s contribution margin for the year was 34 percent. This means that, for every dollar of sales, after the costs that were directly related to the sales were subtracted, 34 cents remained to contribute toward paying for the indirect (fixed) costs and later for profit. Contribution margin (CM), or dollar contribution per unit, is the selling price per unit minus the variable cost per unit. “Contribution” represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. This concept is one of the key building blocks of break-even analysis.

Calculating the contribution margin is an excellent tool for managers to help determine whether to keep or drop certain aspects of the business. For example, a production line with positive contribution margin should be kept even if it causes negative total profit, when the contribution margin offsets part of the fixed cost. However, it should be dropped if contribution margin is negative because the company would suffer from every unit it produces. Both ratios are useful management tools, but reveal different information.

It is also useful for determining the profits that will arise from various sales levels (see the example). Further, the concept can be used to decide which of several products to sell if they use a common bottleneck resource, so that the product with the highest contribution margin is given preference. If you’re an owner or CEO of a small or mid-sized business, in order to have your fingers on the pulse of your business’s financials, and closely manage the bookkeeping and accounting, you need actionable financial intelligence. Outsourcing to a professional team that provided management accounting is essential to your business’s success and growth. The contribution margin is the revenue remaining after subtracting the variable costs involved in producing a product.

The ratio is calculated by dividing the contribution margin (sales minus all variable expenses) by sales. This margin calculator will be your best friend if you want to find out an item’s revenue, assuming you know its cost and your desired profit margin percentage. In general, your profit margin determines how healthy your company is – with low margins you’re dancing on thin ice and any change for the worse may result in big trouble. High profit margins mean there’s a lot of room for errors and bad luck. Keep reading to find out how to find your profit margin and what is the gross margin formula.

Calculating the contribution margin allows you to see how much revenue each product earns. The traditional income statement format uses absorption or full costing, in which variable and fixed manufacturing costs are part of the inventory costs and, thus, part of the cost of goods sold calculation. The contribution margin format uses variable costing, in which fixed manufacturing costs are part of the overhead costs of the accounting period and are not part of the product costs. The reasoning behind this approach is that because companies incur these fixed costs regardless of the sales volume, they should not be a part of product costs. It also measures whether the product is generating enough revenue to pay for fixed costs and determine the profit it is generating.

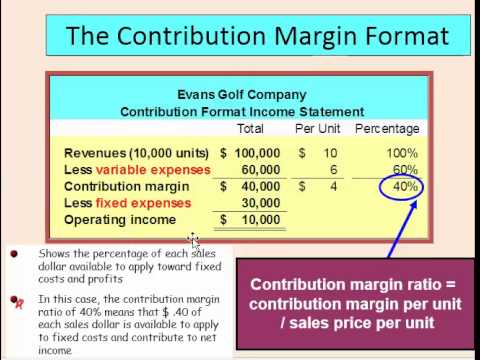

As an example of contribution margin, consider total sales or revenue from an item that a company produces equals $10,000 while the variable costs for the item equal $6,000. The contribution margin is calculated by subtracting the variable costs from the revenue generated from sales of the item and dividing the result by revenue, or (sales – variable costs) / sales. Thus, the contribution margin in our example is 40%, or ($10,000 – $6,000) / $10,000. Gross profit margin measures the amount of revenue that remains after subtracting costs directly associated with production. The contribution margin is a measure of the profitability of various individual products.

Traditional income statement

The breakeven point is the sales level at which the company covers its fixed expenses and begins to make a profit. It appears that Beta would do well by emphasizing Line C in its product mix. Moreover, the statement indicates that perhaps prices for line A and line B products are too low. This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period. Contribution margin is a product’s price minus all associated variable costs, resulting in the incremental profit earned for each unit sold.

Contribution margin per unit is the difference between the price of a product and the sum of the variable costs of one unit of that product. Examples of variable costs are raw materials, direct labor (if such costs vary with sales levels), and sales commissions.

- Examples of variable costs are raw materials, direct labor (if such costs vary with sales levels), and sales commissions.

- Calculating the contribution margin is an excellent tool for managers to help determine whether to keep or drop certain aspects of the business.

- Contribution margin per unit is the difference between the price of a product and the sum of the variable costs of one unit of that product.

However, it should be calculated as direct variable expenses to see gross profit and indirect variable expense to see contribution margin. You need both because if any expenses are in the wrong category on your income statement, then you will not be able to calculate an accurate contribution margin or ratio. contribution margin is essentially a company’s revenues minus its variable expenses, and it shows how much of a company’s revenues are contributing to its fixed costs and net income. Once a contribution margin is determined, a company can subtract all applicable fixed costs to arrive at a net profit or loss for the accounting period in question.

This ratio then explains in percentage form the amount of revenue that is profit and fixed expenses. Due to the relative differences in order size and the efforts that a retailer or distributor have to make, different industries have different typical distribution margins. This ratio indicates the percentage of each sales dollar that is available to cover a company’s fixed expenses and profit.

In comparison with the gross profit margin, it is a per-item profit metric, as opposed to the total profit metric given by gross margin. Contribution margin is the amount of sales left over to contribute to fixed cost and profit. Contribution margin can be expressed in a number of different ways, including per unit and as a percentage of sales (called thecontribution margin ratio).

The next section shows the fixed production and overhead costs, such as building and equipment maintenance costs, insurance and administration. The net income is the difference between the contribution margin and the fixed expenses. Small businesses, including sole proprietorships and partnerships, may use the single-step format, which has two groupings of revenues and expenses. In the multi-step income statement format, the top section shows the gross profit calculation, which is net revenue minus cost of goods sold. The next section lists operating expenses, such as marketing, rent and supplies.

To calculate the contribution margin for each of the products your business sells, you subtract the variable costs related to the specific product from the revenue it generates. Revenue is your gross income and variable costs are directly related to the product and are subject to change. For example, your heating and cooling bills are variable costs while your rent is a fixed cost.

One thing that causes the contribution margin income statement and variable costing to differ from the traditional income statement and absorption costing is the fact that fixed overhead is treated as if it were a period cost. Therefore if there are units that are not sold, a portion of the fixed overhead ends up in inventory. It is useful to create an income statement in the contribution margin format when you want to determine that proportion of expenses that truly varies directly with revenues.

Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. When calculating an accurate contribution margin, defining your variable costs vs. your fixed costs is essential.

Fixed Cost Versus Variable Cost

The income statement line for gross profit margin will help you determine and set the specific profit margins for your products and categories of products. If, during a month, you sell $25,000 worth of products and your wholesale cost for those products was $15,000, your gross profit margin was $10,000 or 40 percent. Using this equation, you can create a Contribution Margin Income Statement, which reverses the order of subtracting fixed and variable costs to clearly list the contribution margin. The contribution margin represents the portion of a product’s sales revenue that isn’t used up by variable costs, and so contributes to covering the company’s fixed costs. Fixed costs include all fixed costs, whether they are product costs (overhead) or period costs (selling and administrative).

The contribution margin is not intended to be an all-encompassing measure of a company’s profitability. However, the contribution margin can be used to examine variable production costs. The contribution margin can also be used to evaluate the profitability of an item and to calculate how to improve its profitability, either by reducing variable production costs or by increasing the item’s price.

How do you calculate contribution margin on an income statement?

A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin, from which all fixed expenses are then subtracted to arrive at the net profit or net loss for the period.

The contribution margin calculates the profitability for individual items that the company manufactures and sells. Specifically, the contribution margin is used to review the variable costs included in the production cost of an individual item.

Gross profit is your income or sales less cost of goods sold (COGS), which are all fixed costs (above the line on your income statement). Contribution margin analyzes sales less variable costs, such as commissions, supplies and other back office expenses (costs listed below the line on the income statement). A traditional income statement shows the gross profit, operating profit and pretax and after-tax net income for an accounting period. Generally accepted accounting principles require companies to use the traditional income statement format for external reporting. The contribution margin format allows stakeholders to determine the breakeven point of individual products or product categories.

In many businesses, the contribution margin will be substantially higher than the gross margin, because such a large proportion of its production costs are fixed, and few of its selling and administrative expenses are variable. The contribution margin ratio is the percentage of difference in a company’s sales and variable expenses. Variable expenses are subtracted from sales to isolate profit and fixed expenses.