Summary of Gross Profit Percentage. Abstract

The company either raised prices, lowered variable material costs from suppliers or found a way to produce its clothing more efficiently (which usually means fewer labor hours per product produced). ABC Clothing did a better job in Year Two of managing its markup on the clothing products it manufactured.

The gross profit margin is calculated by taking total revenue minus the COGS and dividing the difference by total revenue. The gross margin result is typically multiplied by 100 to show the figure as a percentage. The COGS is the amount it costs a company to produce the goods or services that it sells. Gross profit margin is a metric analysts use to assess a company’s financial health by calculating the amount of money left over from product sales after subtracting the cost of goods sold (COGS). Sometimes referred to as the gross margin ratio, gross profit margin is frequently expressed as a percentage of sales.

In accounting, the gross margin refers to sales minus cost of goods sold. It is not necessarily profit as other expenses such as sales, administrative, and financial costs must be deducted. And it means companies are reducing their cost of production or passing their cost to customers.[clarification needed] The higher the ratio, all other things being equal, the better for the retailer.

The difference between gross margin and markup is small but important. The former is the ratio of profit to the sale price and the latter is the ratio of profit to the purchase price (Cost of Goods Sold). In layman’s terms, profit is also known as either markup or margin when we’re dealing with raw numbers, not percentages.

Gross profit is the direct profit left over after deducting the cost of goods sold, or “cost of sales”, from sales revenue. It’s used to calculate the gross profit margin and is the initial profit figure listed on a company’s income statement. Gross profit is calculated before operating profit or net profit. Gross profit margin is calculated by subtracting cost of goods sold (COGS) from total revenue and dividing that number by total revenue.

A high gross profit margin means that the company did well in managing its cost of sales. It also shows that the company has more to cover for operating, financing, and other costs.

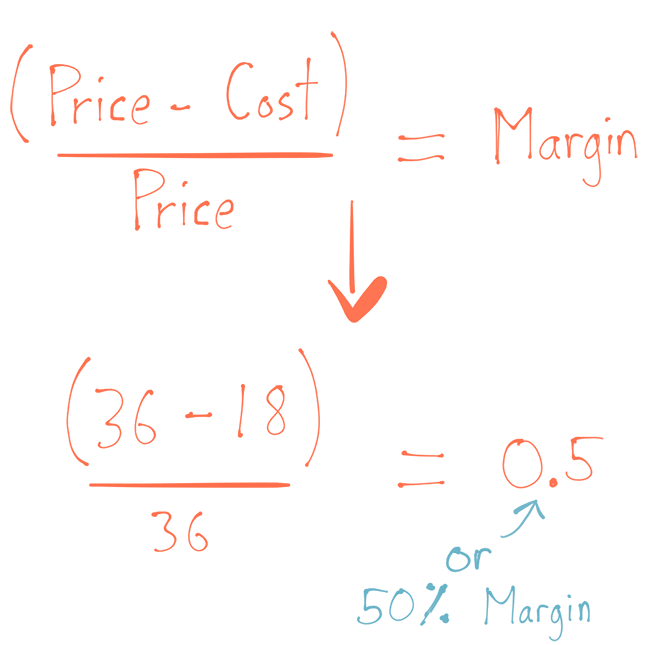

A company’s gross profit margin percentage is calculated by first subtracting the cost of goods sold (COGS) from net sales (gross revenues minus returns, allowances, and discounts). This figure is then divided by net sales, to calculate the gross profit margin in percentage terms. The gross profit margin ratio, also known as gross margin, is the ratio of gross margin expressed as a percentage of sales. Gross margin, alone, indicates how much profit a company makes after paying off its Cost of Goods Sold. It is a measure of the efficiency of a company using its raw materials and labor during the production process.

Gross Profit Percentage Examples

This margin calculator will be your best friend if you want to find out an item’s revenue, assuming you know its cost and your desired profit margin percentage. In general, your profit margin determines how healthy your company is – with low margins you’re dancing on thin ice and any change for the worse may result in big trouble. High profit margins mean there’s a lot of room for errors and bad luck. Keep reading to find out how to find your profit margin and what is the gross margin formula.

Similar margins are calculated comparing your operating profit with revenue and net profit with revenue. All of the numbers used in these margin ratio computations are found on your company’s income statement.

The gross profit margin may be improved by increasing sales price or decreasing cost of sales. However, such measures may have negative effects such as decrease in sales volume due to increased prices, or lower product quality as a result of cutting costs. Nonetheless, the gross profit margin should be relatively stable except when there is significant change to the company’s business model. Gross profit expressed as a percentage of your company’s revenue is referred to as the gross profit margin.

Gross profit margin is an indication of the financial success and viability of a particular product or service. The higher the percentage, the more the company retains on each dollar of sales to service its other costs and obligations. Profit margin is a percentage measurement of profit that expresses the amount a company earns per dollar of sales. If a company makes more money per sale, it has a higher profit margin. Gross profit margin and net profit margin, on the other hand, are two separate profitability ratios used to assess a company’s financial stability and overall health.

What Does Gross Profit Percentage Mean?

- Gross margin is the difference between revenue and cost of goods sold (COGS) divided by revenue.

- Gross Margin is often used interchangeably with Gross Profit, but the terms are different.

The value of gross profit margin varies from company and industry. The higher the profit margin, the more efficient a company is. For example, a company has revenue of $500,000; cost of goods sold is $200,000, leaving a gross profit of $300,000.

The gross profit margin reflects how successful a company’s executive management team is in generating revenue, considering the costs involved in producing their products and services. In short, the higher the number, the more efficient management is in generating profit for every dollar of cost involved.

Many business owners often get confused when relating markup to gross profit margin. They are first cousins in that both computations deal with the same variables. The difference is that gross profit margin is figured as a percentage of the selling price, while markup is figured as a percentage of the seller’s cost.

It’s interesting how some people prefer to calculate the markup, while others think in terms of gross margin. It seems to us that markup is more intuitive, but judging by the number of people who search for markup calculator and margin calculator, the latter is a few times more popular. It is apparent that ABC Clothing earned not only more gross profit dollars during Year Two but also a higher gross profit margin.

While the gross profit is a dollar amount, the gross profit margin is expressed as a percentage. That’s equally important to track, since it allows you to keep an eye on profitability trends. This is critical because many businesses have gotten into financial trouble with an increasing gross profit that coincides with a declining gross profit margin. The gross profit margin (also known as gross profit rate, or gross profit ratio) is a profitability measure that shows the percentage of gross profit in comparison to sales.

Dividing this result by $500,000 results in a profit margin of of 0.6. Multiplying 0.6 by 100 expresses the gross profit margin as a percentage, which in this instance is 60 percent. This means that for every revenue dollar the business generates 60 cents in profits before payment of other business expenses. Gross Profit Percentage is a measure of profitability that calculates how much of every dollar of revenue is left over after paying off the cost of goods sold (COGS). In other words, it measures the efficiency of a company in utilizing its input costs of production, such as raw materials and labour, in order to produce and sell its products profitably.

Can profit margin be too high?

Gross margin is the difference between revenue and cost of goods sold (COGS) divided by revenue. Gross Margin is often used interchangeably with Gross Profit, but the terms are different. When speaking about a monetary amount, it is technically correct to use the term Gross Profit; when referring to a percentage or ratio, it is correct to use Gross Margin.

Gross Profit Margin Formula

The gross profit margin ratioanalysis is an indicator of a company’s financial health. It tells investors how much gross profit every dollar of revenue a company is earning. Compared with industry average, a lower margin could indicate a company is under-pricing. A higher gross profit margin indicates that a company can make a reasonable profit on sales, as long as it keeps overhead costs in control. Investors tend to pay more for a company with higher gross profit.

The gross profit margin is a metric used to assess a firm’s financial health and is equal to revenue less cost of goods sold as a percent of total revenue. Analysts use gross profit margin to compare a company’s business model with that of its competitors. For example, let us assume that Company ABC and Company XYZ both produce widgets with identical characteristics and similar levels of quality. But then, in an effort to make up for its loss in gross margin, XYZ counters by doubling its product price, as a method of bolstering revenue.

In other words, Gross Margin is a percentage value, while Gross Profit is a monetary value. Gross profit margin is a ratio that indicates the performance of a company’s sales and production. This ratio is made by accounting for the cost of goods sold—which include all costs generated to produce or provide your product or service—and your total revenue. If your business has a gross profit margin of 24%, it means that 24% of your total revenue became profit. Gross profit margin is a measure of profitability that shows the percentage of revenue that exceeds the cost of goods sold (COGS).