The Advantages of Amortized Cost

MARKET RESEARCH

In other words, the previous owner must be paid the interest that accrued before the sale. The principal paid off over the life of an amortized loan or bond is divvied up according to an amortization schedule, typically through calculating equal payments all along the way.

When a bond has an interest rate that’s higher than prevailing rates in the bond market, it will typically trade at a price higher than its face value. Such a bond is said to trade at a premium, and the tax laws allow you to amortize the bond’s premium between the time you purchase it and its maturity date in order to offset your income.

These interest payments, known as coupons, are typically paid every six months. During this period the ownership of the bonds can be freely transferred between investors. A problem then arises over the issue of the ownership of interest payments. Only the owner of record can receive the coupon payment, but the investor who sold the bond must be compensated for the period of time for which he or she owned the bond.

Comparison of Amortization Methods

How do you calculate the amortization of a bond?

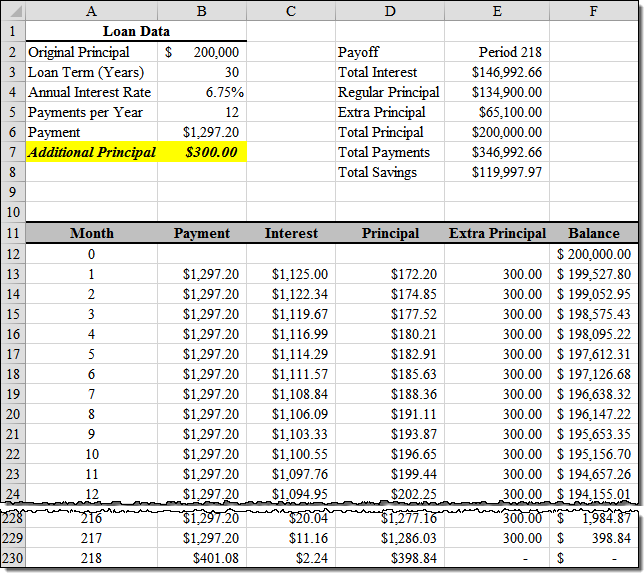

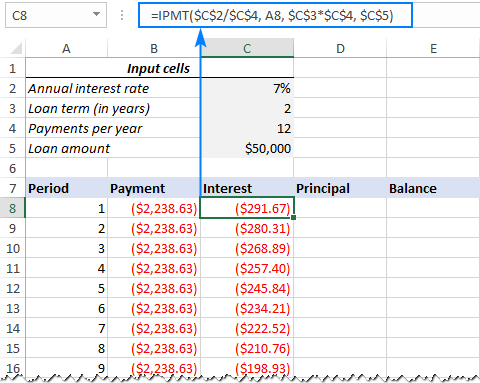

A bond amortization schedule is a table that shows the amount of interest expense, interest payment, and discount or premium amortization of a bond in each successive period. The table is commonly used by the issuers of bonds to assist them in accounting for these instruments over time.

If a company is performing well, its bonds will usually attract buying interest from investors. In the process, the bond’s price rises as investors are willing to pay more for the creditworthy bond from the financially viable issuer.

This is because as time passes, there are smaller interest payments, so the weighted-average maturity (WAM) of the cash flows associated with the bond is lower. The bond market is efficient and matches the current price of the bond to reflect whether current interest rates are higher or lower than the bond’s coupon rate. It’s important for investors to know why a bond is trading for a premium—whether it’s because of market interest rates or the underlying company’s credit rating. In other words, if the premium is so high, it might be worth the added yield as compared to the overall market.

However, if investors buy a premium bond and market rates rise significantly, they’d be at risk of overpaying for the added premium. Instead of going to a bank, the company gets the money from investors who buy its bonds. In exchange for the capital, the company pays an interest coupon—the annual interest rate paid on a bond, expressed as a percentage of the face value. The company pays the interest at predetermined intervals—usually annually or semiannually—and returns the principal on the maturity date, ending the loan. While many investments provide some form of income, bonds tend to offer the highest and most reliable cash streams.

A fixed-rate residential mortgage is one common example because the monthly payment remains constant over its life of, say, 30 years. However, each payment represents a slightly different percentage mix of interest versus principal. An amortized bond is different from a balloon or bullet loan, where there is a large portion of the principal that must be repaid only at its maturity.

- Amortization of debt affects two fundamental risks of bond investing.

If the bond is sold before maturity in the market the seller will receive the bond’s market value. A bond represents a debt obligation whereby the owner (the lender) receives compensation in the form of interest payments.

Amortization of debt affects two fundamental risks of bond investing. Second, amortization reduces the duration of the bond, lowering the debt’s sensitivity to interest rate risk, as compared with other non-amortized debt with the same maturity and coupon rate.

While U.S. Treasury or government agency securities provide substantial protection against credit risk, they do not protect investors against price changes due to changing interest rates. The market values of government securities are not guaranteed and may fluctuate but these securities are guaranteed as to the timely payment of principal and interest. The interest paid on a bond is compensation for the money lent to the borrower, or issuer, this borrowed money is referred to as the principal. The principal amount is paid back to the bondholder at maturity. Similar to the case of the coupon, or interest payment, whoever is the rightful owner of the bond at the time of maturity will receive the principal amount.

Below, you’ll learn more about bond premium amortization and one method of calculating it known as the straight-line method. If you pay a premium to a bond’s face value, you can amortize that premium over the remaining term of the bond. Doing so requires that you keep track of the unamortized bond premium so that you can make the appropriate calculations for annual amortization. Below, we’ll take a closer look at buying bonds at a premium and handling them correctly for tax purposes. An amortized bond is one in which the principal (face value) on the debt is paid down regularly, along with its interest expense over the life of the bond.

Investors will realize a slightly higher yield if the called bonds are paid off at a premium. An investor in such a bond may wish to know what yield will be realized if the bond is called at a particular call date, to determine whether the prepayment risk is worthwhile. It is easiest to calculate the yield to call using Excel’s YIELD or IRR functions, or with a financial calculator. Credit-rating agencies measure the creditworthiness of corporate and government bonds to provide investors with an overview of the risks involved in investing in bonds. Credit rating agencies typically assign letter grades to indicate ratings.

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

This means that in the early years of a loan, the interest portion of the debt service will be larger than the principal portion. As the loan matures, however, the portion of each payment that goes towards interest will become lesser and the payment to principal will be larger. The calculations for an amortizing loan are similar to that of an annuity using the time value of money, and can be carried out quickly using an amortization calculator. A callable bond always bears some probability of being called before the maturity date.

Standard & Poor’s, for instance, has a credit rating scale ranging from AAA (excellent) to C and D. A debt instrument with a rating below BB is considered to be a speculative grade or a junk bond, which means it is more likely to default on loans.

Bonds issued by well-run companies with excellent credit ratings usually sell at a premium to their face values. Since many bond investors are risk-averse, the credit rating of a bond is an important metric.