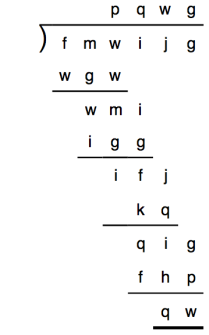

Sum of Year Depreciation

What Is the Tax Impact of Calculating Depreciation?

Salvage value is the estimated resale value of an asset at the end of its useful life. It is subtracted from the cost of a fixed asset to determine the amount of the asset cost that will be depreciated. Thus, salvage value is used as a component of the depreciation calculation. The carrying value would be $200 on the balance sheet at the end of three years.

Thus, depreciation is charged on the reduced value of the fixed asset in the beginning of the year under this method. However, a fixed rate of depreciation is applied just as in case of straight line method. This rate of depreciation is twice the rate charged under straight line method.

The Excel equivalent function for Sum of Years’ Digits Method is SYD(cost,salvage,life,per) will calculate the depreciation expense for any period. For a more accelerated depreciation method see, for example, our Double Declining Balance Method Depreciation Calculator. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value over time.

It’s the simplest and most commonly useddepreciationmethod when calculating this type of expense on an income statement, and it’s the easiest to learn. Depreciation using the straight-line method reflects the consumption of the asset over time and is calculated by subtracting the salvage value from the asset’s purchase price. Companies use depreciation to expense an asset over time, not just in the period that it was purchased. In other words, depreciation involves stretching out the cost of assets over many different accounting periods, enabling companies to benefit from them without deducting the full cost from net income (NI).

There are many methods of distribution depreciation amount over its useful life. The total amount of depreciation for any asset will be identical in the end no matter which method of depreciation is chosen; only the timing of depreciation will be altered. Accelerated depreciation is any method of depreciation used for accounting or income tax purposes that allows greater deductions in the earlier years of the life of an asset.

Accelerated depreciation uses decreasing charge methods, including the sum-of-the-years’ digits (SYD), providing higher depreciation costs in earlier years and lower depreciation charges in later periods. As the depreciation rate decreases over time, so does the depreciation charge. Depreciation is a fixed cost, because it recurs in the same amount per period throughout the useful life of an asset.

For accounting in particular, depreciation concerns allocating the cost of an asset over a period of time, usually its useful life. When a company purchases an asset, such as a piece of equipment, such large purchases can skewer the income statement confusingly. Instead of appearing as a sharp jump in the accounting books, this can be smoothed by expensing the asset over its useful life. The benefit of using an asset will decline as the asset gets older, meaning an asset provides greater service value in earlier years. Therefore, charging higher depreciation costs early on and decreasing depreciation charges in later years reflects the reality of an asset’s changing economic usefulness over time.

Thus, this method leads to an over depreciated asset at the end of its useful life as compared to the anticipated salvage value. Thus, the method is based on the assumption that more amount of depreciation should be charged in early years of the asset. As an asset forays into later stages of its useful life, the cost of repairs and maintenance of such an asset increase. Hence, less amount of depreciation needs to be provided during such years. This graph is deduced after plotting an equal amount of depreciation for each accounting period over the useful life of the asset.

The depreciation expense would be completed under the straight line depreciation method, and management would retire the asset. Any gain or loss above or below the estimated salvage value would be recorded, and there would no longer be any carrying value under the fixed asset line of the balance sheet.

What is sum of years digit method?

Sum of the years’ digits depreciation. The sum of the years’ digits method is used to accelerate the recognition of depreciation. Doing so means that most of the depreciation associated with an asset is recognized in the first few years of its useful life. This method is also called the SYD method.

Economic Usefulness of Assets

- When a company purchases an asset, such as a piece of equipment, such large purchases can skewer the income statement confusingly.

- For accounting in particular, depreciation concerns allocating the cost of an asset over a period of time, usually its useful life.

How do you calculate sum of years digits depreciation?

Sum-of-the-years’-digits (SYD) is an accelerated method for calculating an asset’s depreciation. Each digit is then divided by this sum to determine the percentage by which the asset should be depreciated each year, starting with the highest number in year 1.

However, the estimated useful life can change from year to year depending on usage and production rates. It offers businesses a way to recover the cost of an eligible asset by writing off the expense over the course of its useful life. A business can expect a big impact on its profits if it doesn’t account for the depreciation of its assets. The default method used to gradually reduce the carrying amount of a fixed asset over its useful life is called Straight Line Depreciation. Each full accounting year will be allocated the same amount of the percentage of asset’s cost when you are using the straight-line method of depreciation.

Depreciation is a method of asset cost allocation that apportions an asset’s cost to expenses for each period expected to benefit from using the asset. Depending on the chosen cost apportionment or depreciation rate, depreciation charges can be variable, straight-lined, or accelerated over the useful life of an asset.

Sum-Of-The-Years’ Digits

The reduction in value of an asset due to wear and tear or any other cause is known as depreciation. It is important to show depreciation in the books of accounts failing which the balance sheet would not display a true and fair financial position of business. Depreciation expense is estimated based on actual cost and the estimated useful life of an asset. The original cost of the asset does not change over the life of its use in the business.

Depreciation is a solution for this matching problem for capitalized assets. In regards to depreciation, salvage value (sometimes called residual or scrap value) is the estimated worth of an asset at the end of its useful life. Assets with no salvage value will have the same total depreciation as the cost of the asset. Another accelerated depreciation method is the Sum of Years’ Digits Method. Thus, the depreciable amount of an asset is charged to a fraction over different accounting periods under this method.

The sinking fund method is a technique for depreciating an asset while generating enough money to replace it at the end of its useful life. As depreciation charges are incurred to reflect the asset’s falling value, a matching amount of cash is invested.

Depreciation cannot be considered a variable cost, since it does not vary with activity volume. If a business employs a usage-based depreciation methodology, then depreciation will be incurred in a pattern that is more consistent with a variable cost. Accountants use depreciation to account for the wear and tear on business assets over time. Each year a certain amount of depreciation is written off and the book value of the asset is reduced. Fortunately, they’ll balance out in time as the so-called tax timing differences resolve themselves over the useful life of the asset.

Take the purchase price or acquisition cost of an asset, then subtract the salvage value at the time it’s either retired, sold, or otherwise disposed of. Now divide this figure by the total product years the asset can reasonably be expected to benefit your company. Straight line depreciation is a method by which business owners can stretch the value of an asset over the extent of time that it’s likely to remain useful.

Depreciation is the accounting process of converting the original costs of fixed assets such as plant and machinery, equipment, etc into the expense. It refers to the decline in the value of fixed assets due to their usage, passage of time or obsolescence.

How Do I Calculate Fixed Asset Depreciation Using Excel?

Capitalized assets are assets that provide value for more than one year. Accounting rules dictate that expenses and sales are matched in the period in which they are incurred.