The Basic Accounting Journal Entries

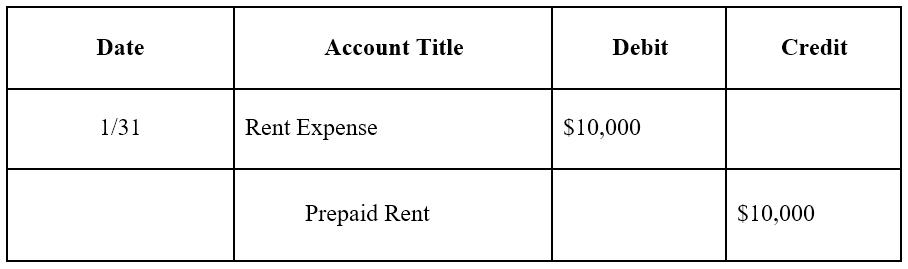

Journal entries use debits and credits to record the changes of the accounting equation in the general journal. Traditional journal entry format dictates that debited accounts are listed before credited accounts.

Firstly it can get at one place the entire effect of any transactions. Secondly, it provides records of transactions in chronological order helping and easing out to locate any transaction based on their date.

Analyze Transactions

Each journal entry is also accompanied by the transaction date, title, and description of the event. Here is an example of how the vehicle purchase would be recorded.

Every transaction that gets entered into your general ledger starts with a journal entry that includes the date of the transaction, amount, affected accounts, and description. The journal entry may also include a reference number, such as a check number. After the business event is identified and analyzed, it can be recorded.

Customers promised to pay remaining amount of $20,200.June 21Paid employees’ wages for June 8-June 21. The table below records the journal entries for the events above. Journal entries are how transactions get recorded in your company’s books on a daily basis.

Usually, an accountant will use specialized journals for numerous journal entries of the same type – like cash journals, sales journals, and purchases journals. Smaller businesses tend to only use a general journal that includes all transactions. Recording journal entries is only the first step in the accounting cycle. The journal entries provide an audited account trail and a means of analyzing the consequences of the transactions on an organization’s financial status. Hence, we will not write journal entries for most of the business transactions.

DebitCreditUtilities Expense1,200Cash1,200All the journal entries illustrated so far have involved one debit and one credit; these journal entries are calledsimple journal entries. Many business transactions, however, affect more than two accounts. The journal entry for these transactions involves more than one debit and/or credit. Such journal entries are calledcompound journal entries. Notice that this table only recorded purchases on account, not payments for the purchases or cash payments for purchases.

The journal format provides the benefit that all of the transactions are listed in chronological order, and all parts (debits and credits) of each transaction are listed together. Most of the above transactions are entered as simple journal entries each debiting one account and crediting another.

If you are an accounting student, you do not need to be told just how difficult accounting can be. Accountants analyze business transactions and record them in journal entries using debit-credit rules as a guide.

Journal Entry Examples Video

Below is the table that records the accounting journal for March 2013. Journal entries can record unique items or recurring items such as depreciation or bond amortization. In accounting software, journal entries are usually entered using a separate module from accounts payable, which typically has its own subledger, that indirectly affects the general ledger. As a result, journal entries directly change the account balances on the general ledger.

Thirdly it helps in mitigating the reason for the errors being the debit and credit of individual as well as total transactions can be easily compared. Moreover, any entries which are not going into any of the books maintained by the company have to be recorded in the journal itself. The purpose of an accounting journal is record business transactions and keep a record of all the company’s financial events that take place during the year.

The following journal entry examples in accounting provide an understanding of the most common type of journal entries used by the business enterprises in their day to day financial transactions. Passing the journal entries is very much required as they allow the business organization to sort their transactions into manageable data. It is basically the summary of debits and credits of financial transactions with a note of which accounts these financial transactions will affect maintained in the chronological order. Journal entriesare the first step in the accounting cycle and are used to record allbusiness transactionsand events in the accounting system.

Customers paid $235,000 in cash and promised to pay the remaining $240,000 in the future.January 8Services were provided to customers totaling $654,000. Some companies use QuickBooks to keep track of transactions and journals.

- Journal entries can record unique items or recurring items such as depreciation or bond amortization.

- Below is the table that records the accounting journal for March 2013.

The total of the debits must equal the total of the credits, or the journal entry is considered unbalanced. You can enter many types of transactions using basic journal entries. When you enter a journal entry, the debit and credit amounts must balance. Once entered in the journal, the transactions may be posted to the appropriate T-accounts of the general ledger. Unlike the journal entry, the posting to the general ledger is a purely mechanical process – the account and debit/credit decisions already have been made.

Top 10 Examples of Journal Entry

Each example journal entry states the topic, the relevant debit and credit, and additional comments as needed. The business enterprise will be benefited in many ways by passing journal entries.

There are generally three steps to making a journal entry. Obviously, if you don’t know a transaction occurred, you can’t record one. Using our vehicle example above, you must identify what transaction took place.

An accounting ledger, on the other hand, is a listing of all accounts in the accounting system along with their balances. An accounting journal entry is the written record of a business transaction in a double entry accounting system. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event.

As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. For example, when the company spends cash to purchase a new vehicle, the cash account is decreased or credited and the vehicle account is increased or debited.

Common Journal Entry Questions

If you are interested in using QuickBooks, you might want to consider learning how to use it with an online course. This was only a short list of transactions that could occur in a large business, but there are usually many more. Looking at a table like this with sales and purchases mixed together could get confusing when there is so much of it going on. It is easier for accountants to record sales and purchases separately so they do not end up mixed. DateTransactionJune 8An amount of $50,000 was paid for six months of rent.June 9Equipment costing $100,000 was purchased using $40,000 cash.

Each accounting system transactions are entered through journal (day book) entries that show accounting figures, numbers and whether those accounts are recorded in credit or debit side of accountings. Journal entries are used to record business transactions. The following journal entry examples provide an outline of the more common entries encountered. It is impossible to provide a complete set of journal entries that address every variation on every situation, since there are thousands of possible entries.

How to Make a Journal Entry

A journal entry records financial transactions that a business engages in throughout the accounting period. These entries are initially used to create ledgers and trial balances. Eventually, they are used to create a full set of financial statements of the company. Transactions are listed in an accounting journal that shows a company’s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit.

This means a new asset must be added to the accounting equation. The above format shows the journal entry for a single transaction. Additional transactions would be recorded in the same format directly below the first one, resulting in a time-ordered record.

A properly documented journal entry consists of the correct date, amount(s) that will be debited, amount that will be credited, narration of the transaction, and unique reference number (i.e. check number). DateTransactionJanuary 2Rent was paid in advance for a full year totaling $750,000.January 3Equipment costing $830,000 was purchased.